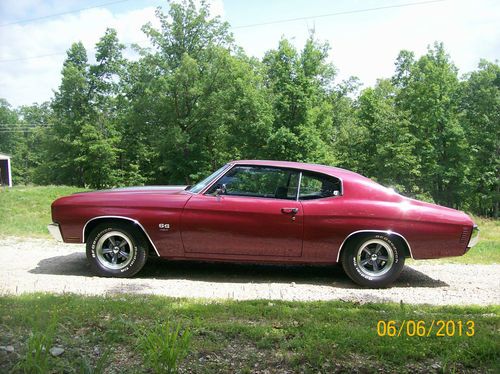

1971 Chevelle Malibu 24k Orig Mi Survivor One Owner Time Capsule on 2040-cars

Long Island New York, United States

Body Type:Coupe

Engine:V8

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Model: Chevelle

Trim: Malibu

Drive Type: Rwd

Power Options: Air Conditioning, Power Locks

Mileage: 24,421

Warranty: Vehicle does NOT have an existing warranty

Exterior Color: White

Interior Color: Black

Chevrolet Chevelle for Sale

1967 chevrolet chevelle

1967 chevrolet chevelle 1971 chevrolet chevy chevelle 2 door coupe no reserve!

1971 chevrolet chevy chevelle 2 door coupe no reserve! 1967 chevelle malibu 2-dr. hard top! original! 283 v8 powerglide auto!!!(US $2,500.00)

1967 chevelle malibu 2-dr. hard top! original! 283 v8 powerglide auto!!!(US $2,500.00) 1970 chevrolet chevelle ss 454, chevelle, 1970 chevrolet, 2 dr(US $34,500.00)

1970 chevrolet chevelle ss 454, chevelle, 1970 chevrolet, 2 dr(US $34,500.00) 1969 chevelle ss396 4-spd "numbers matching" less than 1000 since restoration

1969 chevelle ss396 4-spd "numbers matching" less than 1000 since restoration 1970 ss454 chevelle, disc brakes, turbo 400, 12 bolt 3.73 posi, nice driver(US $19,900.00)

1970 ss454 chevelle, disc brakes, turbo 400, 12 bolt 3.73 posi, nice driver(US $19,900.00)

Auto blog

Pics Aplenty: Meet the 2014 Chevrolet Silverado and GMC Sierra [w/poll]

Thu, 13 Dec 2012Today was a pretty big day for General Motors, debuting the all-new Chevrolet Silverado and GMC Sierra light-duty pickup trucks ahead of their official showcase at the 2013 Detroit Auto Show. And now that the dust has settled at GM's big reveal event, we've had a chance to snap dozens of photos of the new pickup pair from every angle.

We already told you the important bits earlier today (click here in case you missed it), but let's recap. Under the hood are three new engines - a 4.3-liter V6, 5.3-liter V8 and 6.2-liter V8 (you know, a version of the small-block that'll also be found under the hood of the C7 Corvette), all mated to six-speed automatic transmissions. The 2014 model year marks the return of the Z71 off-road package with Rancho shocks, front tow hooks and beefier underbody protection. Inside, there's a host of new technology and a greater focus on better quality and refinement.

Some of the nitty-gritty specifics (like engine output numbers and fuel economy) have yet to be revealed, and since we haven't driven the finished products yet, it's hard to say how these trucks will fare against rivals like the Ram 1500 and Ford F-150. For now, we can only judge these two books by their covers, and while we do like the designs of the new trucks, we Autoblog staffers are torn on exactly which one looks best.

Chevy Volt replacement battery cost varies wildly, up to $34,000

Fri, Jan 10 2014There's a growing hubbub in the plug-in vehicle community over what looks like some ridiculously cheap replacement batteries for the Chevrolet Volt going up for sale. GM Parts Online, for example, is selling a replacement Volt battery with an MSRP of $2,994.64 but, with an online discount, the price comes down to $2,305.88. For the 16-kWh pack in the 2012 Volt, that comes to a very low $144.11 per kilowatt hour (kWH). But is it a real deal? How can it be, when a Chevy dealer may quote you a price of up to $34,000 to replace the pack? For a 16-kWh Volt pack, $2,305.88 comes to a very low $144.11 per kWh. But is it a real deal? Battery packs in alternative propulsion vehicles are usually priced by the kWh and, historically, they've been thought to be in the range of $500-per-kWh for OEM offerings. Since automakers are understandably secretive about their costs, we still don't know what the real number is today, but we do know it varies by automaker. Tesla, for example, has said it pays less than $200-per-kWH at the cell level but, of course, a constructed pack would be more. Whatever is going on, li-ion battery prices are trending downward. So, $144.11 certainly sounds great, but what's the story here? Kevin Kelly, manager of electrification technology communications for General Motors, reminded AutoblogGreen that GM Parts Online is not the official GM parts website and that, "the costs indicated on the site are not what we would charge our dealers or owners for a replacement battery. There would be no cost to the Volt owner if their battery needs replacement or repair while the battery is under the eight year/100,000 mile limited warranty coverage provided by Chevrolet." A single price tag also can't be accurate for everyone, Kelly said. "If the customer needs to have their battery repaired beyond the warranty, the cost to them would vary depending on what needs to be replaced or repaired (i.e. number of modules, which specific internal components need replacement, etc.)." he said. "So, it's hard for us to tell you exactly what the cost would be to the customer because it varies depending on what might need to be repaired/replaced. As a result, the core charge would vary." But, is the $2,300 price even accurate for anyone? Thanks to a reader comment, we see that this similar item on New GM Parts makes it look like the lithium-ion modules that Kelly mentioned – where a lot of the expensive bits are – are not included.

1 in 7 Americans say they might buy an EV next, as sales of electrics surge

Wed, Apr 26 2017About one in seven driving Americans may likely purchase an electric vehicle as their next car, according to an AAA poll, meaning that as many as 30 million Americans may pony up for an EV within the next three to five years. While some of the motivation is environmental, survey recipients say that lower maintenance expenses and solo access to high-occupancy-vehicle lanes are also among the factors behind potentially going electric. Take a look at the AAA press release on the study here. The poll indicates that about as many people are planning to buy an EV for their next car as are looking to buy a pickup, which is impressive given that the best-selling US vehicle is the Ford F-150. And things should only improve, as about 20 percent of millennials polled said that their next car would probably be an EV. The results are all the more encouraging, at least among green-car advocates, because gas prices have fallen about 40 percent within the past five years, meaning that there's less of an incentive to go electric from a purely economic perspective. Through the first quarter of this year, US plug-in vehicle sales were up about 63 percent from a year earlier to about 39,000 vehicles. Meanwhile, when it came to AAA's annual green-vehicle awards for this year, Tesla's Model S and Model X took the large car and SUV categories, respectively, while the Chevrolet Bolt and Volkswagen e-Golf were listed atop the subcompact and compact lists. The Lexus GS 450h hybrid and the Ford F-150 took home AAA's best green vehicle in the midsize and pickup truck categories. Related Video: