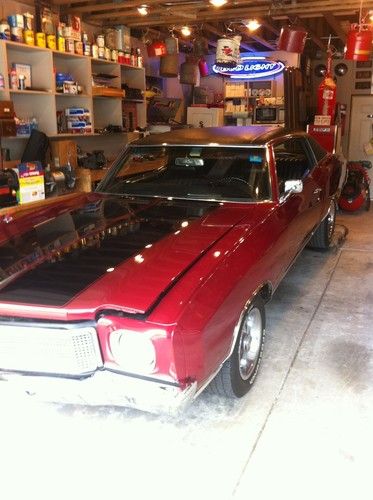

1970 Chevrolet Monte Carlo Base Hardtop 2-door 5.7l on 2040-cars

Melrose Park, Illinois, United States

Body Type:Hardtop

Vehicle Title:Clear

Engine:5.7L 350Cu. In. V8 GAS Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Make: Chevrolet

Model: Monte Carlo

Warranty: Vehicle does NOT have an existing warranty

Trim: Base Hardtop 2-Door

Options: CD Player

Drive Type: U/K

Power Options: Power Seats

Mileage: 50,000

Exterior Color: Burgundy

Disability Equipped: No

Interior Color: Black

Number of Cylinders: 8

1970 Chevy Monte Carlo body and interior restoration in 2000, all original sheet metal. Floors are very solid, suspension is great. I'm on disability since 2010 and I have to sell to keep house or this car wouldn't be going anywhere.

350 SBC

400 transmission with shift kit

12 bolt rear w/ 3.42 gear

Ron (708)860-1144

Chevrolet Monte Carlo for Sale

Monte carlo ss aerocoupe - only 70k miles! one of only 6,052 manufactured!(US $10,500.00)

Monte carlo ss aerocoupe - only 70k miles! one of only 6,052 manufactured!(US $10,500.00) 1987 monte carlo ss aerocoupe(US $9,000.00)

1987 monte carlo ss aerocoupe(US $9,000.00) 1988 chevrolet monte carlo ls 350 automatic holley 4bbl headers dual exhaust

1988 chevrolet monte carlo ls 350 automatic holley 4bbl headers dual exhaust 2002 chevy monte carlo dale earnhardt edition ss w/ only 24,000 miles.(US $8,250.00)

2002 chevy monte carlo dale earnhardt edition ss w/ only 24,000 miles.(US $8,250.00) 2001 chevrolet monte carlo ss coupe 2-door 3.8l(US $1,995.00)

2001 chevrolet monte carlo ss coupe 2-door 3.8l(US $1,995.00) 2006 chevy monte carlo ss v8 htd leather sunroof 10k mi texas direct auto(US $19,980.00)

2006 chevy monte carlo ss v8 htd leather sunroof 10k mi texas direct auto(US $19,980.00)

Auto Services in Illinois

Universal Transmission ★★★★★

Todd`s & Mark`s Auto Repair ★★★★★

Tesla Motors ★★★★★

Team Automotive Service Inc ★★★★★

Sterling Autobody Centers ★★★★★

Security Muffler & Brake Service ★★★★★

Auto blog

Audi S4 drivers are the most accident-prone, insurance report says

Sun, Jun 25 2023Culling data from more than 4.6 million automobile insurance applications, researchers at the Insurify insurance comparison marketplace picked a winner — or more to the point, a loser — in its determination of the car model with the most accidents so far in 2023: the Audi S4. Why does the sporty, luxury-class German sedan rank so high (or so low)? The organization found that S4 drivers, piloting a car with almost 350 horsepower, are among those who collect the most speeding tickets, and that they get into accidents at a rate 54 percent higher than the national average. If the S4 isnÂ’t a surprise with an at-fault accident rate of 11.7 percent, consider the “family friendly” brand that appears three times on the Insurity list: Subaru. It is represented by three models, including the turbocharged WRX and XV Crosstrek, and at the better-performing bottom of the list, the Subaru Impreza, with an accident rate of 10.3 percent. In 2023, 7.6 percent of U.S. drivers were involved in at least one at-fault accident in the prior seven years. For drivers of cars on this list, the average at-fault accident rate was 10.5 percent, meaning these drivers are 1.4 times as likely to have an at-fault accident on record. According to its statement, the Insurity data science team explored key safety features, driver behavior, and Insurance Institute for Highway Safety (IIHS) evaluations to pinpoint possible reasons behind these carsÂ’ high accident rates. Following is the list, counting down to the models with most reported accidents: 10. Subaru Impreza (percentage of drivers with a prior at-fault accident on record: 10.3 percent; MSRP base model): $19,795) 9. Kia Niro (percentage of drivers with a prior at-fault accident on record: 10.4 percent; MSRP base model): $26,590) 8. Chevrolet Silverado LD (percentage of drivers with a prior at-fault accident on record: 10.4%, MSRP base model): $34,500) 7. Subaru XV Crosstrek (percentage of drivers with a prior at-fault accident on record: 10.5 percent, MSRP 6. Subaru WRX.(percentage of drivers with a prior at-fault accident on record: 10.7% MSRP base model): $29,605) 5. Toyota GR86 (percentage of drivers with a prior at-fault accident on record: 10.8 percent MSRP base model): $29,900) 4. Hyundai Veloster N (percentage of drivers with a prior at-fault accident on record: 10.9 percent; MSRP base model): $32,500) 3.

Chevy Malibu Hybrid wins 2016 Connected Green Car of the Year

Thu, Jan 21 2016From the Washington Auto Show today, Green Car Journal's Ron Cogan announced three different fuel-efficient vehicle awards. They were: 2016 Connected Green Car of the Year: Chevy Malibu Hybrid 2016 Luxury Green Car of the Year: Volvo XC90 T8 2016 Green SUV of the Year: Honda HR-V The Volvo was nominated in two categories, but it did not win the Connected Green Car of the Year. Speaking of non-winners, the other green SUV finalists were the BMW X1 XDrive28i, Hyundai Tucson, Mazda CX-3, and Toyota RAV4 Hybrid. The other Luxury Green Car finalists included the BMW x5 xDrive40e, Lexus RX 450h, Porsche Cayenne S E-Hybrid, and the Mercedes-Benz C350e. Finally, the Audi A3 e-tron, BMW 330e, Toyota Prius, and Volvo XC90 T8 were the runners up for Connected Green Car. 2016 Connected Green Car of the Year, Green SUV of the Year, Luxury Green Car of the Year Winners Announced WASHINGTON, Jan. 21, 2016 /PRNewswire/ -- Green Car Journal has announced the winners of its prestigious 2016 Green Car Awards at a press conference held today during the Washington Auto Show's Public Policy Day in Washington DC. Distinguished as 2016 Luxury Green Car of the Year™ is Volvo's new XC90 T8. The Chevrolet Malibu Hybrid tops the field as 2016 Connected Green Car of the Year™ and Honda's HR-V earns Green Car Journal's 2016 Green SUV of the Year™. "These are stand-out vehicles in an increasingly sophisticated and appealing field of 'green' cars," said Ron Cogan, editor and publisher of Green Car Journal and CarsOfChange.com. "To make the cut as a finalist is a real achievement in itself considering the considerable competition in the market today. Rising to the top as award winners means these three exceptional vehicles set a benchmark in the auto industry's effort to create vehicles that are desirable and efficient, while also achieving environmental milestones so important for our driving future." The Green Car Awards are a key feature of The Washington Auto Show, the "public policy show" on the auto show circuit and one that puts a priority on safety and sustainability. "We are extremely proud of our partnership with Ron Cogan, whose eagerly anticipated suite of awards help shape the national conversation on the innovations that will drive our industry and country forward," said Geoff Pohanka, chairman of The Washington Auto Show.

GM recalling over 40,000 Chevy, Pontiac and Saturn models over fuel pump woes

Mon, 01 Oct 2012The National Highway Traffic Safety Administration has issued a recall for a number of General Motors cars and crossovers bought or currently registered in the hot-climate states of Arkansas, Arizona, California, Nevada, Oklahoma and Texas. As many as 40,859 units consisting of the 2007 Chevrolet Equinox, Pontiac Torrent and Saturn Ion and the 2007-2009 Chevrolet Cobalt (shown) and its Pontiac G5 twin are being recalled for potential fuel leaks.

This recall is being issued due to potentially faulty fuel pump components that can crack and cause gasoline to leak from the return or supply ports and possibly cause a fire. NHTSA has not indicated how many fuel leaks or vehicle fires have been reported. As a fix, GM will replace the fuel pump modules on all affected vehicles free of charge. Since Pontiac and Saturn have been shuttered, owners will be able to go to another GM-brand dealership to have their vehicles repaired.

While the list of affected cars and crossovers varies by state and model year, if you own any of these models and live in Arizona, California, Florida, Nevada, Oklahoma or Texas, be sure to check the official notice below for more details.