1967 Chevelle Malibu Ss 396 400\auto Black On Black\red Best On Ebay For The $$$ on 2040-cars

Lewiston, Idaho, United States

| |||||

Chevrolet Chevelle for Sale

1970 chevrolet chevelle 350 v8 automatic disc brakes power steering wheels nice(US $15,999.00)

1970 chevrolet chevelle 350 v8 automatic disc brakes power steering wheels nice(US $15,999.00) 1967 chevrolet chevelle ss 396 4 speed frame off concourse restoration

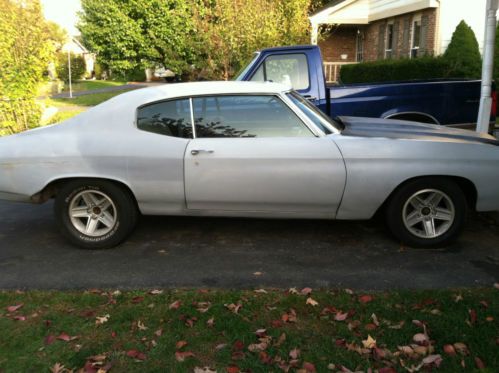

1967 chevrolet chevelle ss 396 4 speed frame off concourse restoration 1972 chevrolet chevelle base hardtop 2-door 5.7l(US $6,500.00)

1972 chevrolet chevelle base hardtop 2-door 5.7l(US $6,500.00) 1970 chevrolet chevelle ss 396

1970 chevrolet chevelle ss 396 1970 ss chevy chevlle ss

1970 ss chevy chevlle ss 1966 chevelle ss convertible factory tuxedo black - documented w/ protecto plate

1966 chevelle ss convertible factory tuxedo black - documented w/ protecto plate

Auto Services in Idaho

Weiser Auto Parts ★★★★★

Scott`s Garage ★★★★★

Pacific Coast Car Co ★★★★★

Northwest Autobody & Towing ★★★★★

My Mechanic ★★★★★

Gentry Ford Subaru ★★★★★

Auto blog

Weekly Recap: Electric Rapide concept showcases Aston's future

Sat, Oct 24 2015Aston Martin showed off an all-electric Rapide S prototype this week and announced an agreement with investment firm ChinaEquity to explore development of a production version of the sports sedan. The car could arrive in about two years if the project advances, and it would be built in Gaydon, England. The concept car, called the "RapidE" was developed with Williams Advanced Engineering. The electric Rapide is meant to highlight British innovation, and it was revealed during a state visit by Chinese president Xi Jinping to the United Kingdom. Spec were not available for the concept on display. "The car we showed in London is a fully running concept but not yet defining [of] our choice of battery, motor, inverter, etc," spokesman Simon Sproule said. "Now that we have a clearer path for producing the car, we will be defining all the parameters." Aston Martin has been vocal about its electric ambitions this year, and Sproule told us at the New York Auto Show that an all-electric Rapide could cost $200,000 to $250,000 or more. "It's a study, but we're serious about it," he said. Some reports have indicated the electric Rapide could pack as much as 1,000 horsepower. Aston considers electric technology the strongest play for modernizing its powertrains and meeting emissions standards around the world. Hybrids and all-electric models can offer high outputs and strong torque delivery, which is in keeping with the Aston's image as a sportscar maker. Company brass prefer this option over dropping down to four-cylinder engines. And yes, V8s and V12s remain part of the plan. The electric push is part of Aston's future strategy to remake its lineup, which includes refreshing its sportscars, building a production version of the electric all-wheel-drive DBX concept shown at the Geneva Motor Show, and adding a four-door Lagonda. OTHER NEWS & NOTES Domino's serves up purpose-built delivery car Domino's revealed a purpose-built pizza delivery car based on the Chevy Spark. It's called the DXP, for Delivery Expert, and it can handle up to 80 pizzas. The pies stay warm thanks to an oven located behind the driver's seat, and the DXP is sauced up with a puddle-lighting feature that projects the Domino's logo outside of the car. Power comes from the Spark's stock 1.2-liter four-cylinder engine rated at 84 hp that gets up to 39 mpg on the highway. Chevy dealers will be trained to service the DXP.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

GM might outsource vans to AM General

Thu, Nov 26 2015General Motors will possibly boost production of the Chevrolet Colorado and GMC Canyon at the Wentzville Assembly Plant in Missouri by contracting out some commercial van manufacturing to AM General. Demand for the two midsize trucks continues to boom, and GM would like to take advantage of the strong market for them. The possible deal came to light in a letter to workers at the factory, according to Automotive News. "This potential partnership would free up production capacity and allow the organization to capitalize on our ability to build midsize trucks to further satisfy customer demand," a portion of the document allegedly said. AM General would reportedly only take over assembly of the cutaway versions of the Chevy Express and GMC Savana. Customers and critics have quickly embraced the latest Colorado and Canyon since their introduction. The Chevy just won back-to-back Motor Trend Truck of the Year awards. GM also had to add a third shift and extra workers in 2014 just to keep up with demand. The Wentzville plant even increased employment on the weekends earlier in 2015 to assemble an extra 2,000 of the trucks each month. While the two pickups boom, deliveries for the Chevy Express and GMC Savana are down 26.9 percent and 26.6 percent respectively through the first 10 months of the year. GM doesn't break out numbers for the cutaway versions, but they make up about a third of production, according to Automotive News. AM General built the Humvee for the US military and does some contract work with automakers. For example, the company's Indiana factory now produces the Mercedes-Benz R-Class for export to China. Here's hoping this potential deal will help both GM and AM General keep their factories humming. Related Video: