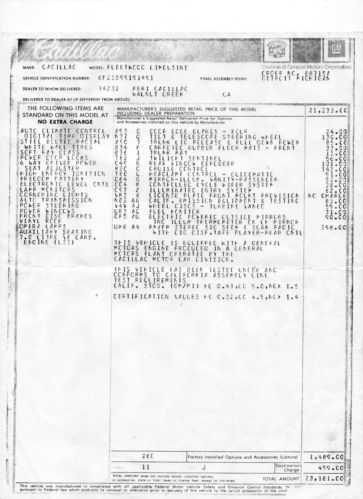

White / Blue Vintage 1979 Cadillac Fleetwood Limousine All Original 50k Miles ! on 2040-cars

Las Vegas, Nevada, United States

Cadillac Fleetwood for Sale

1989 cadillac fleetwood brougham sedan 4-door d'elegance package(US $2,000.00)

1989 cadillac fleetwood brougham sedan 4-door d'elegance package(US $2,000.00) 1991 cadillac fleetwood brougham sedan 4-door 5.7l v8

1991 cadillac fleetwood brougham sedan 4-door 5.7l v8 1966 cadillac fleetwood(US $17,500.00)

1966 cadillac fleetwood(US $17,500.00) Cadillac fleetwood brougham one owner from new 30k original miles full history

Cadillac fleetwood brougham one owner from new 30k original miles full history 1951 pink cadillac fleetwood 4-door sedan

1951 pink cadillac fleetwood 4-door sedan 1954 cadillac fleetwood arizona car project barn find solid complete car with ac

1954 cadillac fleetwood arizona car project barn find solid complete car with ac

Auto Services in Nevada

Transmission Service Center ★★★★★

Sun Auto Service ★★★★★

Sin City Performance ★★★★★

Newby`s Automotive Ctr ★★★★★

Mr Brake ★★★★★

Moody`s Auto Connection ★★★★★

Auto blog

Five awesome Lego car creations

Thu, 23 Oct 2014Lego cars are among our favorite toys. They're fun for play, and if built properly, great to display. With that in mind, we've crafted a list of some of the best creations we've seen. Some are on sale now, while others are merely the work of fanciful enthusiasts. There are even a couple that you definitely cannot buy (we'll explain).

Our choices are diverse, including everything from a diminutive 1969 Chevy Corvette to a fullsize Ferrari Formula One racecar. These are just five projects that caught our eye - there are many more out there - so if you don't see your favorite Lego car on the list (or if you have your own creation), please tell us about it, in Comments.

Next-gen Cadillac CTS-Vs caught in parking lot

Thu, 10 Jan 2013A pair of camouflaged Cadillac CTS prototypes were spotted, and thankfully photographed, outside a grocery store in Southern California. From the image above - there are plenty more if you click over to TotalCarScore.com - it appears these could be testers for the 2014 CTS-V, but that is just speculation. We've seen the obvious "V" motif in the grille before, and there's what could be another "V" in the design of the side mirrors.

The hood on the car in the background appears to include two bulges, but the single shot that affords a tiny peek under the hood shows reveals only the airbox. Plenty of rumors, and the sight of an engine cover inscribed with the words "Twin Turbo," have caused people to wonder if a twin-turbo V6 will live under the production car's hood instead of the V8 currently there. In back, instead of the round tailpipes found outboard on all the CTS sedans, there's a pair of integrated tips in a parallelogram shape. A new shifter with contrasting stitching was spied in the cabin.

If predictions hold up it will arrive later this year. When it does, expect the body underneath all that camo to be softer on the eye compared to the current car - less science and more art. For now, hit the link to see more spy shots of what's coming.

The Beast 2.0: What the 2016 presidential election winner will ride in

Thu, Aug 11 2016The current presidential limousine, which is referred to as "The Beast," will be altered for the next President of the United States. Our photographers managed to capture the vehicle testing. " The Beast 2.0" will follow closely behind the current presidential limousine that's built upon a rugged commercial truck chassis and has a sedan-like body. Instead of wearing styling details from the now-retired Cadillac STS, the new presidential limo appears to borrow looks from the latest Escalade and the CT6 sedan. The bomb-proof prototype is wearing LED headlights, has a more angular grille that features Cadillac's wreathless crest, and ditches regular antennas for a shark fin unit. Other than these changes, the Beast 2.0 should still be able to house seven passengers and have enough protection to be one of the safest vehicles on the planet. The prototype looks like it's higher off the ground, as well, which should help the next president to avoid an embarrassing moment. There's no word on whether the Beast 2.0 will be ready in time for the next president presidential inauguration in January, but our photographers report that GM recently stepped up its testing for the limousine at its Milford Proving Grounds. Related Video: Featured Gallery The Beast 2.0 Spy Shots Image Credit: KGP Photography Government/Legal Spy Photos Cadillac Truck Sedan president Hillary Clinton the beast