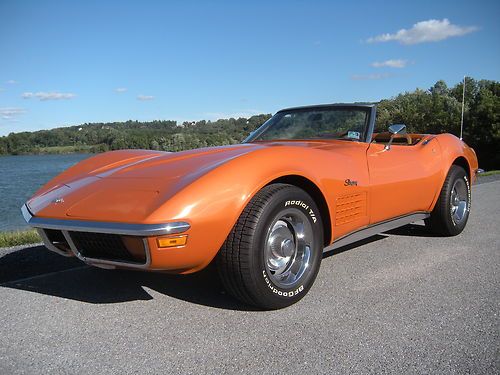

1972 Corvette Convertible (matching Numbers) 4spd. on 2040-cars

Reading, Pennsylvania, United States

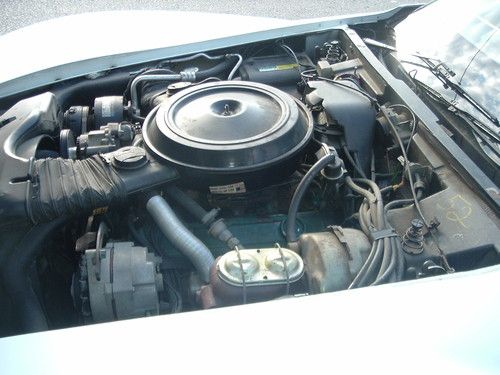

Engine:350

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: saddle

Make: Chevrolet

Number of Cylinders: 8

Model: Corvette

Trim: convertible

Warranty: Vehicle does NOT have an existing warranty

Drive Type: manual 4spd.

Mileage: 103,080

Exterior Color: ontario orange

Up for auction is my # matching 1972 Chevrolet Corvette Convertible with manual 4spd Transmission. The exterior color is Ontario orange code (987)and the interior is saddle vinyl code (417). The paint is a very nice driver quality that shows well. The interior is also in great condition. I do have the factory valve covers, air cleaner and radio that go with the car. Please email or call me with any questions or to schedule a showing. Thanks 610-301-7889 Joel

On Aug-17-13 at 10:32:15 PDT, seller added the following information:

Reserve price has been lowered, looking to have sold by end of auction, purchased another car and need the garage space. Please call or email with any questions.

Chevrolet Corvette for Sale

1998 chevrolet corvette convertible top 98k miles 8-cylinder(US $13,990.00)

1998 chevrolet corvette convertible top 98k miles 8-cylinder(US $13,990.00) 1980 chevrolet corvette base coupe 2-door 5.7l

1980 chevrolet corvette base coupe 2-door 5.7l 1996 corvette convertible lt4 6speed(US $15,500.00)

1996 corvette convertible lt4 6speed(US $15,500.00) 1989 chevrolet corvette base hatchback 2-door 5.7l(US $12,500.00)

1989 chevrolet corvette base hatchback 2-door 5.7l(US $12,500.00) 1974 chevy corvette stingray(US $11,000.00)

1974 chevy corvette stingray(US $11,000.00) 1967 chevrolet corvette convertible two top 327/4-speed ncrs top flight

1967 chevrolet corvette convertible two top 327/4-speed ncrs top flight

Auto Services in Pennsylvania

Wood`s Locksmithing ★★★★★

Wiscount & Sons Auto Parts ★★★★★

West Deptford Auto Repair ★★★★★

Waterdam Auto Service Inc. ★★★★★

Wagner`s Auto Service ★★★★★

Used Auto Parts of Southampton ★★★★★

Auto blog

Nissan Leaf sets another monthly sales record, Chevy Volt remains steady

Mon, Nov 3 2014Here we go again. Another month in the books and another month of record sales by the Nissan Leaf in the US. For October, the world's best-selling pure EV sold 2,589 units, which is 29.3 percent more than October 2013. That makes it 20 times in a row that Nissan can say that last month sales were better than the same month a year before. All told, Nissan has sold 24,411 Leafs in the US this year, a new record, reflecting an overall Leaf sales rate that is up 35 percent, year-to-date. Nissan isn't stopping, either. A new TV ad, one that, "encourages consumers to kick gas" by saving money on fuel will start airing today in major markets, according to Toby Perry, director of Nissan's EV marketing. You can watch it below. As for the Chevy Volt, things remained steady last month in the face of a new model that's coming in the second half of 2015. Chevy sold 1,439 Volts last month, which is about the same as September (1,394) but down 28.8 percent from the October 2013 despite GM having its best overall US October sales this year since 2007. So far, 2014 Volt year-to-date sales are down 14.9 percent through the end of October compared to 2013. And that wraps up the flash report on monthly sales for these two long-standing plug-in vehicles in the US market. As always, we'll have our in-depth write-up of US green car sales available soon. For now, we await your comments, below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Silverado HD, Touareg V10 TDI face off in diesel tug-of-war

Sun, 30 Dec 2012A couple weeks ago, we watched a Chevrolet Silverado get dominated by a Dodge Ram Heavy Duty in a fullsize pickup tug-of-war, but in that truck's defense, Chevy's Vortec gas engine was no match for the torquey Cummins turbo diesel. For our next round of vehicular tug-of-war, a Duramax-powered Silverado HD takes on Volkswagen Touareg V10 TDI.

Now, on paper, putting the Duramax V8's 365 horsepower and 660 pound-feet of torque up against the V10's 310 hp and 553 lb-ft looks like an easy win for the Bowtie, but unfortunately, this battle has a similar result as the Dodge versus Chevy video, with the Silverado smoking its tires trying to move forward as it gets pulled backwards. Put another way: YouTube 2, Chevy Silverado 0.

It just goes to show, though, that big tires, bolt-on fender flares and goofy smoke stacks don't improve your towing abilities. Besides, what did the Silverado driver expect when the Touareg V10 TDI has towed a Boeing 747 in the past?

Pony-car sales war: Mustang vs. Camaro vs. Challenger [UPDATE]

Fri, Jul 3 2015Update: An earlier version of this story misstated the 2015 Mustang's weight when compared with previous models. Additionally, we have added comments from Chevrolet in the text. The Ford Mustang has blown past the Chevy Camaro as America's best-selling pony car, and in June, it wasn't even close. The 'Stang outsold the Camaro 11,719 to 8,611 cars. The Camaro remained ahead of the Dodge Challenger, which sold 6,845 units. Even though the Camaro did post an 11.5-percent sales improvement in June, the competition is arguably stronger than at anytime since the 1970s muscle-car era. The Mustang's sales leapt a whopping 53.6 percent, while the Challenger saw a gain of 56 percent. Several factors are weighing down Camaro sales, including its lame duck status. Chevy is launching a new generation of the Camaro this year that's more than 200 pounds lighter, offers a new turbo four-cylinder engine option, and has a nicer interior than the outgoing model. Put simply: wait a few months and you can get a better car. It's also unlikely Chevy will jack up the price much, as it's historically kept the Camaro within reach of everyday enthusiasts. While Chevy fans wait in anticipation for their new sports car, Ford and Dodge have downshifted. The new Mustang, which went on sale last year, is faster and more sophisticated than its predecessor. It also offers a 2.3-liter EcoBoost four-cylinder, which Ford has credited for the Mustang's recent uptick and makes up 36 percent of the car's sales, Ford analyst Erich Merkle said. View 17 Photos June's performance allowed the Mustang to widen its sales gap with the Camaro this year. Through the first five months, Ford sold 68,290 Mustangs, a 54.4-percent increased compared with 2014. Chevy sold 42,593 Camaros, an 8.7-percent decrease. The Challenger – long the No. 3 pony car in sales volume – has seen its sales surge 41 percent this year to 37,011 units. Spokesman Monte Doran said Chevy expected that 2015 would be a "relatively soft year" for the Camaro. "Mustang is taking advantage of years' worth of pent-up demand for an independent rear suspension," he said. "When Camaro introduced an IRS, in 2009, it helped make us the best-selling performance car in America.