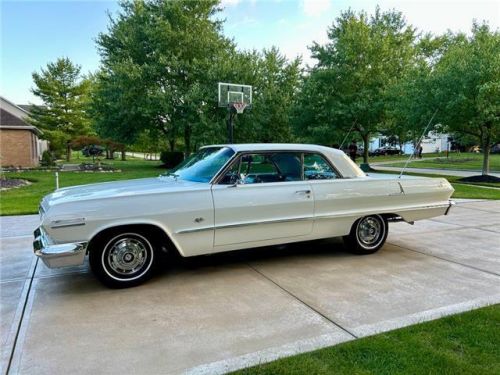

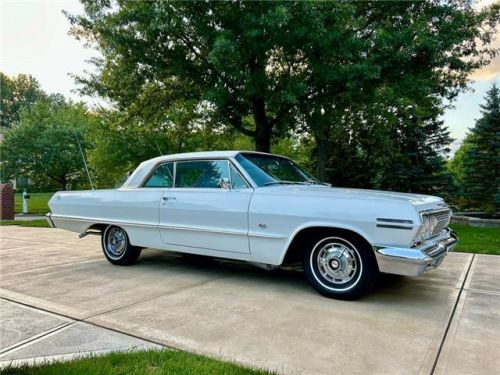

1963 Chevrolet Impala Ss on 2040-cars

North Royalton, Ohio, United States

Engine:--

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 31847S181381

Mileage: 26623

Make: Chevrolet

Trim: SS

Drive Type: --

Horsepower Value: 250

Features: --

Power Options: --

Exterior Color: White

Interior Color: Blue

Warranty: Unspecified

Disability Equipped: No

Model: Impala

Chevrolet Impala for Sale

2011 chevrolet race car track car nascar(US $39,999.00)

2011 chevrolet race car track car nascar(US $39,999.00) 1965 chevrolet impala(US $27,855.00)

1965 chevrolet impala(US $27,855.00) 1968 chevrolet impala(US $1.00)

1968 chevrolet impala(US $1.00) 1966 chevrolet impala impala(US $13,850.00)

1966 chevrolet impala impala(US $13,850.00) 1965 chevrolet impala(US $35,000.00)

1965 chevrolet impala(US $35,000.00) 1958 chevrolet impala(US $169,900.00)

1958 chevrolet impala(US $169,900.00)

Auto Services in Ohio

Weber Road Auto Service ★★★★★

Twinsburg Brake & Tire ★★★★★

Trost`s Service ★★★★★

TransColonial Auto Service ★★★★★

Top Tech Auto ★★★★★

Tire Discounters ★★★★★

Auto blog

GM recalls Colorado, Canyon, and Malibu for airbag problem

Wed, Mar 9 2016The Basics: General Motors will recall and issue a stop sale on 1,740 total examples of the 2016 Chevrolet Colorado, Malibu, and GMC Canyon. This includes 1,579 units in the US and 161 in Canada. The Problem: The second stage of the driver front airbag inflator might not be present. If this happens, the airbag won't fill as quickly as it should in a high-speed crash, which could increase the risk of injury, according to Reuters. This is not related in any way to Takata's inflator problems, and these parts come from a different supplier. Injuries/Deaths: None reported. The Fix: GM will replace the vehicles' airbag assemblies. If You Own One: GM spokesperson Tom Wilkinson told Autoblog he wasn't specifically sure when recall repairs would begin but said it would be "shortly." He expects the fixes to happen "quickly" because of the small number of affected vehicles, and many of them are either in transport or already in dealer stock. More Information: GM recalled the 2015 Canyon and Colorado in 2014 for a completely separate airbag issue. In that case, a manufacturing error improperly wired the connectors. Related Video: GM Statement GM is recalling 1,579 MY 2016 Chevrolet Colorado, GMC Canyon and Chevrolet Malibu vehicles in the United States and 161 in Canada to replace driver-side front airbags. The second stage of the airbag may not deploy properly in certain high-speed crashes. During a routine quality inspection, it was determined that a component required for a second-stage/high-output deployment was not loaded during the inflator build. Dealers will replace the driver-side front airbag assembly. There have been no reports of crashes or injuries related to this issue. This issue is unrelated to the ongoing Takata recalls.

Autoblog Podcast #327

Tue, 02 Apr 2013New York Auto Show, Jim Farley interview, 2014 Chevrolet Silverado fuel economy, Ford fuel economy app challenge

Episode #327 of the Autoblog Podcast is here, and this week, Dan Roth, Zach Bowman and Jeff Ross talk about this year's New York Auto Show, Chevrolet's latest assault in the pickup truck fuel economy battle, and Ford's reward for developing a better fuel economy app. Dan also has an interview with Ford's Jim Farley about the future of Lincoln. We wrap with your questions and emails, and for those of you who hung with us live on our UStream channel, thanks for taking the time. Keep reading for our Q&A module for you to scroll through and follow along, too. Thanks for listening!

Autoblog Podcast #327:

2016 Chevy Camaro teased as current-gen car prepares to hit 500k sales

Fri, Mar 13 2015Just as Chevrolet prepares to launch the sixth-generation Camaro, the current, fifth-generation car is about to hit a major milestone: 500,000 units sold in the United States. That's impressive, and to celebrate, Chevy has released this video, showing the Camaro Z/28 doing what it does best around a race track. But that's not all there is to see in this video. At the end, Chevy gives us a glimpse at the sixth-generation Camaro, expected to debut in the not-too-distant future. Have a look, and check out Chevy's press blast, below, for more details about the 500k sales mark. Related Video: Fifth-gen Camaro Approaches 500,000 U.S. Sales Production milestone caps five years as America's best-selling performance car DETROIT – Talk about a big family: Chevrolet expects to deliver the 500,000th fifth-generation Camaro in the United States this month. The fifth-generation Camaro has been a runaway success for Chevrolet since it went on sale in August 2009. Camaro sales passed Mustang in 2010, to become America's best-selling performance car – a title Camaro has retained for five consecutive years. In the process, the Camaro has helped bring new buyers to Chevrolet – with 63 percent of retail buyers new to GM. "The fifth-generation Camaro has clearly resonated with both long-time Camaro fans, and first time performance-car buyers," said Todd Christensen, Camaro marketing manager. "That sets the bar high for the next chapter of the car's history." Remarkably, the Camaro continues to gain momentum, even as the fifth-generation Camaro nears the end of production this year. In 2014, Camaro total sales increased 7.1 percent for its second-best year of sales since its introduction.