Custom Fuel Injected Classic on 2040-cars

Anacortes, Washington, United States

|

Car has many upgrades including; Tuned Port Injection, headers, aluminum radiator w/electric fans, Summit heads (2.02, 1.60 w/185runners), 466 Lunati cam, 4 bolt main and lots of billet; Hotchkis suspension with drop spindles in front and lowering springs in rear, cross drilled and slotted rotors, TH350 w/2400 stall, 8x18 Weld Prostar XP wheels w/ Hankook 245-45-18 tires; 3:73 gears with Auburn Posi; 2 1/2 gallons of Gloss black paint and no bondo or rust; custom gauges, bucket seats, Hurst V-matic; Viper alarm with start, entry, radar and voice alert.

|

Chevrolet Monte Carlo for Sale

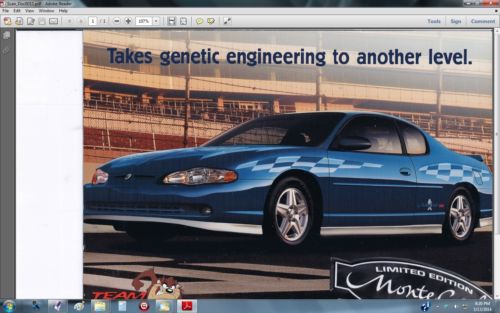

2003 chevrolet monte carlo ss jeff gordon only 114k excellent condition(US $9,775.00)

2003 chevrolet monte carlo ss jeff gordon only 114k excellent condition(US $9,775.00) 1987 monte carlo ss(US $15,000.00)

1987 monte carlo ss(US $15,000.00) 2003 chevolet monte carlo pace car edition(US $7,995.00)

2003 chevolet monte carlo pace car edition(US $7,995.00) 1985 chevrolet monte carlo base coupe 2-door 3.8l(US $6,000.00)

1985 chevrolet monte carlo base coupe 2-door 3.8l(US $6,000.00) 1972 chevrolet monte carlo base hardtop 2-door coupe restored

1972 chevrolet monte carlo base hardtop 2-door coupe restored 2000 chervrolet monti carlo jeff gordon signature series #24 of 24 made

2000 chervrolet monti carlo jeff gordon signature series #24 of 24 made

Auto Services in Washington

Xtreme Car Audio & Tint ★★★★★

West Seattle Brake Service ★★★★★

United Battery Systems Inc ★★★★★

Skys Auto Repair & Detailing ★★★★★

Setina Manufacturing Co. ★★★★★

Salvage Yard Guru ★★★★★

Auto blog

Supercharged 2015 Chevy Corvette Z06 takes the C7 beyond the ZR1

Mon, 13 Jan 2014

The Z06 is just about everything we got in the last ZR1, but better.

After a bright-yellow false start, here is the real thing: the fourth-generation, 2015 Corvette Z06. If Chevrolet makes a ZR1 version of the C7 Corvette, it's going to be absolutely mega, because the Z06 is just about everything we got in the last ZR1, but better.

GM Recalling Another 2.7 Million Vehicles In Five Separate Campaigns

Thu, May 15 2014The recalls keep rolling in from General Motors, evidently keen to avoid repeating the mistakes of the ignition-switch debacle and clean house. This time they're all coming at once, with five separate recalls announced together covering approximately 2.7 million vehicles. The largest of the five actions involves over 2.4 million units of the previous-generation Chevrolet Malibu and Malibu Maxx, Pontiac G6 and Saturn Aura in order to fix brake light wiring harness, which have been found to be susceptible to corrosion. The recall is separate from the 56k Aura sedans which GM recently recalled over faulty shift cables, not to mention the previous massive recall of 1.3 million vehicles – some of them the same models – but appears to have resulted from the National Highway Traffic Safety Administration investigation that started with the G6 almost a year ago. The second-largest campaign involves the 2014 Chevy Malibu, specifically those fitted with GM's 2.5-liter engine and stop/start system, approximately 140,000 examples of which has been found to have problematic brakes. The issue does not appear to be connected to the recall of 8k Malibu and Buick LaCrosse sedans (also involving brake woes) which we reported upon last week. Four crashes have been reported in such models, but GM admits it's not yet clear if the problem was a contributing factor in the accidents. A further 112k Corvette models from the 2005-2007 model years are being called in for problems with their low-beam headlamps resulting from a flexing relay control circuit wire that's not meant to bend. GM says it is "aware of several hundred complaints" about this issue, but notes that there have been no reports of related accidents. In addition, over 19k examples of Cadillac CTS from the 2013 and 2014 model years are being recalled over windshield wipers that might not work after a jump start. Finally, GM is also bringing in 477 examples of its 2014 Chevy Silverado, Tahoe and GMC Sierra (though not the Yukon) to fix a problem with a tie rod in its steering rack. As ever, all recall repairs will be performed free of charge, and GM is now estimating that recall-related actions this quarter will result in an estimated $200-million charge against its second-quarter earnings. Read the full announcement from GM below for further details.

2016 Chevy Camaro teased as current-gen car prepares to hit 500k sales

Fri, Mar 13 2015Just as Chevrolet prepares to launch the sixth-generation Camaro, the current, fifth-generation car is about to hit a major milestone: 500,000 units sold in the United States. That's impressive, and to celebrate, Chevy has released this video, showing the Camaro Z/28 doing what it does best around a race track. But that's not all there is to see in this video. At the end, Chevy gives us a glimpse at the sixth-generation Camaro, expected to debut in the not-too-distant future. Have a look, and check out Chevy's press blast, below, for more details about the 500k sales mark. Related Video: Fifth-gen Camaro Approaches 500,000 U.S. Sales Production milestone caps five years as America's best-selling performance car DETROIT – Talk about a big family: Chevrolet expects to deliver the 500,000th fifth-generation Camaro in the United States this month. The fifth-generation Camaro has been a runaway success for Chevrolet since it went on sale in August 2009. Camaro sales passed Mustang in 2010, to become America's best-selling performance car – a title Camaro has retained for five consecutive years. In the process, the Camaro has helped bring new buyers to Chevrolet – with 63 percent of retail buyers new to GM. "The fifth-generation Camaro has clearly resonated with both long-time Camaro fans, and first time performance-car buyers," said Todd Christensen, Camaro marketing manager. "That sets the bar high for the next chapter of the car's history." Remarkably, the Camaro continues to gain momentum, even as the fifth-generation Camaro nears the end of production this year. In 2014, Camaro total sales increased 7.1 percent for its second-best year of sales since its introduction.