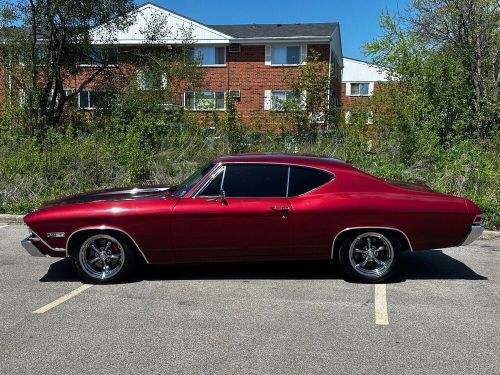

1970 Chevrolet Chevelle on 2040-cars

Lehi, Utah, United States

Transmission:Automatic

Vehicle Title:Clean

Fuel Type:Gasoline

VIN (Vehicle Identification Number): 1366708192713

Mileage: 53000

Model: Chevelle

Make: Chevrolet

Interior Color: Black

Number of Cylinders: 8

Exterior Color: Red

Drive Type: RWD

Chevrolet Chevelle for Sale

1970 chevrolet chevelle super sport(US $72,970.00)

1970 chevrolet chevelle super sport(US $72,970.00) 1971 chevrolet chevelle(US $20,000.00)

1971 chevrolet chevelle(US $20,000.00) 1969 chevrolet chevelle big block 4 speed-see video(US $63,900.00)

1969 chevrolet chevelle big block 4 speed-see video(US $63,900.00) 1968 chevrolet chevelle merlot paint ls2 pro touring(US $65,000.00)

1968 chevrolet chevelle merlot paint ls2 pro touring(US $65,000.00) 1966 chevrolet chevelle ss 396(US $10,000.00)

1966 chevrolet chevelle ss 396(US $10,000.00) 1967 chevrolet chevelle(US $10,000.00)

1967 chevrolet chevelle(US $10,000.00)

Auto Services in Utah

Tri-City Auto & RV, Inc ★★★★★

The Tire Pro`s Tire Factory ★★★★★

St George Transmission ★★★★★

Speed Shop ★★★★★

Rocky Mountain Tire & Service ★★★★★

Reynolds Auto Care ★★★★★

Auto blog

Ford GT dominates Le Mans qualifying, gets slapped with performance adjustment

Fri, Jun 17 2016Fifty years after Bruce McLaren and Chris Amon drove the Ford GT40 to victory at the 24 Hours of Le Mans, Ford is poised for a historic return to the Circuit de la Sarthe. The new Ford GT took the top two qualifying positions in the LMGTE Pro class, and four of the top five. Ferrari's 488 filled in the rest of the spots in the top seven, the first two from AF Corse. In other words, we're primed for a reboot of the classic Ford-Ferrari feud at this year's race. Or not, as the ACO, which organizes the 24 Hours of Le Mans, announced sweeping pre-race Balance of Performance (BOP) adjustments this morning that make this year's GT class anybody's race. In LMP1, last year's overall winner Porsche locked up the top two spots with the 919 Hybrid and will lead the entire field at race start. Toyota's two-car factory effort followed with qualifying times 1.004 and 2.170 seconds behind the pole lap. Audi rounds out the manufacturer-backed LMP1 class in fifth and sixth. Full qualifying results can be found here. The storyline for the GT cars is perfect - some say too perfect. Ford's class-leading times came after BOP adjustment to the Corvette Racing C7.R before qualifying. BOP is intended to level the playing field in the class by adjusting power, ballast, and fuel capacity. (Check out this explainer video for more, or even just if you love French accents.) But the process is riddled with unknowns and ripe for accusations of sandbagging. That is, if the Ford cars were intentionally slow in practice they could hope for BOP adjustment to improve their race chances. On the Corvette side, last year's GTE Pro winner went from the top of the field to the bottom, barely improving from practice to qualifying. If you think Le Mans is as rigged at the NBA Playoffs, well, it's not that simple. Because if Ford and Ferrari held back until qualifying - the eighth-place Porsche 911 RSR is three-and-a-half seconds off the class pole time - it was a pretty dumb strategy. This morning, the ACO tried to put things back in order by limiting the boost in the Ford GT's twin-turbo V6 and adding 11 pounds of ballast. Ferrari was also given extra weight but allowed more fuel capacity. The Corvette and Aston Martin teams were both given breaks on their air restrictors, which will allow their engines to make more power. Both Ford and Porsche also received extra fuel capacity.

GM Recalling 370,000 Trucks For Fire Risk

Mon, Jan 13 2014DETROIT (AP) - General Motors is recalling 370,000 Chevrolet Silverado and GMC Sierra pickups from the 2014 model year to fix software that could cause the exhaust components to overheat and start a fire. The recall includes 303,000 trucks in the U.S. and 67,000 in Canada and Mexico. All of the trucks involved have 4.3-liter or 5.3-liter engines. GM said eight fires have been reported, but no injuries. One garage was damaged, the company said. All of the incidents occurred in cold weather. The company is asking customers not to leave their trucks idling unattended. GM dealers will reprogram the software for free. The company will inform owners starting Jan. 16. The major recall announcement, which came on Saturday, marred the Silverado's winning of the 2014 North American Truck of the Year Award at the Detroit Auto Show on Monday. Related Gallery Our Favorite Cars For Winter View 11 Photos Recalls Chevrolet sierra

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.