1952 Chevy 2 Door Sedan Great Driver With A Nice Older Finish Oklahoma Car on 2040-cars

Oklahoma City, Oklahoma, United States

|

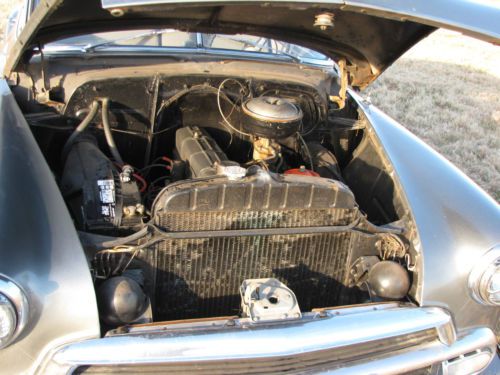

This is a neat old car and is adult owned that runs great and has been well taken care of. The paint is older and tired but still has a decent shine and gets a lot of attention wherever it goes. The engine has been freshened and runs great . The interior is nice and looks very presentable at local car cruises and shows. The little car is reliable and fun to drive . I am happy to answer any questions or send more pictures if needed .. The car belongs to my Grandfather and is located in Tuttle Oklahoma just 20 min from Oklahoma City ....

The paint is older and shows signs of light filler and I do see some rust on the floor pans but nothing terrible and the car is very solid for a 52 Chevy... Call or text 405-473-3204 to answer questions or arrange to see the car. thanks for viewing we are currently selling a few from his collection please see my other auctions .. |

Chevrolet Bel Air/150/210 for Sale

1956 chevy 210 handyman wagon(US $26,000.00)

1956 chevy 210 handyman wagon(US $26,000.00) 1956 chevy restomod pro touring style 1955 1957 1958

1956 chevy restomod pro touring style 1955 1957 1958 1959 chevrolet bel air base sedan 4-door 3.8l

1959 chevrolet bel air base sedan 4-door 3.8l Chevy 2-door sedan, 348 tri-power engine, 4 speed transmission

Chevy 2-door sedan, 348 tri-power engine, 4 speed transmission 1956 chevrolet bel-air 2-door hard top! trades?

1956 chevrolet bel-air 2-door hard top! trades? 1957 chevrolet belair 2 door hardtop sports coupe v8 project car selling cheap(US $2,995.00)

1957 chevrolet belair 2 door hardtop sports coupe v8 project car selling cheap(US $2,995.00)

Auto Services in Oklahoma

Villa Auto Plaza, LLC ★★★★★

Two Brothers Mobile Auto Service ★★★★★

Todd`s Custom & Collision ★★★★★

Tioli Motors ★★★★★

Tidmore`s Used Cars ★★★★★

Roy`s Transmission Shop ★★★★★

Auto blog

GM finds steering flaw, decides it doesn't warrant a recall

Tue, Apr 14 2015Guess what? General Motors is back in the spotlight for not recalling something. This time, though, not only does the company have an argument against a recall campaign, but its position is supported by the National Highway Traffic Safety Administration. According to The New York Times, over 50 owners of GM vehicles have reported instances of stuck or seized steering after driving long distances without moving the wheel. One owner complained to NHTSA that the "locked" steering of their 2013 Buick Verano caused a collision with a concrete barrier in a construction zone. Along with the 2013 to 2014 model year Verano sedans, Chevrolet Cruze and Malibu sedans are also affected. Considering the popularity of those models, GM needs to have a reason for not issuing a recall, right? "Based on a very low rate of occurrence – ranging from less than one half to less than two incidents per thousand vehicles – and the fact that the condition is remedied when the wheel is turned, GM determined this was not a safety issue," spokesman Alan Adler told The Times. The company has, however, issued a technical service bulletin for owners that complain of the problem. The fix is nothing more than a software update that is covered for 10 years or 150,000 miles from new. NHTSA cited GM's actions, along with descriptions of the problems from customers, in its decision not to issue a recall, with spokeswoman Catherine Howden saying, "the symptoms described would be a brief, perceptible change in steering feel that has little to no effect on the driver's ability to safely steer the vehicle." "When terms like 'notchy,' 'stick,' 'slip' or 'feel' are used, it does not indicate a meaningful increase in steering effort," Howden told The Times via email. What do you think? Is GM in the wrong here? Should there be a recall, or is the issue so limited as to not warrant one? Have your say in Comments. Featured Gallery 2013 Buick Verano Turbo: Review View 20 Photos Related Gallery 2014 Chevrolet Malibu: First Drive View 36 Photos Related Gallery 2014 Chevrolet Cruze Turbo Diesel: Quick Spin View 14 Photos News Source: The New York TimesImage Credit: Copyright 2015 Steven J. Ewing, Seyth Miersma / AOL Government/Legal Recalls Buick Chevrolet GM Safety Sedan buick verano

Chevy Volt has worst sales month since August 2011, Nissan Leaf also down

Tue, Feb 3 2015January is traditionally a time when new car shoppers take a break. For the last few years, if we isolate our focus to just the first two major plug-in cars in the US market, we see that the first month of the year was lower – often dramatically lower – than the 11 that followed. So, when you see the Chevy Volt dropped and Nissan Leaf sales figures for January 2015, don't be too surprised. The Volt sold only 542 units last month, that model's lowest since August 2011. That also represents a 41 percent drop from January 2014, and it reinforces the thought that if anyone out there is interested in a new Volt, they're going to be waiting for the new model to drop later this year. While we do expect sales to climb in February and into spring, we won't be surprised if the general Volt trend remains quiet until the second-generation arrives. On the Leaf side of the ledger, January's low sales numbers were still about twice as high as the Volt's – the Leaf sold 1,070 units last month, the lowest since February 2013 – but it did break a streak for the Japanese automaker. Usually, each month represents at least an increase over the same month a year ago, but that wasn't the case this time. In January 2014, Nissan sold 1,252 Leafs. Still, Brendan Jones, Nissan's director of electric vehicle sales and infrastructure, issued an upbeat statement: "We saw a significant increase in demand in December from Nissan Leaf customers looking to take advantage of federal and state incentives at the end of the tax year, which pulled some sales ahead. We're confident that EV sales will continue to rise over time due to increasing emission regulations and other reasons for purchase of EVs such as lower operating costs, reducing dependence on foreign energy sources, environmental concerns and a great driving experience." The numbers will tell us soon enough. News Source: General Motors, Nissan Green Chevrolet Nissan Electric Hybrid ev sales brendan jones

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.