4dr Sedan Lt W/1lt Low Miles Automatic 2.4l 4 Cyl Mocha Steel Metallic on 2040-cars

Hickory, North Carolina, United States

Fuel Type:Other

For Sale By:Dealer

Transmission:Automatic

Body Type:Sedan

Used

Year: 2012

Warranty: Vehicle does NOT have an existing warranty

Make: Chevrolet

Model: Malibu

Options: Compact Disc

Mileage: 47,084

Safety Features: Anti-Lock Brakes, Driver Side Airbag

Sub Model: 4dr Sedan LT w/1LT

Power Options: Air Conditioning, Cruise Control, Power Windows

Exterior Color: Brown

Interior Color: Tan

Number of Cylinders: 4

Doors: 4

Engine Description: 2.4L 4 Cylinder

Chevrolet Malibu for Sale

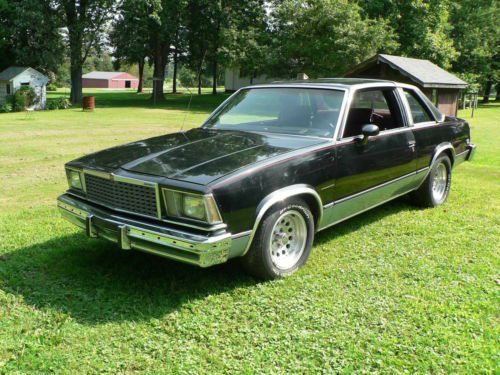

1978 chevrolet malibu classic coupe 2-door 5.7l. hot rod, street rod

1978 chevrolet malibu classic coupe 2-door 5.7l. hot rod, street rod 2002 chevy malibu

2002 chevy malibu 2003 chevrolet malibu ls sedan 4-door 3.1l in silver - great car!(US $2,200.00)

2003 chevrolet malibu ls sedan 4-door 3.1l in silver - great car!(US $2,200.00) 2001 chevrolet malibu low mileage, original owner(US $4,700.00)

2001 chevrolet malibu low mileage, original owner(US $4,700.00) 2008 chevrolet malibu classic ls sedan 4-door 2.2l

2008 chevrolet malibu classic ls sedan 4-door 2.2l 1981 chevrolet malibu base coupe 2-door 5.7l

1981 chevrolet malibu base coupe 2-door 5.7l

Auto Services in North Carolina

Wilburn Auto Body Shop-Mooresville ★★★★★

Westover Lawn Mower Service ★★★★★

Truck Alterations ★★★★★

Troy Auto Sales ★★★★★

Thee Car Lot ★★★★★

T&E Tires and Service ★★★★★

Auto blog

Nissan Leaf sales get January jump as Chevy Volt trends downward

Mon, Feb 3 2014The cold January sales dip hit both the Nissan Leaf and the Chevy Volt last month, but when compared 2014 to 2013's first-month-of-the-year sales totals, one of the two early plug-in vehicles obviously came out on top. The top Leaf market also shifted away from Atlanta for the first time in months. Last year, the Leaf sold just 650 units in January, but it managed to move 1,252 last month, a 92.6-percent increase over 2013 but a big drop from the 2,529 sold in December 2013. Paige Presley over at Nissan told AutoblogGreen that the Leaf has now broken sales records for 11 months straight and that, "we see unique seasonality with some December pull-ahead demand based on federal and state tax incentives." The number one Leaf market also shifted away from Atlanta for the first time in months, moving back to San Francisco. That change could be short-lived. "We had some inventory constraint issues early in the month in Atlanta with end-of-year demand depleting stock," Presley said. "By the time we resolved that, the weather hampered sales." There was not as much good news on the Chevrolet front. Last month, the Volt sold 918 units, down from 1,140 in January 2013 and 2,392 in December 2013. It also marks the first time the Volt has sold in the three-digit range since January 2012, when it sold 603 copies. That string of solid months means that the plug-in hybrid has a roughly 12,000-unit lead over the EV since the two cars brought plug-in vehicles back to the mass market all the way back in December 2010. We will have our full report of January's green car sales up soon.

GM warning 800,000 owners that their cars may need oil changes more frequently than they say

Fri, 05 Apr 2013The days of changing your engine oil every 3,000 miles are long gone thanks to most cars having automatic oil monitoring systems, but about 800,000 General Motors vehicles apparently have incorrect monitoring software that is leading to premature engine component wear. According to Autoweek, certain 2010-2012 Buick LaCrosse, Regal, Chevrolet Equinox and GMC Terrain models equipped with 2.4-liter four-cylinder engines could be going too long in between oil changes resulting in a higher-than-normal number of warranty claims for the engine's balance chain. The balance chain links the balance shaft to the crankshaft, and a worn one can produce higher noise levels.

As a fix, GM dealers will be reprogramming the software for the monitors in an effort to reduce the interval between oil changes, which varies based on driving habits and conditions. Through February 2015, the software update will be done at no cost to vehicle owners, but since this is not a recall, after that point, it will be up to the discretion of dealers as to whether or not they will charge for the service. What isn't immediately clear is whether GM plans on giving assistance to out-of-warranty customers who are experiencing engine issues from the worn chain.

GM profit dips on truck changeover, but beats estimates

Thu, Apr 26 2018DETROIT — General Motors on Thursday reported a higher-than-expected quarterly profit despite a drop in production of high-margin pickup trucks, as it gears up for new models that are expected to boost profits next year. Like rivals Ford and Fiat Chrysler Automobiles, GM is banking on highly-profitable Chevy Silverado and GMC Sierra pickup trucks to lift profits, as consumers shift away from traditional passenger cars in favor of these larger, more comfortable trucks, SUVs and crossovers. During the first quarter, the process of changing over to GM's new pickups resulted in a drop in production of 47,000 units. GM Chief Financial Officer Chuck Stevens said the production drop had resulted in a drop in pre-tax profit of up to $800 million. Earlier this year, GM said its 2018 profits would be flat compared with 2017, but expected its all-new pickup trucks would boost margins starting in 2019. On Thursday, GM reiterated its full-year 2018 forecast for adjusted earnings in a range from $6.30 to $6.60 per share. The automaker said capital expenditures were more than $500 million higher in the quarter because of investments its new pickup trucks and a family of low-cost vehicles under development with Chinese partner SAIC Motor Corp. On Wednesday, rival Ford said it would stop investing in most traditional passenger sedans in North America. CFO Stevens told reporters on Thursday that GM has "already indicated that we will make significantly lower investments on a go-forward basis" in sedans. 2019 GMC Sierra View 21 Photos GM benefited from a lower effective tax rate in the quarter, but adjusted pre-tax margin fell to 7.2 percent from 9.5 percent a year earlier. Stevens said the company's profit margin should hit 10 percent or higher in the second quarter and for the full year. GM said material costs were $700 million higher in the first quarter, and it expects those costs to continue rising. The automaker said it would counter those increases with cost cutting measures. "It is a more difficult environment than it was three or four months ago," Stevens said when asked about rising commodity prices from potential steel and aluminum tariffs announced by the Trump administration. "But we are confident we can continue to offset that." The company reported quarterly net income of $1.05 billion or $1.43 per share, a drop of nearly 60 percent from $2.61 billion or $1.75 per share a year earlier. Analysts had on average expected earnings per share of $1.24.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.085 s, 7841 u