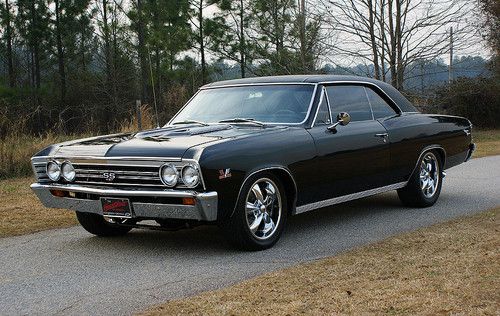

1967 Chevelle Ss427 4-speed * Triple Black * Frame-off Restore * Ac * Hotchkis on 2040-cars

Appling, Georgia, United States

Engine:427ci

Vehicle Title:Clear

Exterior Color: Black

Make: Chevrolet

Interior Color: Black

Model: Chevelle

Trim: Super Sport

Warranty: Vehicle does NOT have an existing warranty

Mileage: 2,245

Chevrolet Chevelle for Sale

1972 chevrolet chevelle convrtible 350 automatic ps matching numbers pt pb(US $12,999.00)

1972 chevrolet chevelle convrtible 350 automatic ps matching numbers pt pb(US $12,999.00) 1965 chevelle malibu ss coupe 5-speed manual 461 big block(US $45,000.00)

1965 chevelle malibu ss coupe 5-speed manual 461 big block(US $45,000.00) 1971 chevrolet chevelle malibu 2 door coupe

1971 chevrolet chevelle malibu 2 door coupe 1970 chevrolet chevelle malibu 4.1l

1970 chevrolet chevelle malibu 4.1l 1966 chevelle ss completely restored

1966 chevelle ss completely restored 1967chevelle convertible-big block

1967chevelle convertible-big block

Auto Services in Georgia

Youngblood Ford ★★★★★

Will`s Auto Machine Shop Inc ★★★★★

Wildcat Auto Parts ★★★★★

Wilbur James Tire & Battery ★★★★★

Walker Smith Body Shop ★★★★★

Vip Auto Tech ★★★★★

Auto blog

New GM subcompact SUV spied, could be a Chevy or GMC

Mon, Aug 13 2018GM's pair of subcompact crossovers have been trundling along for a while now. The Buick Encore was the first for Americans in the 2013 model year, and the Chevy Trax that was based on the Encore (an encore of the Encore, if you will) arrived for the 2015 model year. Each has undergone a mild update, but these spy photos could indicate their replacements are in the works. Or not. For starters, we can't be sure which GM brand this new SUV is destined for. Though the timing and its flowing lines could indicate Buick, the thick horizontal bars visible in the grille would indicate otherwise. The next Encore being at least related to this is at least a possibility. Making the case for GMC are those thick grille bars, the fact that it extends far below the lights, and may even rise above them, similar to the Acadia. And that rising beltline isn't that different from that of the Acadia. Arguing against the GMC idea is the Encore, which is almost always sold in GMC-Buick combo dealers. Much as the Acadia was made smaller to eliminate confusion and in-house competition with the Enclave, it's hard to see GM opting to resurrect such an issue at the bottom end of the SUV market. That means we're leaning toward this little SUV wearing a Chevy bowtie. The split grille with a large lower section and small upper section is the brand's current design language, as seen on the new Malibus and Cruzes. The shape is vaguely Equinox-like. And like Buick, Chevy also has a subcompact crossover ready for replacement: the Trax. Now, our photographer reports he's seen another subcompact testing that has Blazer design cues, but in this crossover-hungry market, we wouldn't be surprised if two similarly sized but differently styled Chevy crossovers make the grade. It's a strategy that's working pretty well for Jeep. We'll no doubt be seeing more of these disguised test vehicles milling about the country in the coming months, so perhaps we'll eventually get a better idea of what this is before more official information starts trickling out within one or two years. Related Video: Featured Gallery GM Subcompact Crossover spy shots View 10 Photos Image Credit: SpiedBilde Spy Photos Buick Chevrolet GM GMC Crossover SUV buick encore chevy trax

UAW Chief Shawn Fain disrupts Detroit's labor tradition

Fri, Sep 15 2023He's known to quote the Bible and Nation of Islam civil rights leader Malcolm X. He's a social media fanatic who keeps the pay stubs of his union member grandfather in his wallet. And now, Shawn Fain is representing nearly 150,000 auto workers in one of the biggest labor strikes in decades. In taking action against all three Detroit carmakers, Fain, the head of the United Auto Workers, has remade the strategy of the union he leads, choosing a bolder, much riskier path than his predecessors after he won office by a narrow margin in a first-ever direct election earlier this year. The strike started as the clock hit midnight on Friday, and followed Fain's decision to open negotiations with Ford Motor, General Motors and Stellantis simultaneously and eschew public niceties involving choreographed handshakes that famously kicked off previous negotiating efforts. The strategy is not without risk. A weeks-long strike would hit workers who live paycheck to paycheck, while the Detroit Three automakers have billions in cash to withstand the walkout. Fain, 54, has made creative use of social media, appearances on network and cable news programs and alliances with high-profile progressive politicians such as U.S. Senator Bernie Sanders, to reframe the UAW's contract bargaining as a battle to re-set the balance of power between workers and global corporations. He has rebutted automakers' concerns about labor costs by pointing out that they have poured billions into share buybacks to benefit investors. "If they’ve got money for Wall Street they sure as hell have money for the workers making the product," he said. “We fight for the good of the entire working class and the poor." In lengthy social media talks to UAW members, Fain alternates quoting Bible verses with the use of charts and graphs to dissect wage and benefit offers from the automakers - details his predecessors kept behind closed doors during bargaining crunch time. Fain, in his unorthodox approach, ran what amounted to a public auction among the companies to push each one to top the other to avoid a costly walkout. Prior UAW presidents picked just one automaker to set a pattern for the other two. Over and over, Fain has told UAW members at the Detroit Three that they can reverse 20 years of wage and retiree benefit concessions, stop further plant closures and end a seniority-based, tiered compensation system that pays new hires as much as 44% less than veteran workers.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.