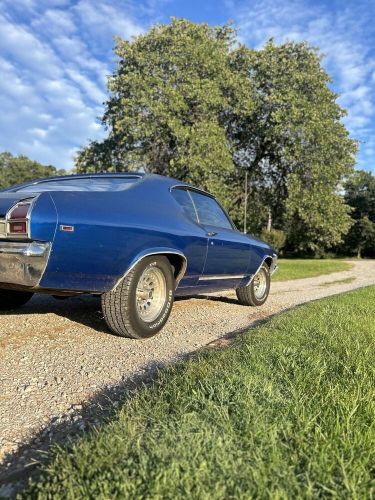

1969 Chevrolet Chevelle Chevelle on 2040-cars

Lexington, Oklahoma, United States

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

Engine:350sbc

VIN (Vehicle Identification Number): 136379Z366958

Mileage: 71500

Trim: chevelle

Number of Cylinders: 8

Make: Chevrolet

Drive Type: RWD

Model: Chevelle

Exterior Color: Blue

Chevrolet Chevelle for Sale

1970 chevrolet chevelle convertible(US $27,500.00)

1970 chevrolet chevelle convertible(US $27,500.00) 1967 chevrolet chevelle(US $50,000.00)

1967 chevrolet chevelle(US $50,000.00) 1967 chevrolet chevelle chevelle(US $47,900.00)

1967 chevrolet chevelle chevelle(US $47,900.00) 1971 chevrolet chevelle(US $129,900.00)

1971 chevrolet chevelle(US $129,900.00) 1970 chevrolet chevelle ss 454 tribute(US $18,500.00)

1970 chevrolet chevelle ss 454 tribute(US $18,500.00) 1969 chevrolet chevelle(US $137,900.00)

1969 chevrolet chevelle(US $137,900.00)

Auto Services in Oklahoma

Twister Auto Sales ★★★★★

Turn Key Auto Mart ★★★★★

Steve`s Country Garage ★★★★★

Sports & Imports ★★★★★

South 281 Autos ★★★★★

Select Auto Sales ★★★★★

Auto blog

Here are the best-selling cars and trucks from January 2015

Fri, Feb 6 2015Every month, Autoblog slogs through all the sales figures reported by automakers that do business in the United States, and, after a little bit of sorting, we put it into an easy-to-read chart in an attempt to make it as easy as possible to follow the ins and outs of sales and shipments. But that only covers the brands themselves, not the individual models they sell. And we think you'd all be interested in knowing which vehicles beat their rivals in sales from month to month, so we've put together this handy gallery to keep you in the know. While the leader of the pack may not come as much of a surprise, the order that the top ten finishes in changes frequently – due to automaker deals, the price of gas, etc. – and we've included some statistics to help you see how their current performance stacks up to month's past. Click here to see January 2015's Top Ten Best-Selling Cars And Trucks In America. By the Numbers Chevrolet Ford GM Honda Nissan RAM Toyota Car Buying

How long will the 'golden age' of performance last?

Sat, Mar 26 2016High-powered sports and luxury cars were everywhere at the New York Auto Show, prompting the obvious question for enthusiasts: How long will this golden age of performance last? Industry leaders have some time before regulations elevate the Corporate Average Fuel Economy level in 2025. Even then, they expect cars rippling with power to survive in some form. "Is it the end of an era," I don't think so," said Ola Kallenius, Daimler AG board member for Mercedes-Benz cars marketing and sales. "That performance element of individual mobility I don't think will ever go away." Kallenius, who oversaw the company's AMG division from 2010-2013, expects it to continue to grow. Last year, AMG sold a record 68,875 units around the world, an increase of 44.6 percent over 2014, with strong growth in the US, China, and Germany. Still, there's always the potential for gas to spike, and pending fuel economy regulations are looming. That could lead AMG to add electrification to its products, Kallenius said, pointing to the electric SLS as a test case. Chevy is also thinking ahead, said Al Oppenheiser, chief engineer of the Camaro. He wouldn't bite when asked about electrification for the Camaro (he did say "never say never"), but admitted in 2025 "it's going to be pretty tough to sell V8s." For now, things are rosy for muscle cars, and Chevy confidently showcased the 640-hp Camaro ZL1 in coupe and convertible form in New York. "I think that this is truly the golden age of performance," Oppenheiser said. It's hard to disagree. News & Analysis News: The 2017 Mazda MX-5 Miata RF was a show-stopper in New York. Analysis: There was a palpable energy when this RF — for Retractable Fastback — was revealed the night before the show at a trendy off-site venue near the Hudson River. Even as a parade of SUVs and flashy luxury cars rolled out the rest of the week, the Miata remained a hot topic. The Retractable Fastback is really a clever targa top, with part of the roof stowing behind the seats, adding about 100 pounds compared to the standard convertible. It makes the car more practical and arguably more attractive. The RF continues Mazda's tradition of selling the Miata with a hardtop variant. The first and second generations offered a detachable one, and a power retractable hardtop (a $1,700 option) was available on third-gen models. Judging by its reception in New York, the RF could prove to be even more popular than its predecessors.

Watch the live reveal of the 2014 Chevy Silverado and GMC Sierra [UPDATE]

Thu, 13 Dec 2012UPDATE: The trucks have been revealed. Click here for all of the official details.

As promised, Chevrolet and GMC are offering a live webcast of the world premiere for the all-new 2014 Silverado 1500 and Sierra 1500. After being teased with spy shots and blurry images like the one above for ages, now is the time to see the trucks in the metal, for real (well, as 'real' as it gets on a webcast, at any rate).

Shift your eyes down just below to see the reveal as it happens, starting at 9:30 AM EST. We anticipate having loads of images full technical information to share after the webcast, too, so truck aficionados should stay tuned. We'll also be bringing you live images of both trucks too, when we see them on the show floor at next month's Detroit Auto Show.