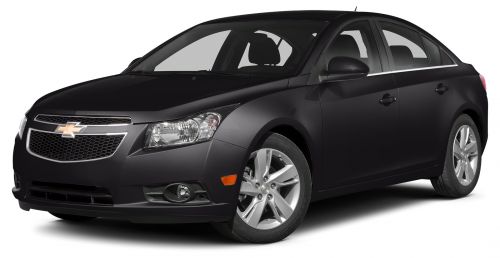

2014 Chevrolet Cruze Diesel on 2040-cars

1000 MO-47, Union, Missouri, United States

Engine:2.0L I4 16V DDI DOHC Turbo Diesel

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 1G1P75SZ2E7108940

Stock Num: U14459

Make: Chevrolet

Model: Cruze Diesel

Year: 2014

Exterior Color: Black Granite Metallic

Interior Color: Jet Black

Options: Drive Type: FWD

Number of Doors: 4 Doors

Email/Chat/ or call and ask for Internet Sales! I have additional savings available to put deals together!

Chevrolet Cruze for Sale

2014 chevrolet cruze ls(US $18,280.00)

2014 chevrolet cruze ls(US $18,280.00) 2014 chevrolet cruze 1lt(US $19,295.00)

2014 chevrolet cruze 1lt(US $19,295.00) 2014 chevrolet cruze 1lt(US $19,295.00)

2014 chevrolet cruze 1lt(US $19,295.00) 2014 chevrolet cruze ls(US $19,530.00)

2014 chevrolet cruze ls(US $19,530.00) 2013 chevrolet cruze 2lt(US $18,486.00)

2013 chevrolet cruze 2lt(US $18,486.00) 2011 chevrolet cruze ls(US $12,460.00)

2011 chevrolet cruze ls(US $12,460.00)

Auto Services in Missouri

West County Auto Body Repair ★★★★★

Villars Automotive Center ★★★★★

Tuff Toy Sales ★★★★★

T & K Automotive ★★★★★

Stock`s Underhood Specialist ★★★★★

Schorr`s Transmission, Auto & Truck Service ★★★★★

Auto blog

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

GM starting to talk seriously about 200-mile EV

Sun, Oct 12 2014We've been hearing word of a 200-mile EV from Chevrolet for a while now. First, there was General Motors then-CEO Dan Akerson hinting at a $30,000, 200-mile EV that would take the competition by surprise. Then Akerson confirmed that GM is working on a 200-mile EV in a speech in March. LG Chem, which supplies batteries to GM and other automakers, recently said it was working on batteries for EVs with a range of 200 miles. GM's head of global product development Mark Reuss just re-confirmed that there are plans for an EV with a 200-mile range, and sources have told Automotive News what that car will be. While Reuss didn't mention anything about a specific model or platform, two undisclosed sources with knowledge of GM's plans have said that an EV with a range of about 200 miles is indeed in the works, and that it will be based on the Chevrolet Sonic. The sources also gave a timeline for the car, saying it is slated for sometime in 2017. According to Reuss, the plan is for Chevy to offer a lineup of electric cars, with the 200-mile EV joining ranks of the Chevrolet Volt and the Spark EV. He didn't hint at a timeline, but if the sources are correct, we could see a Sonic EV being built within a few years. Reuss sees demand for it, too. When speaking of the Spark EV, currently only available in California and Oregon, he says that "people wish we would sell it all around the country." If he's right about that, it's not difficult to imagine people taking interest in Chevrolet's 200-mile electric car, whether or not it's a Sonic.

Subprime financing on the rise in new car sales, leasing too

Fri, 07 Dec 2012We all remember the financial crisis that began several years back. At its core was a splurge of subprime lending for housing loans. The housing bubble burst, triggering a collapse of the mortgage-backed securities market. Apparently, those types of loans still exist in the automotive industry, and the market share for these types of "nonprime, subprime, and deep subprime," loans has grown 13.6 percent compared to the third quarter a year ago.

According to an Automotive News report, high-risk lending expanded to 24.8 percent of total loans in Q3, up from 21.9 percent for this time last year. As this level increased, average credit scores of borrowers dropped to 755, down from 763 a year ago. In that time, the average financing amount increased $90 per vehicle, to $25,963.

At 818, Volvo maintains the highest per-owner credit score, while Mitsubishi has the lowest, at 694. The highest rate of borrowers was at Toyota, with 14 percent of the market, followed by Ford with 13.1 percent and Chevrolet at 11.1.