2014 Chevrolet Impala 1lt on 2040-cars

631 W Lincoln Ave, Charleston, Illinois, United States

Engine:2.5L I4 16V GDI DOHC

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 2G1115SL6E9251827

Stock Num: S4337

Make: Chevrolet

Model: Impala 1LT

Year: 2014

Exterior Color: Summit White

Interior Color: Jet Black

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 1

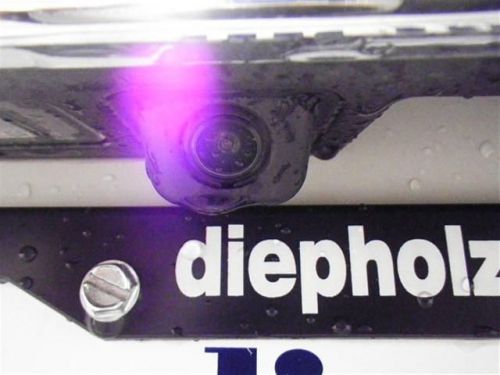

$4500 total available rebates! Classy!!! NEW 2014! 1LT, ADVANCED SAFETY PACKAGE, BACKUP CAMERA, REMOTE START, MYLINK SYSTEM, BLUETOOTH and much more! CLICK in for MORE details! **INVOICE and BELOW pricing available** for Internet Buyers, BIG savings possible -------------------> Call, text or email Matt Sears for more details (matt_sears@diepholzauto.com, phone: 888-903-5117). PLEASE call in advance to check availability, inventory changes quickly! .................................... FULL DETAILS: NEW 2014 Chevrolet Impala. They say All roads lead to Rome, but who cares which one you take when you are having this much fun behind the wheel.. Great MPG: 31 MPG Hwy!!! Standard features include: CD player, OnStar, Satellite Radio, Bluetooth, Remote power door locks, Power windows with 4 one-touch, Automatic Transmission, 4-wheel ABS brakes, Air conditioning with dual zone climate control, Cruise control, Audio controls on steering wheel, Traction control - ABS and driveline, Head airbags - Curtain 1st and 2nd row, 195 hp horsepower, 2.5 liter inline 4 cylinder DOHC engine, 8-way power adjustable drivers seat, Passenger Airbag, Multi-function remote - Trunk/hatch/door/tailgate, Power heated mirrors, Tilt and telescopic steering wheel, 4 Doors, Front-wheel drive, Fuel economy EPA highway (mpg): 31 and EPA city (mpg): 21, Tachometer, Compass, Overhead console - Mini, Interior air filtration, Clock - In-radio display, Signal mirrors - Turn signal in mirrors, Stability control, Front seat type - Bucket, Split-bench rear seats, Intermittent window wipers, Privacy/tinted glass, Speed-proportional power steering, Trip computer, Video Monitor Location - Front, Knee airbags - Driver and passenger, Daytime running lights, Dusk sensing headlights, Rear defogger, Center Console - Full with covered storage... Diepholz Auto Group offers the most customer focused and friendly buying experience on the Internet. If earning your business means selling you a vehicle BELOW cost, OVER allowing for your trade, finding you the PERFECT vehicle or providing FLEXIBLE financing options, consider it done! We want you as a customer. View our inventory of over 300 new and used vehicles online @ www.diepholzauto.com

Chevrolet Impala for Sale

2014 chevrolet impala 1lz(US $34,690.00)

2014 chevrolet impala 1lz(US $34,690.00) 2014 chevrolet impala 2lz(US $39,245.00)

2014 chevrolet impala 2lz(US $39,245.00) 2014 chevrolet impala 1lt(US $31,750.00)

2014 chevrolet impala 1lt(US $31,750.00) 2007 chevrolet impala unmarked police pkg 9c3(US $5,999.00)

2007 chevrolet impala unmarked police pkg 9c3(US $5,999.00) 2008 chevrolet impala unmarked police(US $7,500.00)

2008 chevrolet impala unmarked police(US $7,500.00) 2014 chevrolet impala limited ltz(US $22,899.00)

2014 chevrolet impala limited ltz(US $22,899.00)

Auto Services in Illinois

Woodfield Nissan ★★★★★

West Side Tire and Alignment ★★★★★

U Pull It Auto Parts ★★★★★

Trailside Auto Repair ★★★★★

Tony`s Auto & Truck Repair ★★★★★

Tim`s Automotive ★★★★★

Auto blog

2016 Chevy Colorado grabs Motor Trend Truck of the Year award

Tue, Nov 17 2015It's not an easy feat to win Motor Trend Truck of the Year twice in a row, but the 2016 Chevrolet Colorado managed to do just that. Thanks to the introduction of the 2.8-liter Duramax four-cylinder diesel, the magazine decided to bring the pickup back to defend the title. In more good news for the Bowtie brand, the 2016 Camaro earned the magazine's Car of the Year award. The Colorado beat a tough group of finalists to earn the nod this year, including its GMC Canyon sibling. The Chevy Silverado and GMC Sierra also made this year's list. The Nissan Titan XD and latest Toyota Tacoma rounded out the challengers. A model had to shine in six criteria to earn the title: advancement in design, engineering excellence, safety, efficiency, value, and performance of intended function. Like it did with the Camaro, Motor Trend posted a story online that explained the rationale for picking the Colorado again. They praised the diesel profusely and lauded the whole platform as quite a capable hauler. This year's Motor Trend SUV of the Year honor went to the Volvo XC90. The Swedish 'ute had to win against an initial group of 16 candidates that the magazine eventually whittled down to finalists that consisted of the Honda Pilot, Lincoln MKX, the combined Mercedes-Benz GLE-Class and GLE Coupe, and Nissan Murano. "Seven-passenger people movers aren't supposed to drive like this," senior features editor Jonny Lieberman said about the Volvo in the announcement of the champions. The Honda CR-V won last year. In the explanation online, the judges applauded the XC90's new modular platform, and they loved both the T6 twin-charged engine and T8 hybrid version. The SUV's key enamored the writers, too. Related Video: MOTOR TREND Announces 2016 "Of The Year" Winners Car of the Year, Truck of the Year, SUV of the Year, and Person of the Year announced during live ceremony and webcast in Los Angeles LOS ANGELES, Nov. 16, 2015 /PRNewswire/ -- Today, for the first time in the brand's 66-year history, MOTOR TREND announced winners of the Golden Calipers for Car of the Year, Truck of the Year, SUV of the Year, and Person of the Year at a red-carpet gala in front of an audience of industry insiders and celebrity guests. The awards show was also streamed live on the MOTOR TREND Channel on YouTube, with 3.5 million subscribers the world's largest automotive video channel, and on MOTOR TREND OnDemand, the brand's new subscription video on demand (SVOD) channel.

Chevy's 6.6-liter Duramax is pretty much all new

Thu, Sep 29 2016To say there's a heated battle in heavy-duty pickups is an understatement, with Chevrolet, Ford, and Ram constantly trading blows of increased torque, horsepower, and towing capacity. The latest salvo is the revised, more powerful turbo diesel 6.6-liter Duramax V8 in the 2017 Chevy Silverado. It has 910 pound-feet of torque, an increase of 145, putting it nearly level with the Ford Super Duty. Here's a closer look at where those gains come from. How exactly did Chevrolet add all that torque plus 48 horsepower? The automaker essentially took a fine-tooth comb to the entire engine. Chevy says it changed 90 percent of the V8, and the cumulative effect of those small changes adds up to big increases. As you might guess, the turbocharger is updated. The larger unit features electric actuation of the variable nozzle turbine (VNT), and what Chevy calls a double axle cartridge mechanism that separates the VNT moving parts from the housing. That helps with heat performance as well, with a claim that the exhaust side of the turbo can run continuously up to 1,436 degrees Fahrenheit. Helping that cause are six exhaust gaskets made of Inconel - an nickel alloy that contains chromium and iron – and upgraded stainless steel for the exhaust manifold. Despite having the same cast iron cylinder block, albeit with some minor enhancements, the engine has new cylinder heads, pistons, piston pins, connecting rods, and crankshaft, which have all been upgraded to handle 20 percent higher cylinder pressures. Alongside the increase in pressure, Chevrolet also increased the cylinder head's structure with a honeycomb design. The pattern features high-strength aluminum with dual layer water jackets that not only improve strength, but also optimize water flow for better cooling. For 2017, the cylinder head also benefits from integrated plenum that aids the engine in getting more air under heavy loads. The cylinder head isn't the only component to get a minor update, as the pistons have a larger diameter pin for improved oil flow. The same detailed improvements has been bestowed to the humble connecting rods (second in our hearts only to the inanimate carbon rod). The new design has the bolts oriented roughly 45-degrees to the rod instead of parallel. The angle split design, as it's called allows for easier passage through the cylinder.

2014 Chevrolet Silverado and GMC Sierra debut all-new designs, three new engines

Thu, 13 Dec 2012General Motors has finally dropped the curtain on the 2014 Chevrolet Silverado and 2014 GMC Sierra. Both trucks have undergone substantial revisions with updated versions of the company's 4.3-liter V6, 5.3-liter V8 and 6.2-liter V8 engines. In a shot across the bows of both Ford and Chrysler, GM says it won't use a V6 engine adapted from passenger car applications. Instead, it developed the 4.3-liter engine based on its proven truck-duty architecture.

All three mills will boast direct injection fuel systems as well as a new cylinder head design. Combined with a revised piston, the new engines feature a smaller combustion chamber with a compression ratio of 11:1 or higher depending on the application. Cylinder deactivation and continuously variable valve timing are all part of the recipe, and each engine is paired with a six-speed automatic transmission with auto grade breaking. So far, no fuel economy or horsepower figures have been released, though GM says the new engines will best their predecessors in both areas.

Outside, the trucks feature a number of enhancements to reduce drag and wind noise, and GM claims both the Silverado and Sierra will offer buyers some of the quietest cabins in the class. Extended cab models now feature front-hinged rear doors to allow easier access to the back passenger area, and Crew Cab buyers can now select between a five-foot, eight-inch bed or a six-foot, six-inch bed. Buyers with a mind toward going off road will also rejoice in the return of the Z71 package, complete with Rancho shocks, front tow hooks and additional under-body protection.