2014 Impala Ltz Black! Simply Like New! 14k Miles! Backup Camera! Heated Seats! on 2040-cars

Fort Worth, Texas, United States

Chevrolet Impala for Sale

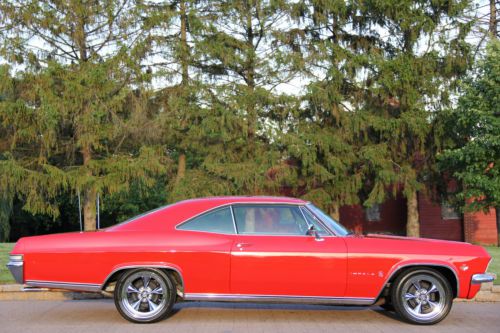

1965 impala convertible 64,65,66,67,68,69

1965 impala convertible 64,65,66,67,68,69 1965 chevrolet impala 327 v8 auto frame off restoration matching #'s no reserve

1965 chevrolet impala 327 v8 auto frame off restoration matching #'s no reserve 2004 chevy impala no reserve

2004 chevy impala no reserve **20inch rims 2 l7 15's with touchscreen head unit**make offer!(US $5,000.00)

**20inch rims 2 l7 15's with touchscreen head unit**make offer!(US $5,000.00) Highly original olympic gold finish, nice patina, great driver, power steering!(US $14,995.00)

Highly original olympic gold finish, nice patina, great driver, power steering!(US $14,995.00) 1980 red, chevrolet impala 2dr runs, as is(US $2,000.00)

1980 red, chevrolet impala 2dr runs, as is(US $2,000.00)

Auto Services in Texas

WorldPac ★★★★★

VICTORY AUTO BODY ★★★★★

US 90 Motors ★★★★★

Unlimited PowerSports Inc ★★★★★

Twist`d Steel Paint and Body, LLC ★★★★★

Transco Transmission ★★★★★

Auto blog

Submit your questions for Autoblog Podcast #313 LIVE!

Mon, 17 Dec 2012We record Autoblog Podcast #313 tonight, and you can drop us your questions and comments regarding the rest of the week's news via our Q&A module below. Subscribe to the Autoblog Podcast in iTunes if you haven't already done so, and if you want to take it all in live, tune in to our UStream (audio only) channel at 10:00 PM Eastern tonight.

Discussion Topics for Autoblog Podcast Episode #313

2014 Chevrolet Silverado and GMC Sierra introduced

GM cutting back on powertrain warranty citing lack of interest

Thu, Mar 12 2015Generally, when a manufacturer offers a long, high-mileage warranty, it's a sign that it stands behind its products. On top of that, it's generally a selling point for consumers, who can rest easy knowing that any catastrophic failures will be picked up by the manufacturer. Considering those facts, it does seem rather strange that General Motors is slashing the mileage warranty on model year 2016 vehicles from Chevrolet and GMC. Instead of offering consumers a 100,000-mile warranty, GM will now only offer a powertrain warranty up to 60,000 miles. The five-year warranty period, though, remains unchanged. GM will also cut the number of free services being offered to Chevy and GMC owners, as well as Buick drivers, from four to two. "Through research, we have determined that when purchasing a new vehicle, included maintenance and warranty rank low on the list of reasons why consumers consider a particular brand over another," explained a memo sent to dealers by Chevrolet VP Brian Sweeney and his GMC counterpart, Duncan Aldred, and obtained by Automotive News. "As a result, we have benchmarked our competitors, reviewed our current offerings and have concluded the following modifications to align closely with our customers' needs and expectations." While the move might seem odd, Sweeney and Aldred are right – according to Automotive News, Ford, Honda and Toyota each offer a five-year, 60,000-mile powertrain warranty. As for what the money saved by trimming the powertrain warranty will go towards, a GM spokesperson simply told AN that the company will "reinvest the savings we will realize into other retail programs," some of which have been requested by consumers. What are your thoughts? Would a 40,000-mile reduction in a new vehicle's powertrain really turn you off from buying one? Even if it matched its competitors? Is GM better off spending its money elsewhere? Have your say in Comments. Featured Gallery 2016 Chevrolet Equinox View 10 Photos News Source: Automotive News - sub. req.Image Credit: Chevrolet Chevrolet GM GMC Auto Repair Maintenance Ownership warranty

GM to squeeze out more production capacity for midsize trucks

Tue, May 26 2015General Motors was predicting a strong showing for the Chevrolet Colorado and GMC Canyon before they debuted, and demand among dealers for the midsize trucks even exceeded company's expectations. The positive situation has left GM with a problem, though: finding ways to increase capacity for the pickups at the Wentzville Assembly plant in Missiouri. With a third shift already running, GM has continued to look for ways to build just a few more of the trucks at the plant. The company has plans to hire as many as 1,000 more workers for the Saturday and Sunday shifts to construct an additional 2,000 pickups a month, according to unnamed insiders at the factory speaking to Automotive News. The little adjustments even extend to getting rid of an unpaid break to add 18 minute of assembly time over the course of a day, which equals about 3,500 more vehicles a year. All of this effort comes because the trucks are in such high demand. According to GM's figures, the company has delivered a combined 35,720 units of the Colorado and Canyon from January through April 2015, and the Chevy was the fastest-selling truck in the US for the previous three months. In May, it spent an average of just 12 days in showrooms before being snapped up. And even better for the company, 43 percent of these buyers came from other brands. According to Automotive News, the most popular trade-ins have included the Ford F-150, Toyota Tacoma, and Dodge Dakota. Related Video: