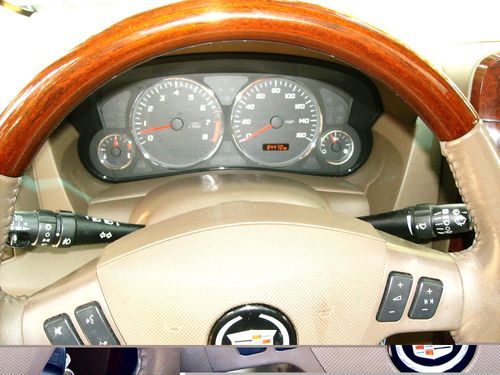

2006 Cadillac Srx Sport Utility 4-door 3.6l Awd 3rd Seat Remote Start on 2040-cars

Genoa City, Wisconsin, United States

Body Type:Sport Utility

Vehicle Title:Clear

Engine:3.6L 217Cu. In. V6 GAS DOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Make: Cadillac

Model: SRX

Trim: Base Sport Utility 4-Door

Options: Sunroof, 4-Wheel Drive, Leather Seats, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Drive Type: AWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 84,470

Exterior Color: Blue

Number of Cylinders: 6

2006 CADILLAC SRX AWD, REMOTE START, HEATED LEATHER SEATS, PANORAMIC MOON ROOF, 3RD ROW SEATING, 6 DISC CHANGER, ONSTAR READY AND SATELLITE STEREO READY, RECENT TIRES, BRAKES AND STRUTS. DRIVES GREAT DROVE TO DISNEY WITH KIDS PLENTY OF ROOM, SELLING TO BUY NEW ONE!!! ALSO HAS TOWING PACKAGE.

RIDES AND HANDLES GREAT, PERFECT FOR SNOW OR RAIN.

NO RIPS OR TEARS IN LEATHER, THERE ARE SCRATCHES ON REAR BUMPER (LOOKS LIKE PREVIOUS OWNER HAD DOG THAT CLIMBED IN AND OUT OF BACK) BODY VERY NICE ONE DOOR DING ON PASSENGER SIDE, I WILL ADD MORE PICTURES DURING THE WEEK WILL HELP WITH SHIPPING AS MUCH AS POSSIBLE.

JUST UNDER 85000 MILES!!

Cadillac SRX for Sale

2010 cadillac srx performance sport utility 4-door 3.0l-nav-dvd-heated seats(US $27,250.00)

2010 cadillac srx performance sport utility 4-door 3.0l-nav-dvd-heated seats(US $27,250.00) 2010 cadillac srx 4 awd luxury escalade rx350 3.5l v6 great mpg rear dvd clean(US $18,500.00)

2010 cadillac srx 4 awd luxury escalade rx350 3.5l v6 great mpg rear dvd clean(US $18,500.00) Awd 4dr luxu 3.0l nav cd power windows power door locks tilt wheel am/fm stereo

Awd 4dr luxu 3.0l nav cd power windows power door locks tilt wheel am/fm stereo 2010 cadillac srx performance package

2010 cadillac srx performance package 2004 cadillac srx luxury - low miles - v8 - leather(US $9,999.00)

2004 cadillac srx luxury - low miles - v8 - leather(US $9,999.00) 2004 cadillac srx base sport utility 4-door 3.6l

2004 cadillac srx base sport utility 4-door 3.6l

Auto Services in Wisconsin

Zinecker`s Auto Repair ★★★★★

Wilson Collision Center ★★★★★

Van Linn`s ★★★★★

Tuff Enuff Auto Body ★★★★★

Scotts Automotive Pewaukee ★★★★★

Schok`s Autobody ★★★★★

Auto blog

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

Ford Edge ST and Mercedes-AMG E 53 | Autoblog Podcast #557

Fri, Oct 12 2018On this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Associate Editor Reese Counts. They talk about driving the Cadillac Escalade, Mercedes-AMG E 53 Coupe and Ford Edge ST. Then they run down the news: Lexus LFA prototype spy shots and the Buick Cascada's death knell. Then Green Editor John Beltz Snyder crashes the studio to talk about reducing your carbon footprint. Finally, the fellas help spend a listener's hard-earned money on a new car.Autoblog Podcast #557 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving: Cadillac Escalade and Mercedes-AMG E 53 Coupe First drive of the Ford Edge ST Lexus LFA prototype spied at the Nurburgring with new body work Buick Cascada at death's door? Climate change sucks, but it doesn't have to Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: Green Podcasts Buick Cadillac Ford Lexus Mercedes-Benz Car Buying Used Car Buying Convertible Coupe Crossover SUV Luxury Performance lexus lfa buick cascada

General Motors posts record earnings, but global sales fall

Thu, Apr 21 2016General Motors started the year with record success. The automaker's $2.7 billion in adjusted earnings before interest and taxes was its highest ever in in the first quarter of 2016, up from $2.1 billion in from the same time period a year earlier. Net income grew to $1.95 billion, which was more than double the $953 million in the same period last year. The company's figures also beat analysts' predictions, according to the Detroit Free Press. Despite the financial growth, global sales actually decreased by 2.5 percent to 2.36 million vehicles. "We're growing where it counts, gaining retail share in the US, outpacing the industry in Europe and capitalizing on robust growth in SUV and luxury segments in China," CEO Mary Barra said in the company's financial announcement. GM did well in North America with an adjusted EBIT of $2.3 billion, up from $2.2 billion last year. Sales in the region also grew 1.2 percent to 800,000 vehicles. According to The Detroit Free Press, the company has been especially successful at selling more expensive models in the US. The company's average vehicle was $34,600 in Q1, about $3,000 more than the industry average. Elsewhere in the world, GM also showed improvement. Europe practically broke even after losing about $200 million last year, and Opel and Vauxhall sales grew 8.4 percent to more than 300,000 vehicles for the quarter. South America only lost $100 million, which was half as much as Q1 2015's $200 million loss. China remained flat at $500 million of income. Cadillac volume jumped 6.1 percent there, and Buick's deliveries increased 22 percent, thanks to the Envision crossover's success. GM Reports First-Quarter Net Income of $2.0 Billion 2016-04-21 EPS diluted of $1.24; First-quarter record EPS diluted-adjusted of $1.26 First-quarter record EBIT-adjusted of $2.7 billion GM Europe posts break-even performance DETROIT – General Motors Co. (NYSE: GM) today announced first-quarter net income to common stockholders of $2.0 billion or $1.24 per diluted share, compared to $0.9 billion or $0.56 per diluted share a year ago. Earnings per share diluted-adjusted for special items was a first-quarter record at $1.26, up 47 percent compared to the first quarter of 2015. The company set first-quarter records for earnings and margin, with earnings before interest and tax (EBIT) adjusted of $2.7 billion and EBIT-adjusted margin of 7.1 percent.