1956 Chevrolet Bel Air 150/210 on 2040-cars

Victoria, Texas, United States

IF YOU ARE INTERESTED EMAIL ME AT: sorosalez@juno.com .

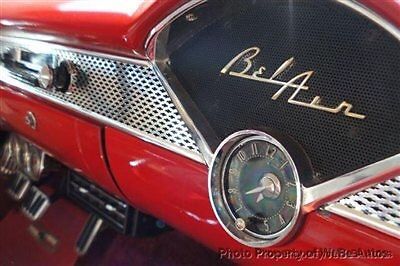

custom 56 Belair. it has went through an extensive frame off restore a few years back. frame has been blasted and por 15 added. absolutely no rust on car. paint is beautiful. it has a custom lt1 fuel injected engine. 4l60e auto trans. custom 56 belair scripted valve covers. aluminum radiator with electric fans. it has air conditioning and heat. 17 in american racing rims with new kumho tires. front disc brakes have been added. it has a ford 9 in rear with 373 posi gears. runs and drives awesome on the road. power steering and brakes. this classic has it all.it has a jensen in dash unit with 2 6x9 speakers in the package tray. all gauges, lights, wipers, horn, etc work.

Chevrolet Bel Air/150/210 for Sale

1953 chevrolet bel air150210(US $7,500.00)

1953 chevrolet bel air150210(US $7,500.00) 1956 chevrolet bel air150210(US $17,000.00)

1956 chevrolet bel air150210(US $17,000.00) 1955 chevrolet bel air150210(US $18,700.00)

1955 chevrolet bel air150210(US $18,700.00) 1957 chevrolet bel air150210(US $18,100.00)

1957 chevrolet bel air150210(US $18,100.00) 1955 chevrolet bel air150210 true bel air not 150210(US $13,200.00)

1955 chevrolet bel air150210 true bel air not 150210(US $13,200.00) 1957 chevrolet bel air150210(US $7,500.00)

1957 chevrolet bel air150210(US $7,500.00)

Auto Services in Texas

Woodway Car Center ★★★★★

Woods Paint & Body ★★★★★

Wilson Paint & Body Shop ★★★★★

WHITAKERS Auto Body & Paint ★★★★★

Westerly Tire & Automotive Inc ★★★★★

VIP Engine Installation ★★★★★

Auto blog

Super Bowl MVP Tom Brady gives Chevy Colorado to Malcolm Butler [w/poll]

Tue, Feb 3 2015Winning the Super Bowl, we'd imagine, is pretty sweet. Winning the MVP award at the Super Bowl, even more so – for many reasons, among them that you get a brand new Chevy Colorado, packed full of, you know... technology and stuff. Of course this year's Most Valuable Player was none other than Tom Brady, the New England Patriots quaterback who was crowned Super Bowl MVP for the third time and lead the Pats to win the Super Bowl for the fourth time. He makes tens of millions every season, and Mrs. Brady (a.k.a. Gisele Bundchen) probably makes an extraordinarily pretty penny herself. So what does one of the most successful and wealthy players in NFL history need with a new pickup truck? Not a whole lot, apparently: the Boston Business Journal reports that he gave the truck to Malcolm Butler, the rookie cornerback who intercepted Seattle Seahawks QB Russell Wilson's pass on the Patriots' one-yard line with only twenty seconds to go and sealed the victory for New England. Which strikes us as a fitting gesture, even if Brady did keep the MVP trophy for himself. Related Video: Related Gallery 2015 Chevrolet Colorado View 31 Photos News Source: Chevrolet, Boston Business JournalImage Credit: Jamie Squire/Getty Celebrities Chevrolet Truck tom brady new england patriots

Chevrolet considering midsize crossover to slot between Traverse and Equinox

Mon, Jan 9 2017Crossovers are the new hotness, and automakers are looking to cash in by offering a size and shape for every customer. With Chevrolet's debut of the new 2018 Traverse in Detroit, which grew ever so slightly compared to the first-generation model, there is now a midsize-crossover-sized hole between the three-row Traverse and the compact Equinox. When asked about that obvious space, a Chevrolet spokesperson told us the company is looking into the possibility of expanding its crossover lineup. It should be a relatively simple thing to do, since all it would take is reskinning and rechristening the GMC Acadia with a bow tie, and we all know how much GM loves platform sharing. Although they're now different sizes, the new Acadia and Traverse still use the same platform; the Acadia is now on a short-wheelbase version of the C1XX while the Traverse uses long-wheelbase C1XX parts. A short-wheelbase Chevy built on the C1XX likely would be differentiated visually from both the Acadia and the larger Traverse. It may seem like flooding the lineup with more and more models would cannibalize sales of existing ones, but Chevrolet said it would rather have customers stay within the brand rather than going to another automaker. There have been whispers that some form of the Blazer name (possibly TrailBlazer) may make a return on a midsizer, but if it does don't expect an old-school body-on-frame SUV like the old one. In the end, if Chevy builds it, customers will come. Related Video:

2015 Chevrolet Trax

Thu, Dec 4 2014After the obligatory product presentation for the 2015 Trax, I caught up with Steve Majoros, Chevrolet's director of marketing for crossovers and cars, and asked him to elaborate on which markets his planners believe will be the hot starters for this tiny CUV. Without much hesitation, Majoros began to click off traditional sales havens for Subaru, namely, New England and the snowy bits of the East Coast, Colorado and the Pacific Northwest. That news might not surprise you, but it did me. Perhaps it's something as basic as the Trax's tall-hatchback looks, or the emphasis Chevrolet put on the urban driving cycle during my test in San Diego. But before my chat with Majoros, I'd considered this a crossover pointed at the Millennial city mouse more than his bumpkin cousin. But a closer look had me re-examining the granola cred of Chevy's smallest crossover. Having spent my fair share of time in New England and around New Englanders, I started by mentally listing the Trax's Subaru-like traits: practicality, thrift, all-weather ability and, well, just a dash of ugliness. (I suppose a hatchback needn't always be ugly to sell in Maine, or Boulder or Portland... but a 'distinctive' face doesn't seem to hurt.) After a day of driving through sunny San Diego and its surroundings, I can say that Trax makes an interesting case for itself against the standard bearers of the L.L. Bean set, but I'm less sure of its argument for young urbanites. The Trax looks a lot like an Equinox whose suit shrunk in the wash. Chevy's has downsized its own, rather conservative crossover styling to fit the proportions of the subcompact Trax; to my eyes, it looks a lot like an Equinox whose suit shrunk in the wash. That's fine for offering a cohesive look for the Chevy family of crossovers, but it seems out of step with the rest of the segment. If the Trax's current competitive set were the cast of a high school-based TV show, the Kia Soul would play the lovable nerd, the Nissan Juke perhaps the outsider musician and the Subaru XV Crosstrek the athletic outdoorsy kid. Chevy may see the Trax as the hipster chick wearing intentionally ironic mom jeans, but to me the styling is a little too on the nose; more like an actual grownup trying to hang with the kids. These mom jeans are genuine. Per my earlier point, that quasi-conservative look may be just fast enough for staid New Englanders, but I have a hard time seeing the bluff, big-Bowtied front end playing in Bushwick or Wicker Park.