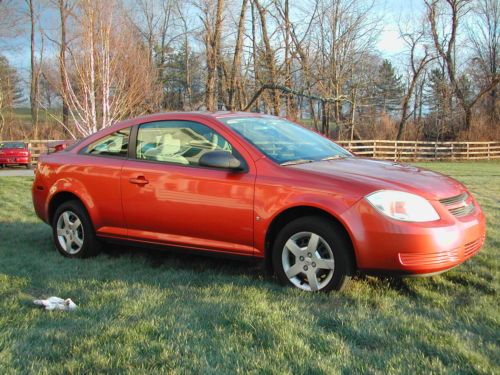

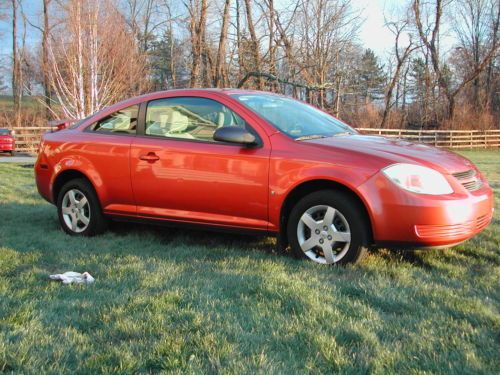

2007 Chevrolet Cobalt Ls Coupe No Reserve on 2040-cars

Montgomery, New York, United States

Vehicle Title:Clear

Engine:2.2L 2198CC 134Cu. In. l4 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Coupe

Fuel Type:GAS

Year: 2007

Make: Chevrolet

Warranty: Vehicle does NOT have an existing warranty

Model: Cobalt

Trim: LS Coupe 2-Door

Options: CD Player

Power Options: Air Conditioning

Drive Type: FWD

Mileage: 98,491

Number of Doors: 2

Sub Model: 2dr Cpe LS

Exterior Color: Orange

Number of Cylinders: 4

Interior Color: Gray

Chevrolet Cobalt for Sale

2006 chevrolet cobalt ss coupe 2-door 2.0l

2006 chevrolet cobalt ss coupe 2-door 2.0l 2005 chevrolet cobalt ls sedan 4-door 2.2l

2005 chevrolet cobalt ls sedan 4-door 2.2l 2007 cobalt no reserve nice gas saver 5 speed low mileage

2007 cobalt no reserve nice gas saver 5 speed low mileage 2010 chevrolet cobalt base coupe 2-door 2.2l

2010 chevrolet cobalt base coupe 2-door 2.2l 2008 chevy cobalt ls 2dr coupe 2.2 engine, whtie(US $6,200.00)

2008 chevy cobalt ls 2dr coupe 2.2 engine, whtie(US $6,200.00) 2009 chevrolet cobalt ss coupe turbocharged slp exhaust(US $16,977.00)

2009 chevrolet cobalt ss coupe turbocharged slp exhaust(US $16,977.00)

Auto Services in New York

Wayne`s Auto Repair ★★★★★

Vk Auto Repair ★★★★★

Village Auto Body Works Inc ★★★★★

TOWING BROOKLYN TODAY.COM ★★★★★

Total Performance Incorporated ★★★★★

Tom & Arties Automotive Repair ★★★★★

Auto blog

GM profit dips on truck changeover, but beats estimates

Thu, Apr 26 2018DETROIT — General Motors on Thursday reported a higher-than-expected quarterly profit despite a drop in production of high-margin pickup trucks, as it gears up for new models that are expected to boost profits next year. Like rivals Ford and Fiat Chrysler Automobiles, GM is banking on highly-profitable Chevy Silverado and GMC Sierra pickup trucks to lift profits, as consumers shift away from traditional passenger cars in favor of these larger, more comfortable trucks, SUVs and crossovers. During the first quarter, the process of changing over to GM's new pickups resulted in a drop in production of 47,000 units. GM Chief Financial Officer Chuck Stevens said the production drop had resulted in a drop in pre-tax profit of up to $800 million. Earlier this year, GM said its 2018 profits would be flat compared with 2017, but expected its all-new pickup trucks would boost margins starting in 2019. On Thursday, GM reiterated its full-year 2018 forecast for adjusted earnings in a range from $6.30 to $6.60 per share. The automaker said capital expenditures were more than $500 million higher in the quarter because of investments its new pickup trucks and a family of low-cost vehicles under development with Chinese partner SAIC Motor Corp. On Wednesday, rival Ford said it would stop investing in most traditional passenger sedans in North America. CFO Stevens told reporters on Thursday that GM has "already indicated that we will make significantly lower investments on a go-forward basis" in sedans. 2019 GMC Sierra View 21 Photos GM benefited from a lower effective tax rate in the quarter, but adjusted pre-tax margin fell to 7.2 percent from 9.5 percent a year earlier. Stevens said the company's profit margin should hit 10 percent or higher in the second quarter and for the full year. GM said material costs were $700 million higher in the first quarter, and it expects those costs to continue rising. The automaker said it would counter those increases with cost cutting measures. "It is a more difficult environment than it was three or four months ago," Stevens said when asked about rising commodity prices from potential steel and aluminum tariffs announced by the Trump administration. "But we are confident we can continue to offset that." The company reported quarterly net income of $1.05 billion or $1.43 per share, a drop of nearly 60 percent from $2.61 billion or $1.75 per share a year earlier. Analysts had on average expected earnings per share of $1.24.

Chevy Volt sales drop in June, Nissan Leaf inches upwards

Tue, Jul 1 2014Different month, same story. That's the gist of the monthly US sales numbers from the Chevy Volt and the Nissan Leaf. These were the first two mass-market plug-in vehicles to go on sale in the US and we've been comparing their sales numbers for what seems like ages now. So far, the 2014 tale of the tape shows the all-electric once again trumping the plug-in hybrid. The last time the Volt outsold the Leaf was in October 2013. Chevrolet sold 1,777 Volts in June. That was good enough to be the Volt's best sales month of the year, but it's down 34 percent from the 2,698 units sold in June 2013. In fact, it's on par with the 1,760 Volts sold in June 2012. Given the steady sales, General Motors might need to push up the release of the next-gen Volt to gin up excitement, especially if it also offers some of the things that current Volt drivers say they want improved: more range, a lower price and a fifth seat. GM also said it sold 85 Spark EVs in June, an increase of 215 percent over June 2013 Nissan sold 2,347 Leafs last month. The good news continues for Nissan, which says it sold 2,347 Leafs last month. That's an increase of 5.5 percent over 2013 numbers and makes 2014 the best June ever for Leaf sales. Let's credit Texas. Toby Perry, Nissan's director of EV sales and marketing, said in a statement that, "Since the Texas state incentive went into effect in May, we've seen a big jump in Leaf sales in the Austin, Dallas and Houston markets. Our dealers are telling us that they saw more traffic in their stores, and they had their best Leaf sales performance in the last weekend in June." Even with that increase, Atlanta remains the top Leaf market. Nissan has sold 12,736 Leafs in the US so far this year; Chevy 8,615 Volts. Our detailed monthly sales write-up of green cars in the US, including plug-in vehicles, hybrids and diesel cars, is coming soon. For now, we invite you to discuss these numbers in the Comments. Related Gallery 2013 Nissan Leaf View 55 Photos News Source: GM, Nissan Green Chevrolet Nissan Electric Hybrid PHEV ev sales

Former Fisker CEO has some advice for Tesla Motors

Wed, Oct 22 2014Former Fisker Automotive CEO and ex-Chevrolet Volt vehicle-line director Tony Posawatz has some words of caution for Tesla Motors. The long-time automaker executive questions the California automaker's long-term viability – and gives some praise – in a talk with Benzinga, which you can listen to below. While the all-wheel-drive D that Tesla unveiled earlier this month in Southern California wowed a packed crowd, Posawatz (starting at around minute 4:45 in the interview) says Tesla would've been better off taking the resources it expended toward that Model S upgrade and directed them towards speeding up the development of a more affordable plug-in. Perhaps a number of investors agreed, since the company's stock fell the day after the D was announced. Posawatz says Tesla has been over-reliant on the sale of ZEV credits. Posawatz also says that Tesla has been over-reliant on the sale of zero-emissions vehicle credits in California for its earnings and questions whether the automaker will ever work at a large enough scale to sufficiently drive down costs and make consistent profits. Tesla CEO Elon Musk would take issue with this characterization. Posawatz first made his mark in the plug-in vehicle world when he was the vehicle-line director at General Motors for the Volt extended-range plug-in from 2006 to 2012. Later that year, he joined extended-range plug-in maker Fisker Automotive as its CEO, though quit that job during the summer of 2013 as the company was descending into insolvency. He joined the Electrification Coalition this past March. News Source: Benzinga Green Chevrolet Fisker Tesla Electric PHEV Tony Posawatz

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.077 s, 7891 u