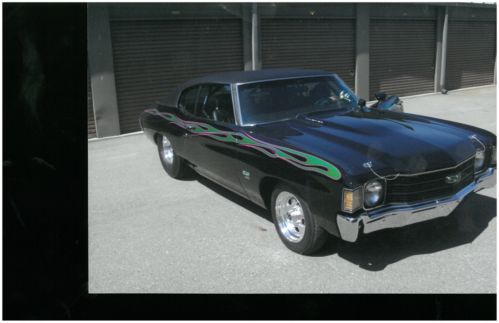

1970 Chevrolet Chevelle Ss Clone 2 Door Hardtop**(stock # R12023)** on 2040-cars

Redwood City, California, United States

Chevrolet Chevelle for Sale

1967 chevelle ss restomod(US $37,700.00)

1967 chevelle ss restomod(US $37,700.00) 1972 chevelle ss pro street reher morrison 509 super comp

1972 chevelle ss pro street reher morrison 509 super comp 1967 chevelle

1967 chevelle 1972 chevrolet chevelle base hardtop 2-door 5.7l project/parts car

1972 chevrolet chevelle base hardtop 2-door 5.7l project/parts car 1965 chevelle 300 deluxe station wagon

1965 chevelle 300 deluxe station wagon 1970 chevelle. best of the best! pro touring custom. high-end custom show car(US $70,000.00)

1970 chevelle. best of the best! pro touring custom. high-end custom show car(US $70,000.00)

Auto Services in California

Z Best Auto Sales ★★★★★

Woodland Hills Imports ★★★★★

Woodcrest Auto Service ★★★★★

Western Tire Co ★★★★★

Western Muffler ★★★★★

Western Motors ★★★★★

Auto blog

Recharge Wrap-up: Panasonic, Tesla on Gigafactory deal?

Tue, Jul 29 2014Bentley has been awarded the Carbon Trust Standard for reductions of carbon, water use and waste production in manufacturing. The Carbon Trust is an organization that helps groups such as businesses and governments reduce carbon emissions, use of energy and resources, and waste output. From 2011 to 2013, Bentley reduced CO2 emissions by 16 percent per car manufactured, curtailed water use by 35.7 percent, and saw significant waste reductions. Darran Messem of Carbon trust says, "Bentley is clearly passionate about continuing to improve its environmental performance, which is reflected by the fact the company has consistently invested in new technology." Read more in the press release below. Chevrolet is giving 12 Volts to MBAs Across America. The organization will use the range-extended electric cars in its efforts to help MBA students learn from and work with small business owners. As part of the MBAs Across America program's first year, four students drove 8,000 miles to provide entrepreneurs with free business counseling. The program has expanded, and this year, teams of MBAs will use the Volts to travel to 25 cities to offer their services. Learn more about the partnership between Chevrolet and MBAs Across America in the press release below. A professor from the University of Michigan has found fuel cycle analysis to be too flawed to be relied upon for measuring CO2 impacts of transportation fuels. Professor John DeCicco of the university's Energy Institute feels that the flaws in calculating the carbon footprint of liquid fuel production and combustion make such lifecycle analysis impractical. He suggests, instead, to focus to carbon capture. Since capturing CO2 directly from a vehicle is probably never going to happen, DiCicco believes the solution is to capture carbon from the atmosphere in sectors outside of transportation. Says DiCicco, "Research should be ramped up on options for increasing the rate at which CO2 is removed from the atmosphere and on programs to manage and utilize carbon fixed in the biosphere, which offers the best CO2 removal mechanism now at hand. Such strategies can complement measures that control the demand for liquid fuels by reducing travel activity, improving vehicle efficiency and shifting to non-carbon fuels." Read more at Green Car Congress. Global transportation energy consumption is expected to increase by 25.4 percent by 2035, according to a report by Navigant Research.

Chevy exec confirms SS production model reveal at Daytona on Feb 16

Wed, 06 Feb 2013The 2014 Chevrolet SS will make its racing debut for the 2013 Daytona 500, but the production version of the car will get its official unveiling on February 16 in Daytona, a week before The Great American Race. According to a report by Automotive News, the reveal has been confirmed by Jim Campbell, Chevy's US vice president of performance and motorsports. With the departure of the Dodge Charger, the new Chevrolet racecar will be the only competitor to feature a V8, rear-wheel-drive layout in both street and NASCAR form.

NASCAR fans will be able to see the new fullsize performance-oriented sedan on display in the festivities leading up to the Daytona 500, but the car won't go on sale until later in the year. The Australian-built Chevy SS will be a low-volume performance model, and it will be priced above the 2014 Impala, which starts at $27,535.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.