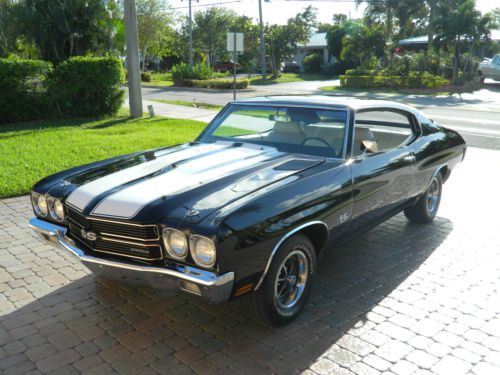

1970 Chevrolet Convertible 2-door 7.4l on 2040-cars

Tarpon Springs, Florida, United States

|

This beautiful 1970 Chevelle Malibu is a period correct SS 454. The 454 engine date coded 1970 is freshly rebuilt with its original steel crankshaft. It has a Turbo 400 transmission and a 12 Bolt rear end in great shape, the body has been repainted to its original color, car was ordered with factory gauges, rally wheels, power disc brakes, power steering, power top.Interior has its original bench seat, column shift and is in great shape, it comes with original build sheet and window sticker pre-order forms. An awesome car for the price. can drive anywhere, for more information please contact Mike at 727-455-1987

|

Chevrolet Chevelle for Sale

Auto Services in Florida

Zych`s Certified Auto Svc ★★★★★

Yachty Rentals, Inc. ★★★★★

www.orlando.nflcarsworldwide.com ★★★★★

Westbrook Paint And Body ★★★★★

Westbrook Paint & Body ★★★★★

Ulmerton Road Automotive ★★★★★

Auto blog

Reuss says GM diesel plans are still on pace

Fri, Oct 16 2015General Motors is not going to let Volkswagen's diesel emissions scandal ruin its plans for a new line of efficient, torquey oil-burners, the company's Executive Vice President Mark Reuss said at a recent press event. "No way," Reuss responded when asked about cancelling the upcoming diesel-powered Chevrolet Cruze and other vehicles. "The Cruze Diesel is too good not to do it." Slated for 2017, the compact is just the latest member of a diesel offensive that initially kicked off with the first Cruze Diesel and most recently saw the introduction of the oil-burning Chevy Colorado and GMC Canyon. Reuss also reassured those in attendance that there was "no delay" in development of Cadillac's diesel lineup. Cadillac is working on a line of four- and six-cylinder turbodiesels for Europe. They'd make their way into the US market, too, eventually. "It's a question of timing," Reuss said, according to Car and Driver. Volkswagen's diesel emissions scandal has caused automakers across the globe to at least reanalyze their diesel strategy. Jaguar Land Rover, which is preparing several diesel-powered models for the US market, went on record late last month to reaffirm its commitment to diesel. Related Video: Featured Gallery 2014 Chevrolet Cruze Turbo Diesel: Quick Spin View 14 Photos News Source: Car and DriverImage Credit: Copyright 2015 Seyth Miersma / AOL Green Cadillac Chevrolet GM Diesel Vehicles

Recharge Wrap-up: Tesla sells Model S 85 and 70D in Malaysia, Chevy Spark EV built using clean energy

Mon, May 18 2015Tesla will send Model S 70D and Model S 85 EVs to Malaysia for leasing to government-linked companies. Only those companies will have access to the models as a two-year lease, which will be imported and leased by Malaysian Green Technology Corporation. The plan is part of an initiative by the Ministry of Energy, Green Technology and Water to allow government officials and other influential people to get to know the electric vehicles and the benefits that come along with them. Most of the 120 vehicles available will be the 70D model, and the lessee companies will have the option to purchase the cars at the end of the two years. Read more from Paul Tan's Automotive News. Wanxiang is hosting students from Delaware in China as part of a program to learn Mandarin and visit schools and science and technology sites. Wanxiang, the auto parts company that acquired Fisker (which had manufacturing based in Delaware) and battery maker A123 Systems, will give the students tours of its solar technology facilities, among other places, and see what daily life is like for families in the region. The program helps students interested in science and technology to foster marketable skills — like learning a foreign language — that will help them get jobs in industries around the world. Read more at Delaware Online. The Chevrolet Spark EV's electric motor (pictured) and drive unit are manufactured using clean energy. The e-motors building of the General Motors Baltimore Operations complex has a new rooftop solar array and uses LED and CFL lighting, helping the building recently earn LEED Silver certification. The landfill-free facility also takes advantage of the 1.23-megawatt solar array on the grounds, helping it source six percent its energy from renewable sources. The plant has reduced its energy intensity by 15.5 percent in three years, and continues to work toward reducing consumption and sourcing clean energy. "We believe reducing our environmental footprint is good for the climate and good for our business," says GM Executive Director of Global Public Policy Greg Martin. Read more in the press release below. Spark EV Motor Plant Fueled by Green, Clean Energy ENERGY STAR®, USGBC and Maryland state agency recognize facility's efforts WHITE MARSH, Md. – Chevrolet recently began selling the Spark EV to Maryland commuters able to take advantage of the state's robust charging infrastructure.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

1971 chevelle

1971 chevelle 1970 chevelle ls6

1970 chevelle ls6 1968 chevelle real super sport factory 4 speed barn find same owner last 35 yrs

1968 chevelle real super sport factory 4 speed barn find same owner last 35 yrs National award winning chevelle ss convertible ls5

National award winning chevelle ss convertible ls5 1970 chevelle super sport

1970 chevelle super sport Frame off restored chevelle ss 396/350 hp v8 4 speed

Frame off restored chevelle ss 396/350 hp v8 4 speed