Grand Sport Low Miles 2 Dr Convertible Gasoline 6.2l V8 Sfi Ohv 16v Arctic White on 2040-cars

Tomball, Texas, United States

Vehicle Title:Clear

Engine:6.2L 376Cu. In. V8 GAS OHV Naturally Aspirated

Fuel Type:GAS

For Sale By:Dealer

Transmission:Automatic

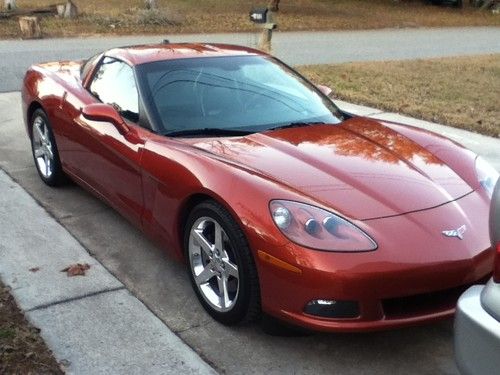

Make: Chevrolet

Warranty: Vehicle has an existing warranty

Model: Corvette

Trim: Grand Sport Convertible 2-Door

Options: Leather, Compact Disc

Safety Features: Anti-Lock Brakes, Driver Side Airbag

Drive Type: RWD

Power Options: Air Conditioning, Cruise Control, Power Windows

Mileage: 3,600

Sub Model: Grand Sport

Number of Doors: 2

Exterior Color: White

Interior Color: Red

Doors: 2

Number of Cylinders: 8

Engine Description: 6.2L V8 SFI OHV 16V

Chevrolet Corvette for Sale

2008 corvette convertible, 4,900 miles, brand new condition(US $38,500.00)

2008 corvette convertible, 4,900 miles, brand new condition(US $38,500.00) Hatchback 6.0l power door locks power windows power driver's seat alloy wheels(US $35,066.00)

Hatchback 6.0l power door locks power windows power driver's seat alloy wheels(US $35,066.00) 2005 chevrolet corvette base coupe 2-door 6.0l(US $23,500.00)

2005 chevrolet corvette base coupe 2-door 6.0l(US $23,500.00) Chevrolet corvette convertible 1 owner 150%(US $10,500.00)

Chevrolet corvette convertible 1 owner 150%(US $10,500.00) 2006 corvette 3lt, f55 select ride, h.u.d, dual roofs, 6.0l

2006 corvette 3lt, f55 select ride, h.u.d, dual roofs, 6.0l Lt1 convertible(US $15,000.00)

Lt1 convertible(US $15,000.00)

Auto Services in Texas

Zeke`s Inspections Plus ★★★★★

Value Import ★★★★★

USA Car Care ★★★★★

USA Auto ★★★★★

Uresti Jesse Camper Sales ★★★★★

Universal Village Auto Inc ★★★★★

Auto blog

Awaiting Chevy Trailblazer, driving Ford Ranger | Autoblog Podcast #580

Fri, May 17 2019In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Consumer Editor Jeremy Korzeniewski and Green Editor John Beltz Snyder. First, they discuss the news, including the Chevy Trailblazer, Ferrari to stop providing Maserati with engines, an upcoming Ferrari Hybrid, Elon Musk's sex jokes and the reveal of the McLaren GT. They also talk at length about a couple vehicles they've been driving: the Kia Niro EV and the Ford Ranger. Autoblog Podcast #580 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Chevy Trailblazer could be coming to the U.S. Ferrari to stop supplying engines to Maserati Ferrari to reveal a hybrid supercar Sex on Autopilot McLaren GT revealed Cars we're driving: 2019 Kia Niro EV 2019 Ford Ranger Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: Green Podcasts Chevrolet Ferrari Ford Kia Maserati McLaren Tesla Truck Coupe Crossover Hatchback Electric Future Vehicles Hybrid Off-Road Vehicles Performance Supercars

GM to build outgoing Silverado and Sierra until late 2019

Tue, Nov 6 2018As it has done with previous generations, General Motors is keeping the outgoing versions of its 1500 pickups in production despite the arrival of the all-new 2019 Chevrolet Silverado and 2019 GMC Sierra. The production of the previous, K2 generation models will begin to be wound down gradually, according to Automotive News, starting with crew cabs "early next year," and double and regular cab models following during "the early second half of next year." The old model trucks will continue to be built into "late 2019" based on market demand, GM's spokesperson Kim Carpenter said. The Chevrolet will go by the name Silverado LD, with the GMC Sierra designation still to be announced. Some of the outgoing models are built by sharing the assembly work between two GM plants. Partially finished Silverado and Sierra double cab bodies are shipped from Fort Wayne, Ind., to Oshawa, Ont., where the trucks are completed, including receiving paint. This eases the workload in Fort Wayne, where production of the new T1 generation trucks started in July 2018. In January, the Silao plant in Mexico will take on the duties of building new generation regular cab and crew cab trucks. Carpenter also said that the "Oshawa shuttle," as the shared production is called, has been very successful. As a result, 60,000 more trucks will be built than what the original production forecast initially called for. GM's latest quarterly profits, disclosed last week to be $1 billion, have been far higher than expected and will result in full-year profits far higher than what had been predicted in light of steel tariffs. GM isn't the only truck maker taking a similar multi-generation approach for 2019. Both the outgoing and redesigned Ram 1500 are in production, with the previous generation being dubbed Ram 1500 Classic. Related Video:

Submit your questions for Autoblog Podcast #313 LIVE!

Mon, 17 Dec 2012We record Autoblog Podcast #313 tonight, and you can drop us your questions and comments regarding the rest of the week's news via our Q&A module below. Subscribe to the Autoblog Podcast in iTunes if you haven't already done so, and if you want to take it all in live, tune in to our UStream (audio only) channel at 10:00 PM Eastern tonight.

Discussion Topics for Autoblog Podcast Episode #313

2014 Chevrolet Silverado and GMC Sierra introduced