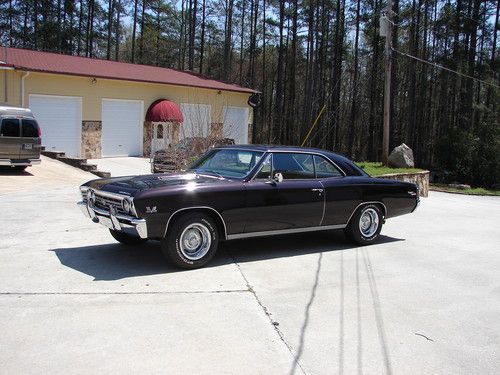

1967 Chevelle Ss on 2040-cars

Stockbridge, Georgia, United States

Vehicle Title:Clear

Make: Chevrolet

Drive Type: rwd

Model: Chevelle

Mileage: 18,732

Trim: Coupe ss

This is a 1967 Chevelle SS 138 car.. The paint is a blackberry color with some purple it in.. Paint is in really good condition.. The interior is black with bucket seats, also in great condition. This car is powered with a 396 big block and a 4 speed manual transmission.. This car has power steering, power front disc breaks and cold AC. Very straight car, has no bondo that i know of and underneath the car is solid.. Good driver,. If you have any questions or would like to request any more pictures please e-mail me or give me a call at 678-763-5591, my name is Chris, thank you and have a great day.

Chevrolet Chevelle for Sale

Auto Services in Georgia

Zbest Cars Atlanta ★★★★★

Your Personal Mechanic ★★★★★

Wilson`s Body Shop ★★★★★

West Georgia Discount Tire ★★★★★

Vineville Tire Co. ★★★★★

Trinity Tire & Auto ★★★★★

Auto blog

Reuss says GM diesel plans are still on pace

Fri, Oct 16 2015General Motors is not going to let Volkswagen's diesel emissions scandal ruin its plans for a new line of efficient, torquey oil-burners, the company's Executive Vice President Mark Reuss said at a recent press event. "No way," Reuss responded when asked about cancelling the upcoming diesel-powered Chevrolet Cruze and other vehicles. "The Cruze Diesel is too good not to do it." Slated for 2017, the compact is just the latest member of a diesel offensive that initially kicked off with the first Cruze Diesel and most recently saw the introduction of the oil-burning Chevy Colorado and GMC Canyon. Reuss also reassured those in attendance that there was "no delay" in development of Cadillac's diesel lineup. Cadillac is working on a line of four- and six-cylinder turbodiesels for Europe. They'd make their way into the US market, too, eventually. "It's a question of timing," Reuss said, according to Car and Driver. Volkswagen's diesel emissions scandal has caused automakers across the globe to at least reanalyze their diesel strategy. Jaguar Land Rover, which is preparing several diesel-powered models for the US market, went on record late last month to reaffirm its commitment to diesel. Related Video: Featured Gallery 2014 Chevrolet Cruze Turbo Diesel: Quick Spin View 14 Photos News Source: Car and DriverImage Credit: Copyright 2015 Seyth Miersma / AOL Green Cadillac Chevrolet GM Diesel Vehicles

Junkyard Gem: 2005 Chevrolet Aveo LS Sedan

Sun, Jun 14 2020The story of Daewoo in North America took some interesting plot turns over the decades. First we had the 1988-1993 Pontiac LeMans, a rebadged Daewoo LeMans. A bit later, Daewoo began selling cars under its own nameplate here, with the Lanos, Nubira, and Leganza available for the 1999-2002 model years. Then Daewoo fled the continent and left warranty service of those cars in the hands of Manny, Moe, and Jack. With GM taking over Daewoo Motors after Daewoo's bankruptcy, we got some Daewoos with Suzuki badges hereó the Verona and the Reno¬ó while Chevrolet began selling the South Korean-built Daewoo Kalos as the Aveo for the 2004 model year. This car may not be a¬†gem in the sense that you would want to own one, but it's a gem of automotive history and thus deserves its place in this series (especially because it's one of the rare 5-speed cars sold here). Many (maybe even most) of these cars ended up in the hands of rental-car companies and other fleet users, but we can tell from the three-pedal setup that this car went to a non-fleet buyer. We've had a couple of these cars compete in the 24 Hours of Lemons, where I work as a dignified and respected race official, and they've been amazingly quick on a road course in the hands of good drivers. Power came from this 103-horsepower Opel-designed four displacing 1.6 liters. The Nubira and Lanos got versions of this engine on these shores, too. The LS was the top trim level for the Aveo in 2004, so this car got air conditioning and a halfway decent audio system (by 2004 standards). The seat fabric is industrial-grade stuff, which would have held up well under the steady drip and/or torrents of bodily fluids coating the interiors of rental cars. The 2004 Aveo LS started at $12,045, which comes to about $16,675 in 2020 dollars, so it was a lot of commuter-appliance for the price. The following generation of this car became the Chevrolet Sonic, beginning with the 2012 model year. You can still buy a new Sonic, and the inflation-adjusted price is nearly identical to that of the original Aveo¬Ö though you might want to move fast if you really want one, because Daewoo stopped selling the Kalos in South Korea not long ago. If you want the rarest member of the Aveo family available in North America, find yourself a hen's-teeth Pontiac G3, the short-lived Pontiac-badged version. Speaking of the G3, here's the way it broke the hearts of gas pumps around the world.

2016 Chevy Volt will not need premium gas

Wed, Oct 29 2014Buried in the new technical details of the 2016 Chevy Volt released yesterday was a throwaway line about a small but important change that's due to the new 1.5-liter, four-cylinder engine. The first-gen Volt has always required premium gas but the new powerplant will be happy burning plain old regular. The Volt's chief engineer, Andrew Farah, told AutoblogGreen that the change was due to today's Volt owners explaining they were not happy paying for top-shelf petroleum. "The ability to use regular unleaded was based directly on customer feedback," he said. "Since the range extender is an all-new engine, it was optimized to use regular unleaded at the outset. Using regular fuel will not have effect on vehicle acceleration or other performance factors." As Larry Nitz, GM's executive director of vehicle electrification, told AutoblogGreen yesterday, the new engine is more powerful and quieter than the outgoing 1.4-liter engine that's used in the current Volt. Fuel economy and EV range specs for the next-gen Volt are not expected until the full car is revealed at the Detroit Auto Show in January.

1971 chevrolet chevelle convertible

1971 chevrolet chevelle convertible 1972 chevrolet chevelle malibu / one family owned

1972 chevrolet chevelle malibu / one family owned 1969 chevrolet malibu completely restored with 454 big block

1969 chevrolet malibu completely restored with 454 big block

The big boss is back 71 ss454 needs complete restoration it's all here,original!

The big boss is back 71 ss454 needs complete restoration it's all here,original! 1969 chevelle ss

1969 chevelle ss