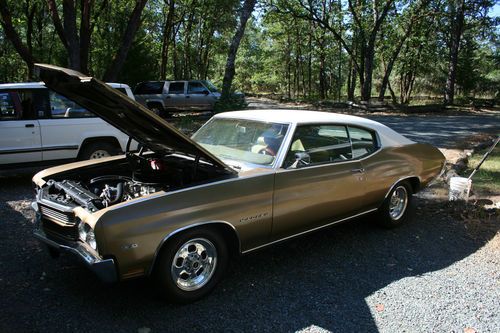

1968 Chevelle Ss 396 Matching Numbers on 2040-cars

Northridge, California, United States

Body Type:hardtop coupe

Engine:396

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Owner

Interior Color: Black

Make: Chevrolet

Number of Cylinders: 8

Model: Chevelle

Trim: Resto mod

Drive Type: RWD

Options: Leather Seats

Mileage: 50,000

Sub Model: SS

Exterior Color: Torch red

matching numbers: 53,000

Chevrolet Chevelle for Sale

1967 chevrolet chevelle ss 396 4 speed frame off concourse restoration

1967 chevrolet chevelle ss 396 4 speed frame off concourse restoration 1967 chevrolet chevelle marina blue 502(US $28,500.00)

1967 chevrolet chevelle marina blue 502(US $28,500.00) 1969 69 396 ss resto-mod clone 454 crate engine 3.53 posi 400 turbo at excellent

1969 69 396 ss resto-mod clone 454 crate engine 3.53 posi 400 turbo at excellent 1967 chevelle racecar rolling chassis

1967 chevelle racecar rolling chassis 1970 chevelle malibu 2 door hard top 350 v8 extras included always garaged

1970 chevelle malibu 2 door hard top 350 v8 extras included always garaged 1969 chevelle super sport, 396 big block(US $23,500.00)

1969 chevelle super sport, 396 big block(US $23,500.00)

Auto Services in California

Young`s Automotive ★★★★★

Yas` Automotive ★★★★★

Wise Tire & Brake Co. Inc. ★★★★★

Wilson Motorsports ★★★★★

White Automotive ★★★★★

Wheeler`s Auto Service ★★★★★

Auto blog

Nissan Leaf sets new November sales record, Chevy Volt drops again

Tue, Dec 2 2014When you talk to people in the plug-in vehicle industry, one theme you hear repeatedly is that the more plug-in cars that are out there, the better things are for everyone. One reason is that more EVs build a need for more public chargers, and more chargers mean more people see that plugging in is feasible. But there's still something to be said for old-fashioned competition, and in the sales race between the two long-running plug-in vehicles in the US, the Nissan Leaf is resoundingly beating the Chevy Volt for 2014. In fact, it won't be long before the EV's cumulative sales top the PHEV's. But that's a topic for another month. For now, we have the sales results from November. Unsurprisingly, Nissan set another monthly record (that is, the best Leaf sales in any November, the 22nd time in a row we've seen a monthly record) with 2,687 sales last month. That's up 34 percent over last November and up 35 percent year-to-date. Toby Perry, Nissan's director of electric vehicle marketing, said in a statement that, "Our 'Kick Gas' ad campaign and 'No Charge to Charge' launch in Chicago and Atlanta drove an increase in November Leaf sales. Even with gas prices falling across the country, consumers appreciate that the cost of driving a Nissan Leaf is still a fraction of that of a gas-powered car." Over on the Chevy side of the ledger, there were 1,336 Volt sales last month, down 30.4 percent from the 1,920 sold in November 2013. So far this year, Volt sales are down 16.4 percent and Chevy has sold 17,315 Volts in 2014. As we said last month, the Volt slump might be due to people waiting on the new version to make an appearance at the Detroit Auto Show next month before going on sale in the second half of 2015. So far in 2014, Nissan has sold 27,098 Leafs. Look for our detailed post of US green car sales in the near future. Until then, please discuss last month's Leaf and Volt sale in the comments, below. News Source: Nissan, General Motors Green Chevrolet Nissan Electric Hybrid PHEV ev sales hybrid sales

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.

GM to squeeze out more production capacity for midsize trucks

Tue, May 26 2015General Motors was predicting a strong showing for the Chevrolet Colorado and GMC Canyon before they debuted, and demand among dealers for the midsize trucks even exceeded company's expectations. The positive situation has left GM with a problem, though: finding ways to increase capacity for the pickups at the Wentzville Assembly plant in Missiouri. With a third shift already running, GM has continued to look for ways to build just a few more of the trucks at the plant. The company has plans to hire as many as 1,000 more workers for the Saturday and Sunday shifts to construct an additional 2,000 pickups a month, according to unnamed insiders at the factory speaking to Automotive News. The little adjustments even extend to getting rid of an unpaid break to add 18 minute of assembly time over the course of a day, which equals about 3,500 more vehicles a year. All of this effort comes because the trucks are in such high demand. According to GM's figures, the company has delivered a combined 35,720 units of the Colorado and Canyon from January through April 2015, and the Chevy was the fastest-selling truck in the US for the previous three months. In May, it spent an average of just 12 days in showrooms before being snapped up. And even better for the company, 43 percent of these buyers came from other brands. According to Automotive News, the most popular trade-ins have included the Ford F-150, Toyota Tacoma, and Dodge Dakota. Related Video: