2019 Chevrolet Camaro Ss on 2040-cars

Gardena, California, United States

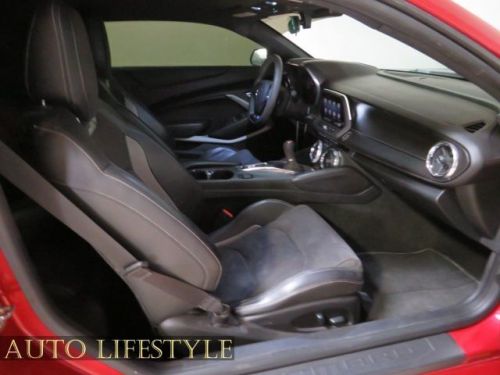

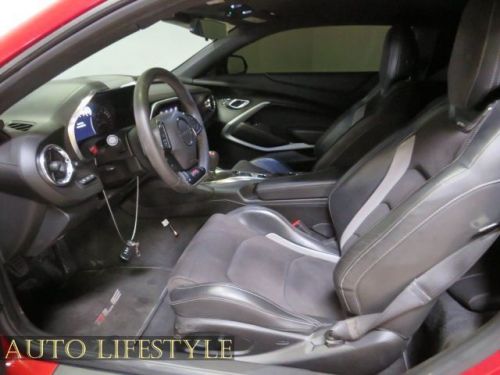

Engine:6.2L V8 455hp 455ft. lbs.

Body Type:Coupe

Fuel Type:Gasoline

For Sale By:Dealer

Year: 2019

VIN (Vehicle Identification Number): 1G1FE1R77K0117233

Mileage: 74723

Make: Chevrolet

Model: Camaro

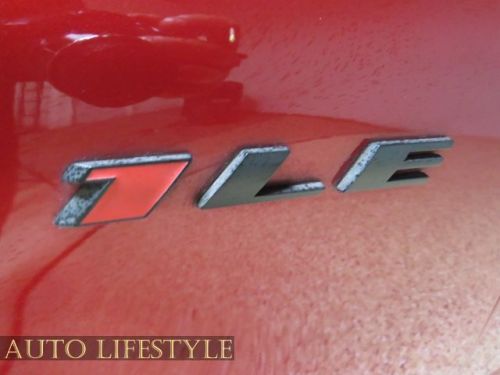

Trim: SS

Number of Cylinders: 8

Chevrolet Camaro for Sale

1982 chevrolet camaro(US $10,000.00)

1982 chevrolet camaro(US $10,000.00) 1986 chevrolet camaro z28 2dr hatchback 45k original miles(US $21,900.00)

1986 chevrolet camaro z28 2dr hatchback 45k original miles(US $21,900.00) 1968 chevrolet camaro rs/ss 2dr coupe(US $33,600.00)

1968 chevrolet camaro rs/ss 2dr coupe(US $33,600.00) 1970 chevrolet camaro(US $40,700.00)

1970 chevrolet camaro(US $40,700.00) 1992 chevrolet camaro z28 25th anniversary(US $5,000.00)

1992 chevrolet camaro z28 25th anniversary(US $5,000.00) 1968 chevrolet camaro(US $18,500.00)

1968 chevrolet camaro(US $18,500.00)

Auto Services in California

Z & H Autobody And Paint ★★★★★

Yanez RV ★★★★★

Yamaha Golf Cars Of Palm Spring ★★★★★

Wilma`s Collision Repair ★★★★★

Will`s Automotive ★★★★★

Will`s Auto Body Shop ★★★★★

Auto blog

GM might outsource vans to AM General

Thu, Nov 26 2015General Motors will possibly boost production of the Chevrolet Colorado and GMC Canyon at the Wentzville Assembly Plant in Missouri by contracting out some commercial van manufacturing to AM General. Demand for the two midsize trucks continues to boom, and GM would like to take advantage of the strong market for them. The possible deal came to light in a letter to workers at the factory, according to Automotive News. "This potential partnership would free up production capacity and allow the organization to capitalize on our ability to build midsize trucks to further satisfy customer demand," a portion of the document allegedly said. AM General would reportedly only take over assembly of the cutaway versions of the Chevy Express and GMC Savana. Customers and critics have quickly embraced the latest Colorado and Canyon since their introduction. The Chevy just won back-to-back Motor Trend Truck of the Year awards. GM also had to add a third shift and extra workers in 2014 just to keep up with demand. The Wentzville plant even increased employment on the weekends earlier in 2015 to assemble an extra 2,000 of the trucks each month. While the two pickups boom, deliveries for the Chevy Express and GMC Savana are down 26.9 percent and 26.6 percent respectively through the first 10 months of the year. GM doesn't break out numbers for the cutaway versions, but they make up about a third of production, according to Automotive News. AM General built the Humvee for the US military and does some contract work with automakers. For example, the company's Indiana factory now produces the Mercedes-Benz R-Class for export to China. Here's hoping this potential deal will help both GM and AM General keep their factories humming. Related Video:

Chevy Corvette is latest car breached by hackers

Wed, Aug 12 2015UPDATE: This story has been updated with comment from General Motors. In the latest car-hacking exploit in a summer full of them, researchers from the University of California-San Diego say they've found a way to manipulate braking in a 2013 Chevrolet Corvette. The vulnerabilities may not be limited to that model. Cyber-security researchers breached the car's security systems via a device they had plugged into the Corvette's OBD-II port, and through that connection, they sent messages that could turn windshield wipers on and off and tamper with the brakes as the car drove at low speeds. It's the latest in a series of car hacks that involve access to critical systems obtained via the OBD-II port, where drivers can plug in devices that provide anything from diagnostic information for mechanics to driving information for insurance companies. Last November, cyber-security engineers from Argus Cyber Security remotely controlled vehicle functions in a car that had a OBD-II dongle called a Zubie installed. In January, researchers from Digital Bond Labs found security holes in an information-tracking dongle popular with more than 2 million Progressive Insurance customers. Those came before prominent hacks unveiled in recent weeks, in which researchers remotely commandeered control of a Jeep Cherokee and, separately, showcased problems with GM's OnStar infotainment system. Regarding the dongles that plug into the OBD-II ports, Stefan Savage, a Cal-San Diego professor involved in the research, tells WIRED that, "we acquired some of these things, reverse-engineered them, and along the way, found that they had a whole bunch of security deficiencies." Savage and others unveiled the latest study at the Usenix security conference Tuesday. In a video of their exploit entitled "Fast and Vulnerable," they show how they sent SMS messages from a smartphone to the dongle plugged into the car's OBD-II port. From there, their messages accessed the CAN bus, a network on the car that connects individual electronic control units, which control dozens of vehicle functions. As they send the commands to brake the car, the driver of the Corvette notes "the pedal doesn't react to any pressure." General Motors issued a written response Wednesday, warning drivers to be careful with third-party devices they plug into their OBD-II ports.

Diesel-powered 2020 Chevrolet Silverado, GMC Sierra get big price cuts

Tue, Sep 8 2020General Motors is reducing the price difference between its diesel-powered light-duty pickups and their gasoline-burning counterparts, according to a recent report. As of September 3, 2020, the Chevrolet Silverado 1500 and the GMC Sierra 1500 benefit from a $1,500 price cut when they're ordered with a turbodiesel under the hood. Enthusiast website GM Authority first reported the news after looking at internal documents sent to dealers across the nation. It wrote the discount applies to in-stock and in-transit units of the Silverado and the Sierra (pictured), and it added dealers will begin receiving amended window stickers on September 8. And, it's not just a quick, easy way for General Motors stores to clear out 2020 inventory. Incoming 2021 models will benefit from it, too. Chevrolet's cheapest diesel-slurping 2020 Silverado, a double-cab LT with two-wheel drive, now starts at $44,000 once a mandatory $1,595 destination charge enters the equation. For context, the same configuration costs $38,795 including destination when it's ordered with the 2.7-liter turbocharged four-cylinder, which is the smallest and cheapest engine on the roster. Selecting the more efficient engine option costs buyers $5,205. At the other end of the spectrum, the crew-cab High Country with a standard cargo box and four-wheel drive is now priced at $59,690. Walk a block to the GMC store, and you'll need to spend between $44,470 (double-cab SLE with two-wheel drive) and $61,685 (crew-cab Denali with a regular cargo box and four-wheel drive) for a diesel-powered Sierra. It doesn't sound like either company is making major mechanical changes to the trucks for 2021. Both are powered by a 3.0-liter straight-six Duramax engine, which makes 277 horsepower and 460 pound-feet of torque. Rear-wheel drive and a 10-speed automatic transmission come standard, and four-wheel drive is offered at an extra cost. In its most efficient configuration, the Silverado returns 23 mpg in the city, 33 mpg on the highway, and 27 mpg in a mixed cycle, impressive numbers for a body-on-frmae pickup that's as heavy as it is capable. Ram's diesel-powered 1500 posts EPA estimates of 22, 32, and 26, respectively. Ford pledged the recently-unveiled 14th-generation F-150 will offer a turbodiesel engine, too, but its fuel economy figures are not available yet.