2014 Cadillac Escalade Platinum Edition on 2040-cars

25191 U.S. Highway 19 N, Clearwater, Florida, United States

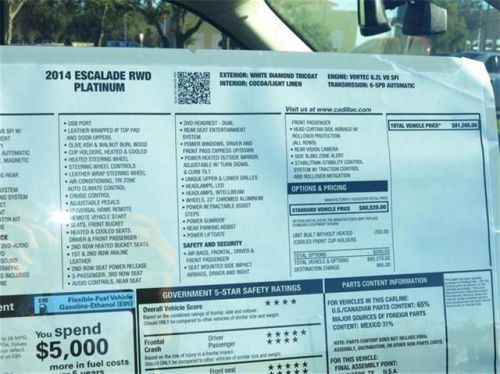

Engine:6.2L V8 16V MPFI OHV

Transmission:6-Speed Automatic

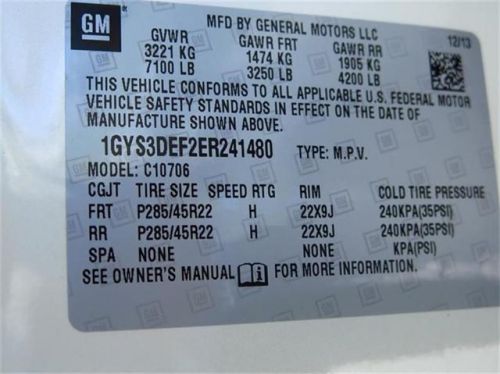

VIN (Vehicle Identification Number): 1GYS3DEF2ER241480

Stock Num: ER241480

Make: Cadillac

Model: Escalade Platinum Edition

Year: 2014

Exterior Color: White

Options: Drive Type: RWD

Number of Doors: 4 Doors

Mileage: 20

Dimmitt Automotive is proud to be an official Bentley, Rolls-Royce, Cadillac and Lotus Authorized Dealership. Dimmitt has been in the luxury car business since 1915 in the Tampa Bay Area. We pride ourselves on unsurpassed selection, customer service and providing our clients the top support when purchasing a high line vehicle from us.

Cadillac Escalade for Sale

2007 cadillac escalade esv base(US $23,995.00)

2007 cadillac escalade esv base(US $23,995.00) 2007 cadillac escalade(US $22,995.00)

2007 cadillac escalade(US $22,995.00) 2007 cadillac escalade ext(US $23,995.00)

2007 cadillac escalade ext(US $23,995.00) 2012 cadillac escalade esv premium(US $49,990.00)

2012 cadillac escalade esv premium(US $49,990.00) 2012 cadillac escalade luxury(US $50,990.00)

2012 cadillac escalade luxury(US $50,990.00) 2009 cadillac escalade awd(US $32,229.00)

2009 cadillac escalade awd(US $32,229.00)

Auto Services in Florida

Your Personal Mechanic ★★★★★

Xotic Dream Cars ★★★★★

Wilke`s General Automotive ★★★★★

Whitehead`s Automotive And Radiator Repairs ★★★★★

US Auto Body Shop ★★★★★

United Imports ★★★★★

Auto blog

Cadillac flagship, possible production Elimiraj, caught testing

Fri, 30 Aug 2013One of the biggest debuts at the Monterey car week, both literally and figuratively, was the Cadillac Elmiraj Concept. The massive coupe made quite a splash with the show's well-heeled guests. Now, we have what might be the very first images of the Elmiraj, or whatever it may be called when it reaches production, out testing.

Don't let that modified Chevrolet Caprice body fool you, this car is about four to six inches longer than Chevy's US-spec cop car, from the A-pillar forward. According to our spy, with the Caprice at 203 inches and the concept at 205, adding a few extra inches here and there fits the bill for the four-door Elmiraj that was hinted at in Jay Leno's Garage.

There are a number of other classic mule signs on this car, including a cover over the fuel door and heavily modified front and rear fascias, each of which serves to hide some significant change from the standard Caprice. Using a Caprice for development also, hopefully, hints at something that big Cadillacs like the XTS have lacked - rear-wheel drive.

Cadillac considering more engines, Vsport model for Escalade

Tue, 15 Jul 2014Want to roll in the latest Cadillac Escalade? You can get it with a 6.2-liter V8... or a 6.2-liter V8. Cadillac only offers the one engine option. But that may soon change.

According to the latest from Automotive News, Cadillac is contemplating a couple of new powertrain options for its blingin' big ute. The report suggests a twin-turbo V6 and a V6 turbodiesel could be offered, and that Cadillac could create a Vsport version of the Escalade like it offers on the new CTS sedan.

The more diverse engine offerings would help attract buyers from the new Lincoln Navigator, its prime competitor, which switched from a 5.4-liter V8 this year to a 3.5-liter twin-turbo V6. The turbo V6 engines (both gasoline and diesel) would also help Cadillac market the Escalade overseas - particularly in Europe, where higher fuel prices preclude the prospect of driving a big V8 SUV for many buyers. Escalade sales have dropped from 35-40k units in the mid-2000s to around 12,000 the past couple of years.

A car writer's year in new vehicles [w/video]

Thu, Dec 18 2014Christmas is only a week away. The New Year is just around the corner. As 2014 draws to a close, I'm not the only one taking stock of the year that's we're almost shut of. Depending on who you are or what you do, the end of the year can bring to mind tax bills, school semesters or scheduling dental appointments. For me, for the last eight or nine years, at least a small part of this transitory time is occupied with recalling the cars I've driven over the preceding 12 months. Since I started writing about and reviewing cars in 2006, I've done an uneven job of tracking every vehicle I've been in, each year. Last year I made a resolution to be better about it, and the result is a spreadsheet with model names, dates, notes and some basic facts and figures. Armed with this basic data and a yen for year-end stories, I figured it would be interesting to parse the figures and quantify my year in cars in a way I'd never done before. The results are, well, they're a little bizarre, honestly. And I think they'll affect how I approach this gig in 2015. {C} My tally for the year is 68 cars, as of this writing. Before the calendar flips to 2015 it'll be as high as 73. Let me give you a tiny bit of background about how automotive journalists typically get cars to test. There are basically two pools of vehicles I drive on a regular basis: media fleet vehicles and those available on "first drive" programs. The latter group is pretty self-explanatory. Journalists are gathered in one location (sometimes local, sometimes far-flung) with a new model(s), there's usually a day of driving, then we report back to you with our impressions. Media fleet vehicles are different. These are distributed to publications and individual journalists far and wide, and the test period goes from a few days to a week or more. Whereas first drives almost always result in a piece of review content, fleet loans only sometimes do. Other times they serve to give context about brands, segments, technology and the like, to editors and writers. So, adding up the loans I've had out of the press fleet and things I've driven at events, my tally for the year is 68 cars, as of this writing. Before the calendar flips to 2015, it'll be as high as 73. At one of the buff books like Car and Driver or Motor Trend, reviewers might rotate through five cars a week, or more. I know that number sounds high, but as best I can tell, it's pretty average for the full-time professionals in this business.