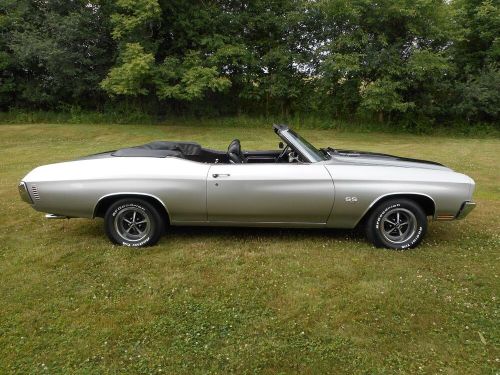

1967 Chevrolet Ss Ss 396 4spd 12 Bolt Ps Pdb Buckets Console on 2040-cars

Cincinnati, Ohio, United States

Engine:396

Fuel Type:Gasoline

Body Type:COUPE

Transmission:Manual

For Sale By:Dealer

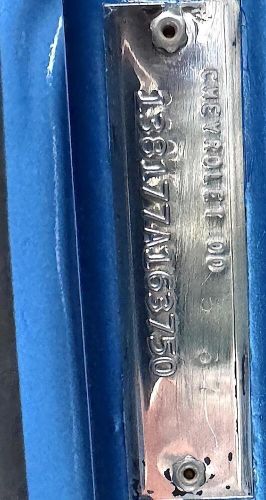

VIN (Vehicle Identification Number): 00000000000000000

Mileage: 96576

Make: Chevrolet

Trim: SS 396 4SPD 12 BOLT PS PDB BUCKETS CONSOLE

Drive Type: COUPE

Horsepower Value: 350

Model: Chevelle

Features: --

Power Options: --

Exterior Color: Blue

Interior Color: Blue

Warranty: Vehicle does NOT have an existing warranty

Chevrolet Chevelle for Sale

2018 chevrolet chevelle(US $39,995.00)

2018 chevrolet chevelle(US $39,995.00) 1971 chevrolet chevelle(US $1,500.00)

1971 chevrolet chevelle(US $1,500.00) 1966 chevrolet chevelle(US $59,900.00)

1966 chevrolet chevelle(US $59,900.00) 1967 chevrolet chevelle ss 396(US $30,000.00)

1967 chevrolet chevelle ss 396(US $30,000.00) 1970 chevrolet chevelle(US $31,200.00)

1970 chevrolet chevelle(US $31,200.00) 1970 chevrolet chevelle 502 big block, ac, 5 speed(US $14,594.00)

1970 chevrolet chevelle 502 big block, ac, 5 speed(US $14,594.00)

Auto Services in Ohio

West Chester Autobody Inc ★★★★★

West Chester Autobody ★★★★★

USA Tire & Auto Service Center ★★★★★

Trans-Master Transmissions ★★★★★

Tom & Jerry Auto Service ★★★★★

Tint Works, LLC ★★★★★

Auto blog

GM to squeeze out more production capacity for midsize trucks

Tue, May 26 2015General Motors was predicting a strong showing for the Chevrolet Colorado and GMC Canyon before they debuted, and demand among dealers for the midsize trucks even exceeded company's expectations. The positive situation has left GM with a problem, though: finding ways to increase capacity for the pickups at the Wentzville Assembly plant in Missiouri. With a third shift already running, GM has continued to look for ways to build just a few more of the trucks at the plant. The company has plans to hire as many as 1,000 more workers for the Saturday and Sunday shifts to construct an additional 2,000 pickups a month, according to unnamed insiders at the factory speaking to Automotive News. The little adjustments even extend to getting rid of an unpaid break to add 18 minute of assembly time over the course of a day, which equals about 3,500 more vehicles a year. All of this effort comes because the trucks are in such high demand. According to GM's figures, the company has delivered a combined 35,720 units of the Colorado and Canyon from January through April 2015, and the Chevy was the fastest-selling truck in the US for the previous three months. In May, it spent an average of just 12 days in showrooms before being snapped up. And even better for the company, 43 percent of these buyers came from other brands. According to Automotive News, the most popular trade-ins have included the Ford F-150, Toyota Tacoma, and Dodge Dakota. Related Video:

GM to idle car production at five factories as Americans continue CUV love affair

Mon, Dec 19 2016In case you needed another reminder that Americans have fallen out of love with sedans, General Motors today announced plans to idle five factories in January in a bid to cut its inventory to 70 days. Detroit-Hamtramck Assembly ( Buick LaCrosse, Cadillac CT6, Chevrolet Volt and Impala) and Fairfax Assembly in Kansas ( Chevy Malibu) will stop production for three weeks. Lansing Grand River ( Cadillac ATS and CTS, and Chevy Camaro) is going down for two weeks, while Lordstown, OH ( Chevy Cruze) and Bowling Green, KY ( Chevy Corvette) will go idle for a week each, Automotive News reports. GM's shutdown reflects a broader problem with the company's supply – at 847,000 vehicles, the company's supply increased unsteadily from a low of 629,000 units in January of 2016. That's more than a 25 percent increase in the past year. Citing information from Autodata, The Detroit News reports that at the end of November, GM had a 168-day supply of LaCrosses, 177 days' worth of Camaro, 170 days of Corvette, 121 days for Cruze, 119 days for ATS, 132 days for CTS, and 110 days of CT6. Meanwhile, inventory of the company's more popular vehicles is actually below the professionally accepted 60- to 70-day supply, The News reports. The Trax, Colorado pickup, and GM's full-size SUVs are sitting below 50 days and experiencing year-over-year sales increases. GM needs a rethink of its inventory levels, which is something that's apparently coming. "We're going to be responsible in managing our inventory levels," GM spokesman Jim Cain told The News. Another unnamed spokesman told Automotive News the company's day-to-day supplies would "fluctuate before moderating at year-end." But at least one analyst thinks this won't be the last time Detroit needs to stop production to level things out. "Incentives are elevated, residuals are declining, and rates are rising," Brian Johnson, an analyst with Barclays, told The News. "And while GM in particular may benefit in the months ahead from new product launches, it's important to recognize that GM's inventory is elevated at the moment, and it wouldn't surprise us if they need to announce another production cut – which could pressure the stock." Related Video: News Source: The Detroit News, Automotive News - sub. req.Image Credit: Paul Sancya / AP Plants/Manufacturing Buick Cadillac Chevrolet GM GMC Crossover SUV Sedan bowling green cadillac xt6 fairfax

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.