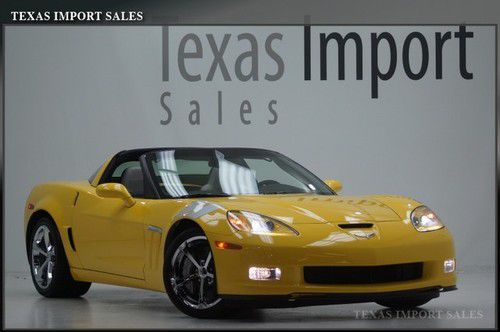

12 Grand Sport 1066 Miles,3lt,navi,hud,automatic,1.99% Financing on 2040-cars

Dallas, Texas, United States

For Sale By:Dealer

Engine:6.2L 376Cu. In. V8 GAS OHV Naturally Aspirated

Body Type:Coupe

Transmission:Automatic

Fuel Type:GAS

Cab Type (For Trucks Only): Other

Make: Chevrolet

Warranty: Vehicle has an existing warranty

Model: Corvette

Trim: Grand Sport Coupe 2-Door

Disability Equipped: No

Drive Type: RWD

Doors: 2

Mileage: 1,066

Drive Train: Rear Wheel Drive

Sub Model: Z16 GS COUPE

Number of Doors: 2

Exterior Color: Yellow

Interior Color: Black

Number of Cylinders: 8

Chevrolet Corvette for Sale

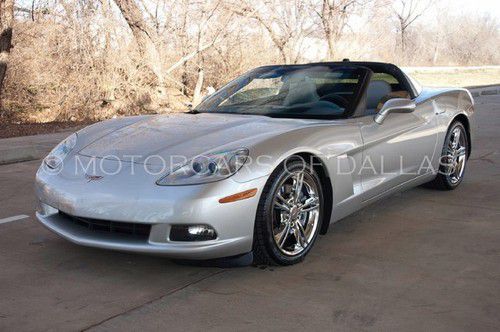

11 grand sport convertible 23k miles,3lt,nav,hud,auto,1.99% financing(US $51,950.00)

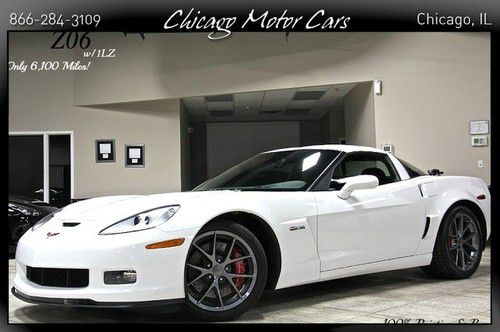

11 grand sport convertible 23k miles,3lt,nav,hud,auto,1.99% financing(US $51,950.00) 2011 chevrolet corvette z06 rare arctic white only 6k miles heads-up display wow(US $63,800.00)

2011 chevrolet corvette z06 rare arctic white only 6k miles heads-up display wow(US $63,800.00) 1970 lt1 coupe

1970 lt1 coupe 2005 chevrolet corvette navigation targa top leather heated seats satellite bose

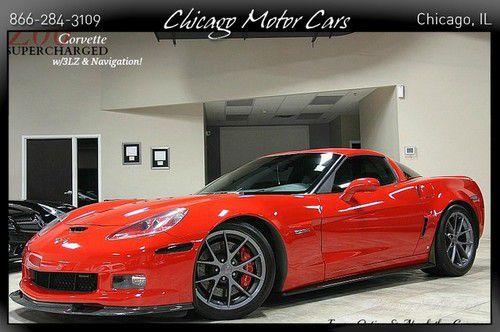

2005 chevrolet corvette navigation targa top leather heated seats satellite bose 2009 chevrolet corvette z06 3lz supercharged over 700 horsepower! $40k upgrades(US $69,800.00)

2009 chevrolet corvette z06 3lz supercharged over 700 horsepower! $40k upgrades(US $69,800.00) 1988 chevy corvette rare low mileage documented car

1988 chevy corvette rare low mileage documented car

Auto Services in Texas

Yang`s Auto Repair ★★★★★

Wilson Mobile Mechanic Service ★★★★★

Wichita Falls Ford ★★★★★

WHO BUYS JUNK CARS IN TEXOMALAND ★★★★★

Wash Me Down Mobile Detailing ★★★★★

Vara Chevrolet ★★★★★

Auto blog

Cadillac could base its entry-level sedan on the Chevy Cruze [UPDATE]

Wed, Apr 27 2016UPDATE: Cadillac spokesperson Donny Nordlicht tells Autoblog , "The post speculating on a future Cadillac model derived from the Chevrolet Cruze is completely false." Premium automakers Mercedes-Benz and Audi have seen plenty of success with new small front-drive-based sedans. The CLA-Class had its best January ever this year, while Audi moved more of its new A3 in 2015 than its predecessor sold in 2005 through 2010 combined. The fact that Cadillac wants a piece of that pie is no surprise, then. There's a new rumor that GM's luxury brand could launch its own compact – possibly called CT2 – to battle the Germans. Cadillac, a brand that's pushed hard to rebuild its rear-drive reputation, could develop a new entry-level model based on the front-wheel-drive 2016 Chevrolet Cruze's D2XX platform. Go ahead and make your Cimarron jokes. Sources are telling GM Inside News that a Cadillac built on the Delta platform would ditch the Cruze's turbocharged 1.4-liter four-cylinder for a 1.5-liter turbo in base models. General Motors' well received 2.0-liter turbo four would serve in higher-end models. According to GMIN, the Delta-based Cadillac would likely command a $6,000 to $9,000 premium over the Cruze, so figure $23,000 to $26,000 on the low end to $30,000 to $33,000 for something at the top of the range. As much as we dislike the kind of badge engineering that brought us the Cavalier-based Cadillac Cimarron in the '80s, the company has done an admirable job of distinguishing vehicles on shared platforms lately. A Delta-platform Cadillac would at least have a good basis – the new Cruze is surprisingly comfy. That said, we question GM's rationale if this rumor is indeed true. Put simply, Cadillac needs another sedan like I need another student loan payment. The company has four sedans, three of which overlap two segments, and none of which are selling very well. That's not because they're bad, but because customers want crossovers, of which Caddy has but one – the new XT5. Spending the time and money to add a fifth sedan to the mix when the company desperately needs to flesh out its CUV range would be a tremendous mistake. As much as we hate to say it, if Cadillac really wants to add a small, entry-level car to its range, it'd better be a crossover. Related Video:

IIHS: High numbers of drivers treat partially automated cars as fully self-driving

Tue, Oct 11 2022WASHINGTON — Drivers using advanced driver assistance systems like Tesla Autopilot or General Motors Super Cruise often treat their vehicles as fully self-driving despite warnings, a new study has found. The Insurance Institute for Highway Safety (IIHS), an industry funded group that prods automakers to make safer vehicles, said on Tuesday a survey found regular users of Super Cruise, Nissan/Infiniti ProPILOT Assist and Tesla Autopilot "said they were more likely to perform non-driving-related activities like eating or texting while using their partial automation systems than while driving unassisted." The IIHS study of 600 active users found 53% of Super Cruise, 42% of Autopilot and 12% of ProPILOT Assist owners "said that they were comfortable treating their vehicles as fully self-driving." About 40% of users of Autopilot and Super Cruise — two systems with lockout features for failing to pay attention — reported systems had at some point switched off while they were driving and would not reactivate. "The big-picture message here is that the early adopters of these systems still have a poor understanding of the technologyÂ’s limits," said IIHS President David Harkey. The study comes as the National Highway Traffic Safety Administration (NHTSA) is scrutinizing Autopilot crashes. Since 2016, the NHTSA has opened 37 special investigations involving 18 deaths in crashes involving Tesla vehicles and where systems like Autopilot were suspected of use. Tesla did not respond to requests for comment. Tesla says Autopilot does not make vehicles autonomous and is intended for use with a fully attentive driver who is prepared to take over. GM, which in August said owners could use Super Cruise on 400,000 miles (643,740 km) of North American roads and plans to offer Super Cruise on 22 models by the end of 2023, did not immediately comment. IIHS said advertisements for Super Cruise focus on hands-free capabilities while Autopilot evokes the name used in passenger airplanes and "implies TeslaÂ’s system is more capable than it really is." IIHS in contrast noted ProPILOT Assist "suggests that itÂ’s an assistance feature, rather than a replacement for the driver." NHTSA and automakers say none of the systems make vehicles autonomous. Nissan said its name "is clearly communicating ProPILOT Assist as a system to aid the driver, and it requires hands-on operation.

Recharge Wrap-up: Tesla P85D upgrades coming soon, lease a Chevy Volt for $149 a month

Wed, Dec 31 2014CarCharging has raised $6 million from shareholders and has restructured to save cash. The EV charging company plans to expand further in 2015 - with an eye toward achieving profitability - in part by investing in technology and "unlocking the value of our significant equipment inventory," says CarCharging CEO Michael D. Farkas. The group expects to reduce administrative costs by 40 percent, and has hired an interim Chief Financial Officer to help carry out its plans for growth. CarCharging raised the cash through offering convertible preferred stock to its shareholders, whom Farkas thanked "for their passion and patience." Read more in the press release below. Rydell Chevrolet in Los Angeles is offering Chevrolet Volt leases for $149 per month. In a video ad, Rydell offers the Volt for $169 a month with $3,390 due at signing, but another ad shows the offer at $149 a month with $3,550 down or $248 per month with $0 down. Rydell Chevrolet will ship the car anywhere in the lower 48 states. It also appears they offer cupcakes. See Rydell's video below, or read more at Inside EVs. Tesla will upgrade the Model S P85D with higher performance and top speed. The free update, which is due "in the next few months" according to a statement from Tesla, will raise the electronically limited top speed from 130 to 155 miles per hour. "Additionally, an over-the-air firmware upgrade to the power electronics will improve P85D performance at high speed above what anyone outside Tesla has experienced to date," Tesla says. The update will be available for the lifetime of the car, which includes subsequent owners. Read more at Green Car Reports. Car Charging Group Completes $6 Million Capital Raise Concurrently Enacts Restructuring Actions to Reduce Cash Burn MIAMI BEACH, Fla., Dec. 29, 2014 /PRNewswire/ -- Car Charging Group, Inc. (OTCQB: CCGI) ("CarCharging" or the "Company"), the largest owner, operator, and provider of electric vehicle (EV) charging services, today announced that it has closed an offering (the "Offering") and raised net proceeds of up to $6 million with current institutional shareholders. The Offering consisted of convertible preferred securities with a conversion price of $0.70 and warrants exercisable at $1.00. Proceeds will be used to: - Strengthen CarCharging's balance sheet; - Build on the past year's progress; and - Provide growth capital for expanding the Company's network.