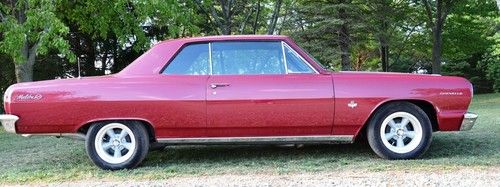

1970 Chevelle Ss Clone 454 on 2040-cars

San Francisco, California, United States

Engine:454

Drive Type: rear wheel

Make: Chevrolet

Mileage: 60,000

Model: Chevelle

Trim: ss

Number of Doors: 2

hello

here my 1970 chevelle ss clone ( not finish )

interior just need a carpet

new head liner , cover seat are in great shape all doors panel are great , SS dash is great condition pad as well

body pretty straight , doors works great no shagging

youll find rust in the trunk floor ( need replace just the deep section , braces for gas tank are good ) and at the back window between window and trunk lid

thats all.... the rest is very dry SEE PICTURES

driveshaft there , and new gas tank

engine start every first crank , tranny shift very good , tranny and engine have 60000 original miles , shifter on the floor

disc brake ,all new brakes lines and brake hoise , master cylinder , still need to be bleed truly

10 bolts ,

and need a exhaust system off your choice

the car still need paint

keep in mind 1970 chevelle SS came with bigblock and SS dash , because outhere too much guy put an SS emblem at the front grill and claim " its an SS" dont be one of them

call me , or text me 4158455528

and please dont come to me with stupid offers

i take paypal , wiring transfer , cash

pink slip in hand

clear title no registred

I can keep the car garaged until shipping

Chevrolet Chevelle for Sale

1966 chevrolet chevelle 4 door(US $2,500.00)

1966 chevrolet chevelle 4 door(US $2,500.00) 1970 chevrolet chevelle ss 396 bench seat 4-speed rock crusher

1970 chevrolet chevelle ss 396 bench seat 4-speed rock crusher 1969 chevy chevelle(US $16,000.00)

1969 chevy chevelle(US $16,000.00) 1964 chevy chevelle malibu ss 4 speed(US $26,000.00)

1964 chevy chevelle malibu ss 4 speed(US $26,000.00) 1971 chevelle ss

1971 chevelle ss Ss 396/375hp trades?

Ss 396/375hp trades?

Auto Services in California

Woody`s Auto Body and Paint ★★★★★

Westside Auto Repair ★★★★★

West Coast Auto Body ★★★★★

Webb`s Auto & Truck ★★★★★

VRC Auto Repair ★★★★★

Visions Automotive Glass ★★★★★

Auto blog

NHTSA approves hybrid rearview mirror display in Cadillac CT6, Bolt EV

Tue, Feb 23 2016The Chevy Bolt EV prototype doesn't just have a fancy new all-electric powertrain. Just outside the driver's line of sight is a newfangled rearview mirror, one that can turn into a screen that shows a moving image from the rear-facing camera. Speaking to NPR's Robert Siegel yesterday, Department of Transportation secretary Anthony Foxx said that NHTSA has now approved this type of mirror/screen for use in vehicles. According to a letter from NHTSA to General Motors, GM will likely use this Full Display Mirror first in the 2016 Cadillac CT6 before coming to the Bolt. In its letter to GM, NHTSA said that the Full Display Mirror will only qualify as a standard rearview mirror as long as there are normal side mirrors in place. In other words, don't expect to see cameras and screens replacing all the mirrors in a motor vehicle just yet. @AutoblogGreen @NPR - #NHTSA has OK'd GM rear-view system that can switch between mirror & camera views. pic.twitter.com/6CBeIit10v — Anthony Foxx (@SecretaryFoxx) February 22, 2016 The Full Display Mirror was developed by Gentex, which has long worked with GM. The FDM debuted in 2014 and some people hoped it would also make its way into the Tesla Model X. Gentex, which also makes auto-dimming mirrors, says that it has "set out to develop the technologies and core competencies necessary to manage this evolution of the rearview mirror." The Chevy Bolt EV will start at $37,500, before incentives. The 200-mile EV will go into production late this year for likely sale in early 2017. Related Video:

Bob Lutz says Tesla remains 'fringe' brand

Sun, Sep 28 2014We've said it before, we'll said it again: Bob Lutz gives great quotes. From his toilet-themed opinion of global warming to Toyota's deity status, the man knows how to get your attention. His latest? Saying that Tesla Motors is and will remain a fringe brand. Take that, Tesla fanbois. This, of course, is the same fringe company that prompted Lutz and his former colleagues at General Motors to start working on the Chevy Volt around eight years ago. The same fringe company that has easily outsold the similarly priced (but don't call it a competitor) Cadillac ELR with its Model S. Lutz did clarify that the fringe status will only last until Tesla comes out with a mass-market electric vehicle that has a range of 200 to 300 miles. Lutz was on CNBC talking about the TSLA stock's recent performance, and he pointed out that even Tesla CEO Elon Musk says that the California automaker's stock is overvalued these days. Despite its prevalence around these parts, Tesla is not yet a household brand. But the company is working hard to get a cheaper, long-range EV to market in the not-too-distant future, so this fringe thing may not last much longer than that show Fringe did. Watch the video below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. News Source: CNBC via Green Car Reports Green Chevrolet Tesla Green Culture Electric Hybrid PHEV cnbc

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.