2015 Chevrolet Camaro Z28 on 2040-cars

Zanesville, Ohio, United States

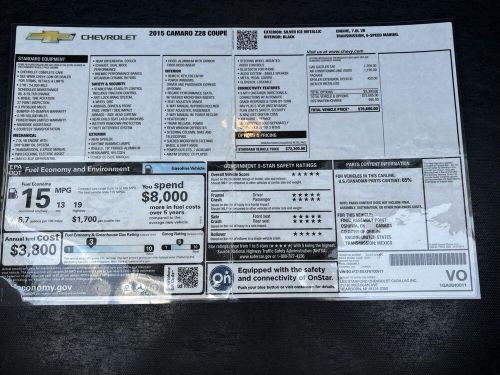

Transmission:Manual

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

Engine:7.0L Gas V8

VIN (Vehicle Identification Number): 2G1FZ1EEXF9700917

Mileage: 6152

Trim: Z28

Number of Cylinders: 8

Make: Chevrolet

Drive Type: RWD

Model: Camaro

Exterior Color: Grey

Chevrolet Camaro for Sale

1968 chevrolet camaro ss l88 427 big block(US $54,995.00)

1968 chevrolet camaro ss l88 427 big block(US $54,995.00) 1969 chevrolet camaro(US $59,490.00)

1969 chevrolet camaro(US $59,490.00) 1968 chevrolet camaro(US $22,000.00)

1968 chevrolet camaro(US $22,000.00) 1969 chevrolet camaro rs/ss convertible ls restomod(US $60,100.00)

1969 chevrolet camaro rs/ss convertible ls restomod(US $60,100.00) 2022 chevrolet camaro zl1(US $65,000.00)

2022 chevrolet camaro zl1(US $65,000.00) 2017 chevrolet camaro ss(US $100.00)

2017 chevrolet camaro ss(US $100.00)

Auto Services in Ohio

West Side Garage ★★★★★

Wally Armour Chrysler Dodge Jeep Ram ★★★★★

Valvoline Instant Oil Change ★★★★★

Tucker Bros Auto Wrecking Co ★★★★★

Tire Discounters Inc ★★★★★

Terry`s Auto Service ★★★★★

Auto blog

Nissan Leaf sets another monthly sales record, Chevy Volt remains steady

Mon, Nov 3 2014Here we go again. Another month in the books and another month of record sales by the Nissan Leaf in the US. For October, the world's best-selling pure EV sold 2,589 units, which is 29.3 percent more than October 2013. That makes it 20 times in a row that Nissan can say that last month sales were better than the same month a year before. All told, Nissan has sold 24,411 Leafs in the US this year, a new record, reflecting an overall Leaf sales rate that is up 35 percent, year-to-date. Nissan isn't stopping, either. A new TV ad, one that, "encourages consumers to kick gas" by saving money on fuel will start airing today in major markets, according to Toby Perry, director of Nissan's EV marketing. You can watch it below. As for the Chevy Volt, things remained steady last month in the face of a new model that's coming in the second half of 2015. Chevy sold 1,439 Volts last month, which is about the same as September (1,394) but down 28.8 percent from the October 2013 despite GM having its best overall US October sales this year since 2007. So far, 2014 Volt year-to-date sales are down 14.9 percent through the end of October compared to 2013. And that wraps up the flash report on monthly sales for these two long-standing plug-in vehicles in the US market. As always, we'll have our in-depth write-up of US green car sales available soon. For now, we await your comments, below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

2015 Chevy Impala Bi-fuel burns CNG, starts at $37,385*

Tue, May 6 2014Currently, the only natural-gas-powered passenger car offered for sale by an OEM in the US is the Honda Civic Natural Gas. Starting this fall, that long-running CNG car will be joined by a CNG-burning 2015 Chevy Impala for both fleet and retail customers. General Motors announced today that the car will start at $37,385, plus an $825 destination charge. That comes to $38,210 before taxes and options. Those options include two trim lines, the base LS and the upper-level LT. Chevy doesn't break out the details in the press release announcing the price, but you can see the trim details for the standard gas-powered 2014 Impala here. Exact information on the 2015 models is not available just yet, but GM spokesman Chad Lyons told AutoblogGreen that the equipment that you see listed on the site for 2014 is "almost exactly the same" as what will be available for 2015. The 2015 Impala gets around 19 city mpg on CNG, but official EPA numbers are not yet available. That means the LS will come with 18-inch aluminum wheels, electric variable-assist power steering, projector-beam headlamps, and 10 air bags. The LT adds an eight-inch touch screen with MyLink, premium Cloth interior and dual-zone automatic climate controls. The cost for this upgrade is unspecified. For CNG purposes, we can ignore the numerical prefix used for the gas-powered LT trims, since that denominates the engine type, and all the CNG models use a 3.6-liter engine with hardened valves and valve seats that can better handle natural gas. The trunk capacity also drops from 18.8 cubic feet to 10 cu .ft. in order to fit in the CNG tank that holds the equivalent of 7.8 gallons of gas. That amount of CNG should move you 150 city miles, which is around 19 mpg, but official EPA numbers are not yet available. With the addition of the gasoline on board, the overall range is 500 city miles. The car burns CNG when available and switches to gas with "no interruption" either when the tank is empty or when the driver selects the gas tank. Find more details in the press release below. GM says the CNG Impala will will be available nationwide this fall. CNG is a growing fuel in the US, thanks in part to fracking. The Civic Natural Gas, which starts at $26,640, is growing towards a nationwide availability. Next year, for example, the Shell Eco-marathon Americas in Detroit will allow CNG for the first time. Chevrolet Announces Pricing of CNG-Capable 2015 Impala 2014-05-06 LONG BEACH, Calif.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.