Like New 2012 Chevrolet Camaro Rs Black&black Loaded $5k In Options Clean Carfax on 2040-cars

Pompano Beach, Florida, United States

Vehicle Title:Clear

Engine:6

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Make: Chevrolet

Warranty: Vehicle does NOT have an existing warranty

Model: Camaro

Mileage: 2,036

Sub Model: 2LT

Disability Equipped: No

Exterior Color: Black

Doors: 2

Interior Color: Black

Drive Train: Rear Wheel Drive

Inspection: Vehicle has been inspected

Chevrolet Camaro for Sale

Convertible soft top candy 3.6 v6 automatic auto

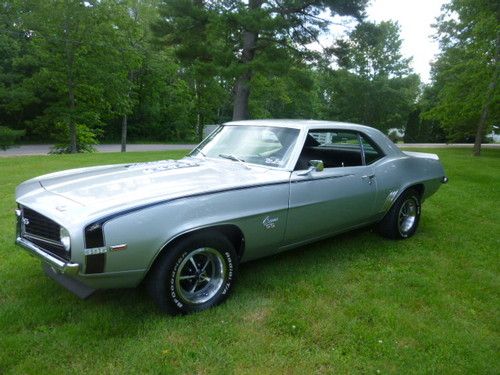

Convertible soft top candy 3.6 v6 automatic auto 1969 chevrolet camaro 396/350hp 4-spd

1969 chevrolet camaro 396/350hp 4-spd 2002 camaro ss 35th anniversary edition 12k miles center exhaust(US $20,900.00)

2002 camaro ss 35th anniversary edition 12k miles center exhaust(US $20,900.00) Frame off built camaro pro touring 496 v8 5 speed a/c(US $99,900.00)

Frame off built camaro pro touring 496 v8 5 speed a/c(US $99,900.00) 1969 camaro rs/ss 396 (434 stroker kit) m22 4speed, 12bolt posi 72 hugger orange

1969 camaro rs/ss 396 (434 stroker kit) m22 4speed, 12bolt posi 72 hugger orange 3800 v6,, $500 transport assist incl , we finance, 3 mo/3000 mi drivetrain warr

3800 v6,, $500 transport assist incl , we finance, 3 mo/3000 mi drivetrain warr

Auto Services in Florida

Zip Automotive ★★★★★

X-Lent Auto Body, Inc. ★★★★★

Wilde Jaguar of Sarasota ★★★★★

Wheeler Power Products ★★★★★

Westland Motors R C P Inc ★★★★★

West Coast Collision Center ★★★★★

Auto blog

GM starting to talk seriously about 200-mile EV

Sun, Oct 12 2014We've been hearing word of a 200-mile EV from Chevrolet for a while now. First, there was General Motors then-CEO Dan Akerson hinting at a $30,000, 200-mile EV that would take the competition by surprise. Then Akerson confirmed that GM is working on a 200-mile EV in a speech in March. LG Chem, which supplies batteries to GM and other automakers, recently said it was working on batteries for EVs with a range of 200 miles. GM's head of global product development Mark Reuss just re-confirmed that there are plans for an EV with a 200-mile range, and sources have told Automotive News what that car will be. While Reuss didn't mention anything about a specific model or platform, two undisclosed sources with knowledge of GM's plans have said that an EV with a range of about 200 miles is indeed in the works, and that it will be based on the Chevrolet Sonic. The sources also gave a timeline for the car, saying it is slated for sometime in 2017. According to Reuss, the plan is for Chevy to offer a lineup of electric cars, with the 200-mile EV joining ranks of the Chevrolet Volt and the Spark EV. He didn't hint at a timeline, but if the sources are correct, we could see a Sonic EV being built within a few years. Reuss sees demand for it, too. When speaking of the Spark EV, currently only available in California and Oregon, he says that "people wish we would sell it all around the country." If he's right about that, it's not difficult to imagine people taking interest in Chevrolet's 200-mile electric car, whether or not it's a Sonic.

GM program sees dealers taking on way more loaner cars

Wed, Dec 17 2014Given the volume of vehicles we're talking about, this is a significant development for GM's bottom line. Bring your car into the dealership for service, and you may need a loaner car in exchange. And with so many recalls being carried out, that means a lot of loaners – especially at General Motors dealerships. That could be one of the reasons why GM is massively expanding its loaner fleet program. While many Chevrolet and Buick-GMC dealerships have an on-site rental car location operated by a third party like Enterprise (which may or may not provide a GM vehicle), others manage their own loaner fleets. But while the range of dealerships operating such fleets was once small, reports Automotive News, the number has been growing rapidly: from the locations responsible for only 20 percent of those brands' sales two years ago to about 90 percent today. The impetus for that growth comes down to a massive expansion of GM's Courtesy Transportation Program. The initiative encourages dealers to ramp up their loaner fleet to a maximum size determined by GM, with a mix determined by the dealer itself, so that a showroom in Texas can be bolstered with a fleet of pickup trucks and a dealer in California can employ more Volt and Camaro Convertible loaners. The dealership gets a $500 credit for each vehicle its puts in its fleet, and can use those vehicles as loaners for service customers, as multi-day test drivers or to rent out separately. The vehicles remain in the dealer's fleet for 90 days or 7,500 miles, then they can be sold as used, but with new-car incentives. The dealer gets a fleet of loaners, customers get to use the loaners, try out a new car overnight or buy a barely used car with attractive incentives, and GM gets to clock more sales. But therein lies the kicker: the automaker counts the dispatch of the loaner new vehicle to the dealership as a new-car sale, which could end up distorting its sales figures. Counting loaner vehicles as sold vehicles is something of an industry-standard practice, but given the volume of vehicles we're talking about, this is a significant development for GM's bottom line. One dealership - Paddock Chevrolet in Kenmore, NY, for example - had no loaner fleet two years ago, but now runs a fleet of 50 vehicles. Multiply that by the 4,000 or so dealers GM has across America and you're talking about the potential for hundreds of thousands of these sorts of sales.

GM profit dips on truck changeover, but beats estimates

Thu, Apr 26 2018DETROIT — General Motors on Thursday reported a higher-than-expected quarterly profit despite a drop in production of high-margin pickup trucks, as it gears up for new models that are expected to boost profits next year. Like rivals Ford and Fiat Chrysler Automobiles, GM is banking on highly-profitable Chevy Silverado and GMC Sierra pickup trucks to lift profits, as consumers shift away from traditional passenger cars in favor of these larger, more comfortable trucks, SUVs and crossovers. During the first quarter, the process of changing over to GM's new pickups resulted in a drop in production of 47,000 units. GM Chief Financial Officer Chuck Stevens said the production drop had resulted in a drop in pre-tax profit of up to $800 million. Earlier this year, GM said its 2018 profits would be flat compared with 2017, but expected its all-new pickup trucks would boost margins starting in 2019. On Thursday, GM reiterated its full-year 2018 forecast for adjusted earnings in a range from $6.30 to $6.60 per share. The automaker said capital expenditures were more than $500 million higher in the quarter because of investments its new pickup trucks and a family of low-cost vehicles under development with Chinese partner SAIC Motor Corp. On Wednesday, rival Ford said it would stop investing in most traditional passenger sedans in North America. CFO Stevens told reporters on Thursday that GM has "already indicated that we will make significantly lower investments on a go-forward basis" in sedans. 2019 GMC Sierra View 21 Photos GM benefited from a lower effective tax rate in the quarter, but adjusted pre-tax margin fell to 7.2 percent from 9.5 percent a year earlier. Stevens said the company's profit margin should hit 10 percent or higher in the second quarter and for the full year. GM said material costs were $700 million higher in the first quarter, and it expects those costs to continue rising. The automaker said it would counter those increases with cost cutting measures. "It is a more difficult environment than it was three or four months ago," Stevens said when asked about rising commodity prices from potential steel and aluminum tariffs announced by the Trump administration. "But we are confident we can continue to offset that." The company reported quarterly net income of $1.05 billion or $1.43 per share, a drop of nearly 60 percent from $2.61 billion or $1.75 per share a year earlier. Analysts had on average expected earnings per share of $1.24.