1994 Chevrolet Silverado 1500 Mechanics Special, 4x4, 100% Rust Free, No Reserve on 2040-cars

Los Angeles, California, United States

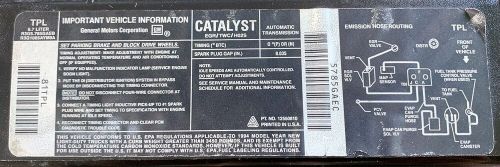

Transmission:Automatic

Fuel Type:Gasoline

Vehicle Title:Clean

Engine:5.7 LITER

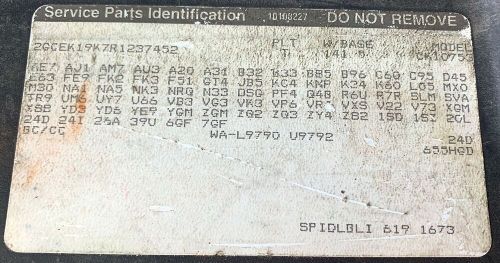

VIN (Vehicle Identification Number): 2GCEK19K7R1237452

Mileage: 192678

Interior Color: Blue

Number of Seats: 4

Trim: Mechanics Special, 4x4, 100% Rust Free, No Reserve

Number of Cylinders: 8

Make: Chevrolet

Drive Type: 4WD

Drive Side: Left-Hand Drive

Engine Size: 5.7 L

Model: Silverado 1500

Exterior Color: Blue

Car Type: Pickup Truck

Number of Doors: 2

Features: Air Conditioning, AM/FM Stereo, Power Locks, Power Steering, Tilt Steering Wheel

Chevrolet Silverado 1500 for Sale

2022 chevrolet silverado 1500 ltz(US $23,950.00)

2022 chevrolet silverado 1500 ltz(US $23,950.00) 1998 chevrolet silverado 1500 whipple supercharged lowered obs budnik wheels!!(US $24,500.00)

1998 chevrolet silverado 1500 whipple supercharged lowered obs budnik wheels!!(US $24,500.00) 2023 chevrolet silverado 1500 custom(US $18,950.00)

2023 chevrolet silverado 1500 custom(US $18,950.00) 2001 chevrolet silverado 1500(US $19,950.00)

2001 chevrolet silverado 1500(US $19,950.00) 2024 chevrolet silverado 1500 rst(US $42,900.00)

2024 chevrolet silverado 1500 rst(US $42,900.00) 2020 chevrolet silverado 1500 4wd crew cab short bed lt(US $25,656.40)

2020 chevrolet silverado 1500 4wd crew cab short bed lt(US $25,656.40)

Auto Services in California

Xtreme Auto Sound ★★★★★

Woodard`s Automotive ★★★★★

Window Tinting A Plus ★★★★★

Wickoff Racing ★★★★★

West Coast Auto Sales ★★★★★

Wescott`s Auto Wrecking & Truck Parts ★★★★★

Auto blog

GM follows up Lambda CUV stop-sale with tire recall

Mon, Feb 9 2015In late January, General Motors announced a stop-sale for about 6,281 examples of the 2015 Chevrolet Traverse, GMC Acadia and Buick Enclave because of the possibility for the treads cracking on their 18-inch Goodyear Fortera HL tires. At the time, GM said that this would also eventually lead to a safety campaign to repair the problem, and the National Highway Traffic Safety Administration has just published those details. GM's recall covers 5,876 of the three Lambda platform crossovers to replace their tires. According to NHTSA, if the treads crack, there could be a loss of pressure and possible failure. Goodyear already announced its own recall of the tires after internal testing found small tread cracks. The company did not believe this was safety issue, but the problem did put the rubber out of compliance with federal laws. The business's safety campaign covered an estimated 48,512 tires. Of those, around 32,000 were reportedly made for GM to either be fitted to vehicles or sold as replacements. The remainder went to the aftermarket. Goodyear's portion of the recall is expected to begin around February 20. RECALL Subject : Tire Tread Cracking/FMVSS 110 Report Receipt Date: JAN 28, 2015 NHTSA Campaign Number: 15V044000 Component(s): TIRES Potential Number of Units Affected: 5,876 All Products Associated with this Recall Vehicle Make Model Model Year(s) BUICK ENCLAVE 2015 CHEVROLET TRAVERSE 2015 GMC ACADIA 2015 Details Manufacturer: General Motors LLC SUMMARY: General Motors LLC (GM) is recalling certain model year 2015 Buick Enclave vehicles manufactured December 9, 2014, to January 14, 2015, 2015 Chevrolet Traverse vehicles manufactured December 9, 2014, to January 20, 2015, and 2015 GMC Acadia vehicles manufactured December 9, 2014, to January 16, 2015, and all equipped with Goodyear P255/65R18 Fortera HL tires. These vehicles are equipped with tires that may experience tread cracking. As such, these vehicles fail to comply with the requirements of Federal Motor Vehicle Safety Standard (FMVSS) No. 110, "Tire Selection and Rims and Motor Home/Recreation Vehicle Trailer Load Carrying Capacity Information for Motor Vehicles with a GVWR of 4,536 kilograms (10,000 pounds) or Less." CONSEQUENCE: If the tire treads crack, a loss of tire pressure and possible tire failure may result, increasing the risk of a crash. REMEDY: GM will notify owners, and dealers will replace the tires that were manufactured within a specific date range, free of charge.

Weekly Recap: Chevy and Alfa plot comeback strategies

Sat, Jun 27 2015Chevrolet and Alfa Romeo were two of the 20th Century's most iconic automotive brands. Chevy embodied America's post-war power and confidence. Alfa was the definition of the stylish Italian sports car. They reached halcyon heights in the 1950s and '60s, before declining precipitously amid new competition, changing consumer tastes, and uneven corporate management. Both say 2015 is the start of something better, and this week Chevy and Alfa laid out ambitious plans and showcased new cars that they hope will make them more relevant this year, and in the coming years. Each brand sits at its own crossroads, and their paths forward are as different as the Chevy Cruze and the Alfa Romeo Giulia. Chevy is still a sales beast, as evidenced by its volume of 4.8 million vehicles sold around the world last year. Chevy executives are fond of saying one of their cars is sold every seven seconds, which illustrates the strength and reach of a car brand that is the fourth largest in the world. "Make no mistake about it, we are a brand for the people," said General Motors North America president Alan Batey. But he wants consumers to want to buy a Chevy for its design and technology, not simply because it's affordable. That starts with all Chevys now featuring a distinctive a family look, with sporty cues from the Corvette or strong lines that riff on the Silverado pickup. "We want people to fall in lust with our cars," said Mike Pevovar, executive design director for Chevy passenger cars. "That initial emotional attraction has to be right on the exterior, and that's where form comes into play." Chevy is also loading up its cars, like the freshly unveiled 2016 Chevy Cruze, with technology to appeal to a younger crowd that prizes connectivity. The Cruze will offer Apple CarPlay and Android Auto with its MyLink infotainment system, and OnStar with 4G LTE and wifi. Seeking out younger buyers is also sound business practice: Millennials now outnumber Baby Boomers as the largest single age group in the United States. Younger buyers also can improve a brand's image, which is another area where Chevy would like to improve. Chevy ranks 82nd on Interbrand's Best Global Brand's list, behind 11 other automakers. Apple is No. 1. "We need our own variation of the Genius Bar," Batey said. 2016 Alfa Romeo Giulia View 3 Photos Meanwhile, Alfa is in different shape.

BMW, Hyundai score big in JD Power's first Tech Experience Index

Mon, Oct 10 2016While automakers are quick to brag about winning a JD Power Initial Quality Study award, the reality, as we've pointed out before, is that these ratings are somewhat misleading, since IQS doesn't necessarily distinguish genuine quality issues. JD Power's new Tech Experience Index aims to solve that problem. The new metric takes the same 90-day approach as IQS but focuses exclusively on technology – collision protection, comfort and convenience, driving assistance, entertainment and connectivity, navigation, and smartphone mirroring. It splits the industry up into just seven segments, based loosely on size, which is why the Chevrolet Camaro is in the same division (mid-size) as Kia Sorento and the Mercedes-Benz GLE-Class is in the same segment as the Hyundai Genesis (mid-size premium). It makes for some screwy bedfellows, to be sure. Still, splitting tech experience away from initial quality should allow customers to make more informed and intelligent decisions when buying new vehicles. In the inaugural study, respondents listed BMW and Hyundai as the big winners, with two segment awards – the 2 Series for small premium and the 4 Series for compact premium, and the Genesis for mid-size premium and Tucson for small segment. The Chevrolet Camaro (midsize), Kia Forte (compact), and Nissan Maxima (large) scored individual wins. Ford also had a surprising hit with the Lincoln MKC, which ranked third in the compact premium segment behind the 4 Series and Lexus IS. This is a coup for the Blue Oval, whose woeful MyFord Touch systems made the brand a victim of the IQS' flaws in the early 2010s. But Ford and other automakers might not want to celebrate just yet. According to JD Power, there's still a lot of room for improvement – navigation systems were the lowest-rated piece of tech in the study. Instead, customers repeatedly saluted collision-avoidance and safety systems, giving the category the best marks of the study and listing blind-spot monitoring and backup cameras as two must-have features – 96 percent of respondents said they wanted those two systems in their next vehicle. But this isn't really a surprise. Implementation of safety systems from brand to brand is similar, and they don't require any input from users, unlike navigation and infotainment systems which are frustratingly deep.