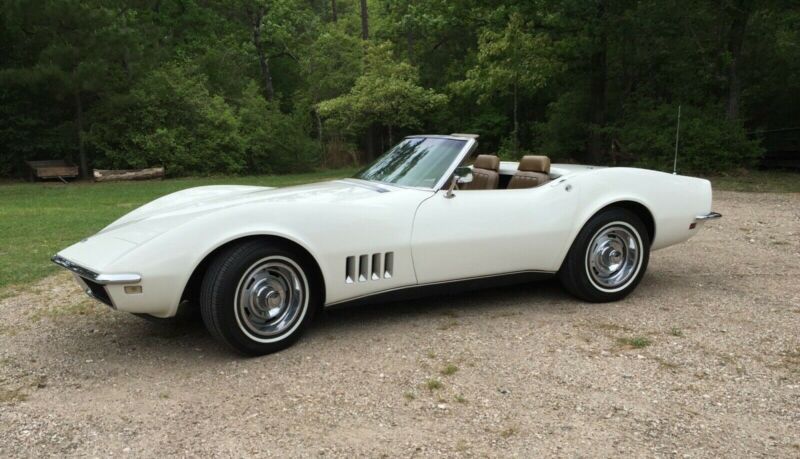

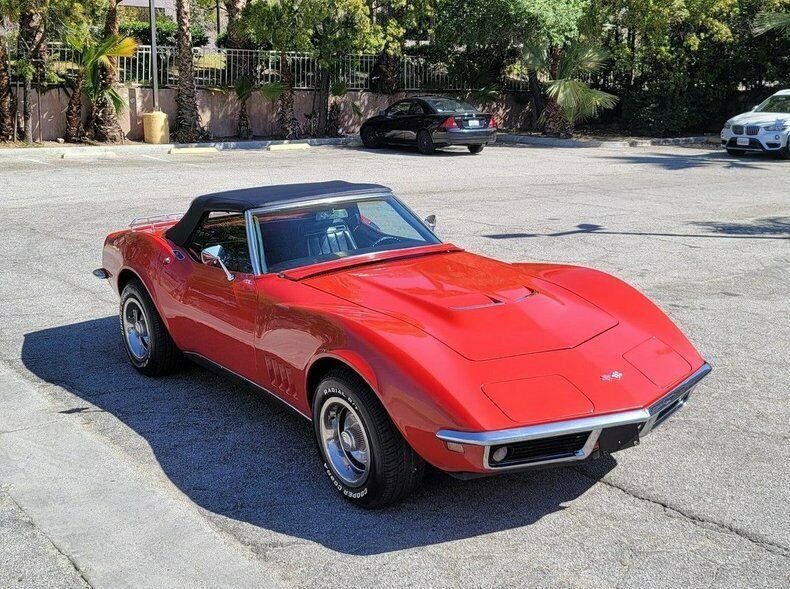

1969 Chevrolet Corvette on 2040-cars

Beeville, Texas, United States

Every car enthusiast's dream car.

1969 Corvette 427, 4 speed

SS brakes

Fresh interior including carpet, rear deck and compartments

New classic Radio with sound bar in back and USB input

Engine rebuilt about 2,000 ago (prior owner)

Rebuilt M 4 speed trans and new clutch/plate

Rebuilt Original carb

Headers and side pipes

HEI added

Large radiator with dual cooling fans

New updated composite rear suspension

New American Racing wheels and tires

Unique factory features include passenger side mirror and luggage rack

Everything works except the wipers. Convinced it's a vacuum thing but never wanted to drive in the rain anyway.

Runs and drives great!

There are a few body blemishes. Small cracks and dings (see pictures).

Paint is probably 7.5 of 10.

Chevrolet Corvette for Sale

1965 chevrolet corvette(US $14,350.00)

1965 chevrolet corvette(US $14,350.00) 1968 chevrolet corvette l-71(US $16,100.00)

1968 chevrolet corvette l-71(US $16,100.00) 1970 chevrolet corvette(US $17,430.00)

1970 chevrolet corvette(US $17,430.00) 1968 chevrolet corvette(US $19,600.00)

1968 chevrolet corvette(US $19,600.00) 1978 chevrolet corvette pace car l82 4-speed 1 of 202 built(US $17,220.00)

1978 chevrolet corvette pace car l82 4-speed 1 of 202 built(US $17,220.00) 1968 chevrolet corvette 1968 chevrolet corvette stingray(US $16,800.00)

1968 chevrolet corvette 1968 chevrolet corvette stingray(US $16,800.00)

Auto Services in Texas

XL Parts ★★★★★

XL Parts ★★★★★

Wyatt`s Towing ★★★★★

vehiclebrakework ★★★★★

V G Motors ★★★★★

Twin City Honda-Nissan ★★★★★

Auto blog

Watch the National Corvette Museum sinkhole being filled in by R/C cars

Sun, Jan 11 2015Okay, so not exactly cars, but Bobcats - but still quite cool. You might remember that the National Corvette Museum had that little divot that needed to be filled in. Turns out the construction firm of Scott, Murphy & Daniel doing the work is using two remote-controlled Bobcats to fill the sinkhole with "manufactured sand," which in this case is crushed limestone. It appears that the Bobcat company has offered remote operation since at least 2007 via a wireless transmitter that works up to 1,500 feet away. So yes, that means two SMD employees stand on the edge of the pit and flick joystick levers for hours at a time, one in charge of a Bobcat with a roller-compactor attachment, the other in charge of a Bobcat with a bucket. And that, to us, is a pretty good way to earn the daily bread. Check out the video above for the latest sinkhole update. News Source: National Corvette Museum via YouTube Auto News Weird Car News Chevrolet GM Videos rc car remote control National Corvette Museum bobcat ncm

Chevy Corvette Stingray "colorizer" lets you chase the rainbow

Thu, 14 Feb 2013After you've convinced your better half to let you buy a new Corvette, then comes the hard part... actually figuring out which 'Vette you want. While Chevrolet has yet to release the official configurator for the 2014 Corvette Stingray, it did give us something else to kill some time playing around with.

The C7 Corvette "colorizer" recently went online, and it lets you look at the car in all of its available colors and wheel options from four different angles so that when this car does go on sale, you know exactly which one you want. It includes the Corvette's full pallet of colors including Torch Red, Laguna Blue and the hue you see above, Velocity Yellow. Toss in the black wheels, and we're sold. If you have some time this afternoon, be sure to check it out the Corvette colorizer for yourself, and even if you don't have the time, we've put together a gallery with all of the possible color combinations.

GM veteran Bryan Nesbitt tapped to head Buick design

Sat, Jun 6 2015General Motors styling veteran Bryan Nesbitt (pictured above) took over a new role on Monday as executive director of global Buick design and global architectures. Andrew Smith, who previously did that job and also coordinated the look for Cadillac, has remained in charge of the pen at Caddy with this shift. Nesbitt rose to prominence when he designed the Chrysler PT Cruiser, according to Automotive News. He joined GM in 2001 and has been there ever since in multiple high-level roles. In 2007, he was appointed vice president of design for North America and was later briefly general manager of Cadillac in 2009-2010. Nesbitt took over as the vice president of GM's international operations design in China in 2011. This shuffle also moves Ken Parkinson, currently styling boss for Chevrolet trucks, to China as design vice president there. In addition, John Cafaro becomes the person in charge of the look for Chevy globally, rather than previously splitting that role between cars and trucks with Parkinson. GM Global Design Leadership Changes – effective June 1, 2015. Bryan Nesbitt, Design Vice President, GM China will repatriate to North America and assume the position of Executive Director, Global Buick and Global Architectures. He will be located in Warren, MI. Bryan will be the design Champion for Buick in the US and China. Ken Parkinson, Executive Director, Global Chevrolet Trucks and Global Architecture will assume the position of Design Vice President, GM China. He will be based in Shanghai, China. Andrew Smith, Executive Director, Global Cadillac and Buick Design will assume the position of Executive Director, Global Cadillac. He will continue to be the design Champion for the Cadillac brand. In addition, he will continue to lead the Global Color & Trim team. He will be based in Warren, Michigan. John Cafaro, Executive Director, Global Chevrolet Cars will assume the position of Executive Director, Global Chevrolet. He will be the design Champion for Chevrolet. In addition, John will lead the exterior components and accessories team. He will continue to be based in Warren, MI. The roles and responsibilities of Helen Emsley, Mark Adams, Carlos Barba, Clay Dean, Michael Simcoe, and Teckla Rhoades remain the same. Related Video: The video meant to be presented here is no longer available. Sorry for the inconvenience.