1987 Chevrolet Monte Carlo on 2040-cars

San Diego, California, United States

Transmission:Automatic

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

Engine:5.7

VIN (Vehicle Identification Number): 1G1GZ11G0HP142608

Mileage: 25000

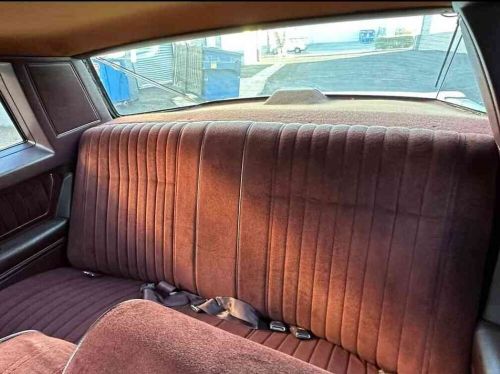

Interior Color: Burgundy

Number of Previous Owners: 2

Number of Cylinders: 8

Make: Chevrolet

Drive Type: RWD

Model: Monte Carlo

Exterior Color: White

Car Type: Collector Cars

Number of Doors: 2

Chevrolet Monte Carlo for Sale

2004 chevrolet monte carlo ss(US $6,900.00)

2004 chevrolet monte carlo ss(US $6,900.00) 1977 chevrolet monte carlo(US $4,800.00)

1977 chevrolet monte carlo(US $4,800.00) 1987 chevrolet monte carlo(US $500.00)

1987 chevrolet monte carlo(US $500.00) 1970 chevrolet monte carlo(US $28,000.00)

1970 chevrolet monte carlo(US $28,000.00) 1972 chevrolet monte carlo gm crate engine(US $24,900.00)

1972 chevrolet monte carlo gm crate engine(US $24,900.00) 1972 chevrolet monte carlo restomod(US $5,000.00)

1972 chevrolet monte carlo restomod(US $5,000.00)

Auto Services in California

Z Best Body & Paint ★★★★★

Woodman & Oxnard 76 ★★★★★

Windshield Repair Pro ★★★★★

Wholesale Tube Bending ★★★★★

Whitney Auto Service ★★★★★

Wheel Enhancement ★★★★★

Auto blog

Watch this time-lapse build of the Chevy SS for NASCAR

Fri, 08 Feb 2013There's only about a week left until we get our first look at the production version of the 2014 Chevrolet SS sedan, but Chevrolet NASCAR teams have been looking at the race version of the car all winter. Autoweek has posted a really neat time-lapse video showing just a portion of what it takes to build one of NASCAR's new Gen6 stock cars.

Though the video is quite brief, it does show almost the entire build process starting with just the car's nose, and it gives us a good look at how integral the template is to the final product. As a bonus, Hendrick Motorsports also provided some videos showing two of its teams performing pit stop tests over the winter. The second video shows some of the more detailed aspects of the racecar's rear end, including the stock-looking trunk cutout and a newly mandated rear bumper extension that will be used on super speedways like Daytona and Talladega.

To see what Team Chevy has been up to all off-season, check out all three videos posted after the jump.

Super Bowl LVII car commercial roundup: Watch them all here

Mon, Feb 13 2023Fewer automakers than usual spent money advertising during Super Bowl LVII. In total, there were only five traditional ad spots from three big OEMs. A number of car-adjacent ads aired during the Big Game, too, and we’ll bring you those ads in this roundup alongside the more obvious ones. WeÂ’ve compiled all of the automotive-related commercials for you here in this post so you donÂ’t have to go searching for them elsewhere. Read on below to see what aired as the Kansas City Chiefs defeated the Philadelphia Eagles. Ram's Super Bowl spot offers a cure for 'Premature Electrification' This commercial revealed the new electric Ram Rev pickup, and itÂ’s themed like a prescription ad for an antidote to "Premature Electrification.” A concerned narrator in the Ram spot asks if you're afraid that going electric too soon will mean "you might not be able to last as long as you like," and there's a guy on a pier who's going to need some new equipment if he wants to catch fish. We're also told there are "options being designed to extend range in satisfying ways," so if this truck isn't right for you, you have choices. All the commercial's missing is a silly medical marketing name and six seconds of speed-reading gibberish about side effects like intestinal bleeding and death. Which are two more good things. Jeep 4xe Super Bowl commercial highlights modern version of 'Electric Boogie' JeepÂ’s “Electric Boogie” commercial follows the Wrangler 4xe and Grand Cherokee 4xe in a variety of simulated off-road situations. Though fun, the soundtrack is the real star of the show. The songÂ’s original artist, Marcia Griffiths, was joined by Grammy winner Shaggy, Jamila Falak, Amber Lee, and Moyann on the track. The modernized re-recording celebrates 40 years since GriffithsÂ’ original track, and Jeep says the track is available for streaming now. Kia returns to the Super Bowl with the tale of 'Binky Dad' This year, Kia follows the adventure of "Binky Dad" in his quest to fetch his daughter's lost pacifier, which naturally takes him over just about every bit of terrain you might encounter upon leaving the civilized confines of Southern California for the not-so-civilized mountains of ... probably also California. It features the refreshed 2023 Kia Telluride, which probably doesnÂ’t need much advertising to see these days, but Kia went for it with the strong three-row SUV anyway.

2016 Tech of the Year | Autoblog Minute

Thu, Oct 29 2015Deliberation on the winners of Autoblog's Tech of the Year Award is under way. Nominees for best car in 2016 are: the Tesla Model S, the Chevy Volt and the BMW 7 series. Nominees for best tech in 2016 are: Apple CarPlay, Android Auto, VW's MiB II with AppConnect, Ford Sync 3, Audi Virtual Cockpit, the Smart Cross Connect App, and Volvo Sensus. Autoblog's Chris McGraw reports on this edition of Autoblog Minute. Audi BMW Chevrolet Ford smart Tesla Volvo Technology of the Year Autoblog Minute Videos Original Video volt android auto ford sync 3