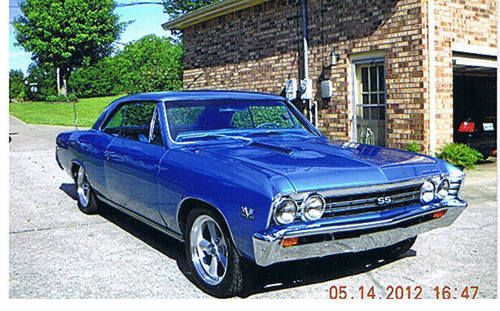

1970 Chevrolet Chevelle Ss on 2040-cars

Hobe Sound, Florida, United States

Engine:427

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Exterior Color: Red

Make: Chevrolet

Interior Color: Black

Model: Chevelle

Number of Cylinders: 8

Trim: SS

Drive Type: Auto rear wheel drive

Mileage: 61,388

Very straight and exceptional example of a 1970 SS 396.

- Low original miles, fresh 427 ci engine from a 1969 Corvette.

- Fresh tires

- Recent maintenance and service

- Straight rust free body and undercarriage

- Starts and runs flawlessly, creat exhaust note.

- Looks incredible

- Sounds healthy

- Impressive performance and handeling

- A true classic

- California origination

A rare American muscle car. This is one vehicle you would be proud to own, show or drive.

Call to discuss, schedule a viewing. Far more car and better than you are expecting or will see nationally.

Chevrolet Chevelle for Sale

1967 chevelle ss, 4 speed, matching numbers, muscle car(US $39,000.00)

1967 chevelle ss, 4 speed, matching numbers, muscle car(US $39,000.00) Ss clone 350 v8 convertible silver black stripes automatic power disc brakes ps

Ss clone 350 v8 convertible silver black stripes automatic power disc brakes ps 1971 chevelle race car roller with 16ft car trailer ,8000.00 obo(US $8,000.00)

1971 chevelle race car roller with 16ft car trailer ,8000.00 obo(US $8,000.00) 1968 chevrolet chevelle convertible 327 4spd manual muncie double hump heads wow(US $18,999.00)

1968 chevrolet chevelle convertible 327 4spd manual muncie double hump heads wow(US $18,999.00) #'s matching 327 ci, brand new a/c, power steering and brakes, awesome color com(US $23,995.00)

#'s matching 327 ci, brand new a/c, power steering and brakes, awesome color com(US $23,995.00) 1970 70 chevelle ss 454 clone(US $25,500.00)

1970 70 chevelle ss 454 clone(US $25,500.00)

Auto Services in Florida

Zephyrhills Auto Repair ★★★★★

Yimmy`s Body Shop & Auto Repair ★★★★★

WRD Auto Tints ★★★★★

Wray`s Auto Service Inc ★★★★★

Wheaton`s Service Center ★★★★★

Waltronics Auto Care ★★★★★

Auto blog

Opel CEO talks new EV, will likely be fresh face for Chevy, too

Wed, Jul 23 2014The rumored demise of the Opel Ampera has been confirmed, but there's good news, too. Opel CEO Karl-Thomas Neumann has been busy Tweeting information about the brand's next plug-in vehicle, admitting that the Ampera is on the way out but that plug-in vehicles are here to stay. His Tweets, in full, read: After the eventual run-out of the current generation Ampera, we'll introduce a successor product in the electric vehicle segment. Our next electric vehicle will be part of our massive product offensive – with 27 new vehicles in the 2014-2018 time frame. We see eMobility as important part of the mobility of tomorrow and we will continue to drive down costs & deliver affordability. As we learned earlier this week, the Ampera will not be refreshed when the current Chevy Volt is updated, most likely because of slow sales. Opel sold just 332 Amperas in the first five months of 2014. For now, General Motors is still building Amperas in Michigan for export to Europe. So, what might this new EV mean for the General Motors plug-in fleet? Official spokespeople are being quiet, but we think it's safe to say the new EV Neumann is talking about is not simply a rebadged Chevy Spark EV. This is the first official word about an entirely new EV, and we expect it will come to both the Chevrolet and Opel brands.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

GM won't pay owners of recalled cars for lost value

Thu, 12 Jun 2014Kenneth Feinberg, the man in charge of the General Motors compensation fund dealing with the its widespread ignition switch woes, has issued an informal, two-letter response to the plaintiffs in more than 70 lawsuits seeking redress for lost resale value of their Cobalts: "No." The cases were recently combined into one, but Feinberg told The Detroit News that the fund will deal "only with death and physical injury claims," and that "perceived diminished value" will get no consideration.

ALG, the firm specializing in establishing residual values, determined that Cobalt owners had lost $300 compared to the segment competition and doesn't envision any long-term effects from the recall situation. Feinberg's statement comes in advance of public details on how the compensation fund will work and adheres to GM's long-held position on the matter. The company has already asked a judge to throw out such suits using the pre-bankruptcy defense, even as it stopped using that defense in cases of injury and death.

With plenty of potential gain from the GM suit, however, don't expect the plaintiffs to give up yet. When Toyota was sued for the same reason during the unintended acceleration debacle, it eventually settled the case for between $1 billion and $1.4 billion just to get it over with. Since the 85 law firms involved in the Toyota litigation took home more than $250 million of that total, we shouldn't expect the attorneys to give up on a GM payout, either.