2014 Chevy Camaro 2ss 1le Performance 6-spd Hud 334 Mi Texas Direct Auto on 2040-cars

Stafford, Texas, United States

Vehicle Title:Clear

Engine:See Description

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Manual

Certified pre-owned

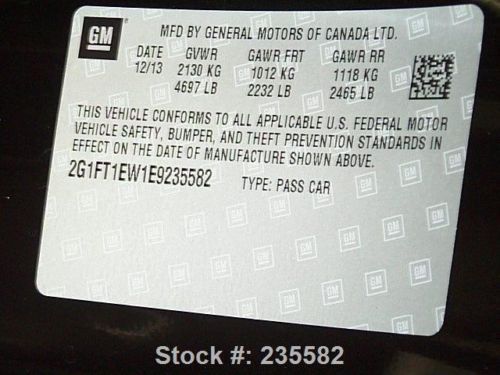

Year: 2014

Make: Chevrolet

Warranty: Vehicle has an existing warranty

Model: Camaro

Power Options: Power Seats, Cruise Control

Mileage: 334

Sub Model: REARVIEW CAM

Exterior Color: Black

Number Of Doors: 2

Interior Color: Black

Inspection: Vehicle has been inspected

Number of Cylinders: 8

CALL NOW: 281-410-6075

Seller Rating: 5 STAR *****

Chevrolet Camaro for Sale

2ss nav heated stripes camera assist bluetooth 2012 2014 2013 head up stripe(US $32,988.00)

2ss nav heated stripes camera assist bluetooth 2012 2014 2013 head up stripe(US $32,988.00) 2012 chevy camaro lt rs rear cam hud 20" wheels 42k mi texas direct auto(US $20,980.00)

2012 chevy camaro lt rs rear cam hud 20" wheels 42k mi texas direct auto(US $20,980.00) 1995 chevrolet camaro z28 convertible 2-door 5.7l

1995 chevrolet camaro z28 convertible 2-door 5.7l Super clean 1989 camaro rs origional owner, 50000 miles, garage kept

Super clean 1989 camaro rs origional owner, 50000 miles, garage kept Very mint z28 red with sunroof & original parts w/ some bolt on

Very mint z28 red with sunroof & original parts w/ some bolt on 1996 chevrolet camaro as-is for parts bill of sale only

1996 chevrolet camaro as-is for parts bill of sale only

Auto Services in Texas

Wolfe Automotive ★★★★★

Williams Transmissions ★★★★★

White And Company ★★★★★

West End Transmissions ★★★★★

Wallisville Auto Repair ★★★★★

VW Of Temple ★★★★★

Auto blog

Here's why automakers roll out those Texas-themed pickup trucks

Thu, Sep 29 2016Every year, automakers with a full-size truck link make a big show of the Texas State Fair, usually involving a reveal of a new model. Sometimes they show a whole new truck, and other times a special edition centered on the Lone Star state. While some people might write this off as a quirk of the industry, others might be wondering, "What's the big deal with Texas?" As it turns out, part of the big deal with Texas is big truck sales. According to Dave Sullivan, product analysis manager at AutoPacific, Texas buys more trucks than any other state in the country. It's not a small margin either. Edmunds.com, one in five trucks sold in the US are sold in Texas. The state also accounts for 15 percent of the country's large truck sales, which is more than twice that of California, the second largest truck market in America. Even when you break down sales only in Texas, trucks are a huge piece of the pie - Sullivan says that a quarter of new vehicle sales in Texas are trucks. One in five trucks sold in the US are sold in Texas. But it's not just sales that make truck builders give attention to Texas. As Sullivan explained, "Pickups are life in Texas." Both he and Hugh Milne, marketing and advertising manager for the Chevy Silverado line, said that trucks are key fixtures in Texas society, as both work trucks and luxury vehicles (or Texas Cadillacs as Milne called them). Milne said Texas is so important in the truck market that if you want to be successful in the rest of the country, "you've got to be successful in Texas." As for the State Fair, it has become a prime location for reveals in part because of the importance of the Texas market and because of how big the fair is. Milne also revealed that the State Fair also hosts its own auto show, so it's an ideal venue for a vehicle introduction. So there you have it. Why do truck builders obsess over Texas? It's because Texas obsesses over trucks. When you have one market that loves your product that much, you give it the attention it deserves. Related Video: Image Credit: Donovan Reese via Getty Images Auto News Marketing/Advertising Chevrolet Ford RAM Truck f-150 texas state fair

GM announces 3 new recalls affecting 1.7M vehicles in North America [w/video]

Mon, Mar 17 2014Still embroiled in the ongoing ignition switch recall, General Motors announced today three more discrete recalls, affecting a grand total of 1,546,900 vehicles in the US. The Detroit News reports that some 1.7 million vehicles are affected overall in North America. The first and largest of the trio of new recalls concerns some 1.18-million Buick Enclave and GMC Acadia crossovers from the 2008-2013 model years, Chevrolet Traverse from 2009-2013 (pictured above) and Saturn Outlook vehicles from 2008-2010. All of the crossover utilities may have an issue with the wiring harness for their seat-mounted side airbags. Apparently, the vehicles are equipped with a Service Air Bag warning light that, if ignored, "will eventually result in the non-deployment of the side impact restraints." Those restraints include the side airbags, a front-center airbag if the vehicle is so equipped and seatbelt pretensioners. Dealers of affected vehicles will be instructed to remove driver and passenger side airbag wiring harness connectors, and then "splice and solder the wires together." The second recall affects 303,000 Chevrolet Express (pictured right) and GMC Savana vans from model years 2009-2014, and with gross vehicle weights under 10,000 pounds. Said vehicles do not comply with a head impact requirement for unrestrained occupants, and will need a reworking of the instrument panel material to be sent back on the road. It doesn't sound as though there's a quick fix for this one, as the GM press release states: "Unsold vehicles have been placed on a stop delivery until development of the solution has been completed and parts are available." Finally, the third recall affects 63,900 Cadillac XTS luxury sedans from model years 2013 and 2014. A brake booster pump may be susceptible to corrosion by way of the relay, potentially causing and electrical short, overheating, melting of plastic components and even engine fires. GM says it is aware of two engine fires in unsold XTS models and two cases of melted parts. Repairs for the issues affecting the XTS have not not mentioned by GM in the release. The Detroit News is also reporting that along with news of the triple-recall, GM is taking a $300-million credit to help pay for the repair costs, and to deal with the ongoing costs associated with the ignition switch recall. In an attempt to explain just what GM has been doing in the face of these very serious issues, newly minted CEO Mary Barra has addressed the issues in a new video.

Ford Bronco, Bronco Sport, sub-Ranger pickup and GM EVs | Autoblog Podcast #618

Thu, Mar 12 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder and Road Test Editor Zac Palmer. Top of the list this week are the leaked photos of the 2021 Ford Bronco and Bronco Sport. Then they talk about the possibility of a small Ford pickup based on the Focus, as well as all the electric vehicles Snyder saw in person at GM's "EV Day." The editors have been driving the Ram Power Wagon and Hyundai Sonata, and Palmer took Autoblog's long-term Subaru Forester to New Orleans. Finally, they help a listener choose a small luxury crossover in this week's "Spend My Money" segment. then, just as they're about to wrap up the show, they learn that the 2020 New York Auto Show has been postponed due to the coronavirus outbreak. Good times. Autoblog Podcast #618 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown 2021 Ford Bronco and Bronco Sport leaked photos (and, just as we predicted, more photos) Ford shows its dealers the sub-Ranger pickup More details about everything we saw at GM's "EV Day" Driving the 2020 Ram 2500 Power Wagon Driving the 2020 Hyundai Sonata Driving our long-term 2019 Subaru Outback to New Orleans Spend My Money: Audi Q3, Volvo XC40 or Range Rover Evoque? 2020 New York International Auto Show postponed Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.043 s, 7841 u