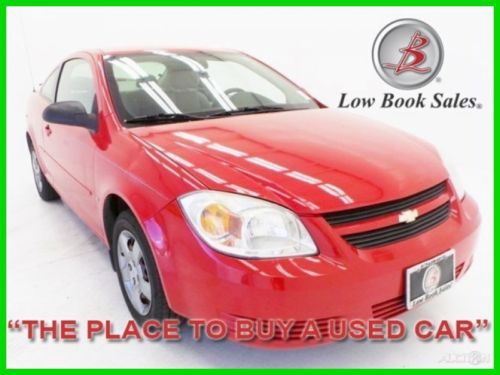

Lt W/1lt 2.2l Engine Door Handles Body-color Fascias Glass Headlamps Mirrors on 2040-cars

Winnsboro, South Carolina, United States

For Sale By:Dealer

Engine:2.2L 2198CC 134Cu. In. l4 GAS DOHC Naturally Aspirated

Body Type:Sedan

Transmission:Unspecified

Vehicle Title:Clear

Used

Year: 2009

Power Options: Air Conditioning

Make: Chevrolet

Model: Cobalt

Mileage: 128,481

Trim: LT Sedan 4-Door

Sub Model: LT w/1LT

Exterior Color: Other

Drive Type: FWD

Interior Color: Gray

Number of Cylinders: 4

Warranty: Unspecified

Chevrolet Cobalt for Sale

4dr sedan lt w/1lt automatic gasoline 2.2l 4 cyl victory red

4dr sedan lt w/1lt automatic gasoline 2.2l 4 cyl victory red 2005 chevy cobalt(US $3,500.00)

2005 chevy cobalt(US $3,500.00) 2009 cobalt ss turbo(US $10,200.00)

2009 cobalt ss turbo(US $10,200.00) 2006 chevrolet cobalt ss(US $9,300.00)

2006 chevrolet cobalt ss(US $9,300.00) Chevorlet cobalt lt 2008(US $4,500.00)

Chevorlet cobalt lt 2008(US $4,500.00) 2006 ls used 2.2l i4 16v fwd coupe(US $8,795.00)

2006 ls used 2.2l i4 16v fwd coupe(US $8,795.00)

Auto Services in South Carolina

Walker`s Auto Service ★★★★★

Truck Toyz ★★★★★

Toyota of Orangeburg ★★★★★

Toyota Of Greer ★★★★★

The Wholesale Outlet ★★★★★

Summerfield Auto Repair ★★★★★

Auto blog

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

Recharge Wrap-up: Chevy Volt class action suit proposed, Tesla stock could outperform in 2015

Sat, Dec 27 2014A class action suit has been proposed against General Motors for a steering problem in the Chevrolet Volt. The plaintiffs claim that a defect can cause the steering to freeze intermittently, and that General Motors either knows or should have known about the problem. The case, filed in New Jersey, also claims that defective parts are replaced with the same or similar parts, which are also defective. The plaintiffs say that claims for the 100-plus-member class exceed $5 million. Read more at Law360 or at BigClassAction. Tesla Motors stock (TSLA) has risen after weeks of losses. It gained 5.4 percent during the week ending December 19, when it closed at $219.29 per share. Since then, it rose slightly more, closing at $222.26 on December 24. Morgan Stanley lowered its target price on Tesla stock from $320 to $290, predicting lower sales on the upcoming Model III than expected before, but still called Tesla a good long-term investment. Analysts at CNBC predicted Tesla to be the best performing stock of 2015. Read more at ETF Daily News. Oslo- and New York-based architecture firm Snohetta has designed a zero-emissions house that also charges an electric car. The ZEB Pilot House, built in Larvik, Norway, uses a solar panel on the roof to power the house, which also provides enough excess energy to charge an EV. To make the most of energy most efficiently, the house uses smart technology to use as much energy as it can once it's harvested. This means one can turn on appliances like the washing machine remotely while the sun is at the optimum angle in the sky - perhaps during mid-day when the residents are at work. The house also uses organic materials and is designed to save as much energy as possible. Read more at Wired.

Officially Official: Chevrolet replaces Daewoo name in Korea

Thu, 20 Jan 2011

Chevrolet Camaro in Korea - Click above for high-resolution image

There once was a time when Daewoo was one of the biggest companies in South Korea. It was larger than both LG and Samsung, and second only to Hyundai. But these days the name is all but gone.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.231 s, 7888 u