1981 El Camino 406 Sbc on 2040-cars

Columbus, Indiana, United States

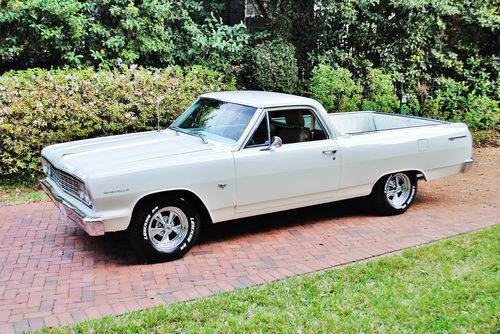

Body Type:El camino

Vehicle Title:Clear

Engine:406 Small Block

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Chevrolet

Model: El Camino

Trim: 406 sbc

Options: CD Player

Drive Type: RWD

Mileage: 200,000

Exterior Color: White

Disability Equipped: No

Interior Color: Red

Warranty: Vehicle does NOT have an existing warranty

Chevrolet El Camino for Sale

1970 ss 454 chevy el camino big block turbo 400 very clean bbc super sport

1970 ss 454 chevy el camino big block turbo 400 very clean bbc super sport 1981 el camino

1981 el camino 1978 chevy el camino 305 v8 at 5th gen custom sport ute(US $5,500.00)

1978 chevy el camino 305 v8 at 5th gen custom sport ute(US $5,500.00) Absolutly beautiful 64 chevrolet elcamino 283 4 speed p.s,p.b,leather sweet car

Absolutly beautiful 64 chevrolet elcamino 283 4 speed p.s,p.b,leather sweet car Classic 1984 chevy el camino zz4 350 700r4 transmission must see description

Classic 1984 chevy el camino zz4 350 700r4 transmission must see description 1984 chevrolet elcamino super sport ss 5.0l v-8 4bbl rwd *very solid ride* l@@k

1984 chevrolet elcamino super sport ss 5.0l v-8 4bbl rwd *very solid ride* l@@k

Auto Services in Indiana

Westfalls Auto Repair ★★★★★

Trinity Body Shop ★★★★★

Tri-County Collision Center & Towing ★★★★★

Tom O`Brien Chrysler Jeep Dodge Ram-In ★★★★★

TJ`s Auto Salvage ★★★★★

Tire Central and Service Southern Plaza ★★★★★

Auto blog

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

GM will stop reporting monthly U.S. vehicle sales

Tue, Apr 3 2018DETROIT — General Motors said on Tuesday it will stop reporting monthly U.S. vehicle sales, saying the 30-day snapshot does not accurately reflect the market, and will instead issue quarterly sales. GM will also no longer report monthly sales in China, its largest market, and Brazil. GM will provide monthly data to the U.S. Federal Reserve, industry associations and government agencies across the globe, but that data is not made public. Analysts and investors rely on monthly U.S. vehicle sales not just to track the performance of individual automakers, but as a barometer of the health of the world's second-largest auto market and as an indicator of consumer confidence in the U.S. economy overall. GM and its Detroit rivals Ford and Fiat Chrysler have relied heavily on sales of high-margin pickup truck and SUV sales to boost profits. GM's total U.S. sales, its second-largest market, are down 3.2 percent for the first two months of 2018, reflecting a 6.8 percent drop in retail sales to individual customers, the company reported last month. GM executives have expressed frustration that comparisons of monthly U.S. sales results among rival automakers are distorted by short-term discount programs, and by differences in strategy for selling vehicles in bulk to rental car fleets. "Thirty days is not enough time to separate real sales trends from short-term fluctuations in a very dynamic, highly competitive market," Kurt McNeil, U.S. vice president for sales operations said in a statement. GM's actions could prompt other automakers to also switch to quarterly U.S. sales reports. Major automakers will report March U.S. new vehicle sales on Tuesday. Until the early 1990s, most U.S. automakers released sales results every 10 days. The former Chrysler Corp. stopped reporting sales on a 10-day basis in 1990, and rivals followed suit over the next three years. GM executives are betting that investors will quickly adapt to receiving U.S. sales data every three months, as investors in other retail sectors already have. Retailers such as Walmart report sales on a quarterly basis. Reporting by Joe WhiteRelated Video: Image Credit: Reuters Earnings/Financials Green Buick Cadillac Chevrolet GM GMC US

Race Recap: 2013 Twelve Hours of Sebring, cakewalk up front, grindfest out back [w/spoilers]

Tue, 19 Mar 2013This year's 12 Hours of Sebring wasn't exactly a foregone conclusion because we're still talking about racing, and anything can happen when the speeds are as high as the adrenaline and the desire. But we're still talking about Audi bringing it's two top-spec racers - and its huge budget and its nearly neurotic attention to detail - to a race that it uses as a test bed for The 24 Hours of Le Mans and as a way to open the endurance racing season with a victory.

Besides, 12 hours is a long time, especially at Sebring, and things didn't go all Audi's way. On top of that, although it was a pretty quiet race, behind the Audis things got even grimier, with plenty of battles, plenty of mechanical issues, and the new BMW Z4 GTE and Viper GTS-R being race tested. Oh, and that brand new chromed-out DeltaWing...