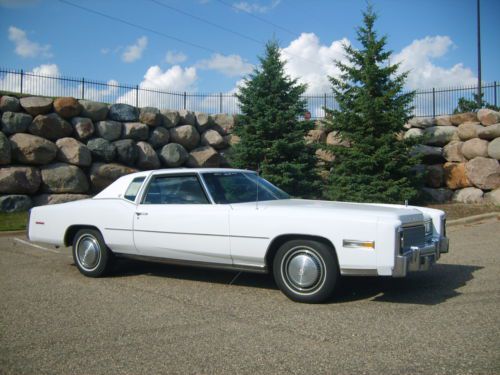

Eldorado Classic Cadillac Low Milage 12000! Like New! on 2040-cars

Lubbock, Texas, United States

|

A CLASSIC WITH ONLY 12000 MILES.STILL DRIVES LIKE A CADILLAC.ALL MAINTENANCES ARE UP TO DATE.HAS WIRE WHEELS AND HAS A TOP NOTCH CONTINENTAL KIT ON THE BACK.ONLY 11950.

|

Cadillac Eldorado for Sale

1985 cadillac biarritz eldorado convertible california caddy selling no reserve!

1985 cadillac biarritz eldorado convertible california caddy selling no reserve! 1975 cadillac eldorado base convertible 2-door 8.2l

1975 cadillac eldorado base convertible 2-door 8.2l 1973 cadillac eldorado base convertible 2-door 8.2l(US $6,400.00)

1973 cadillac eldorado base convertible 2-door 8.2l(US $6,400.00) Cadillac eldorado biarritz low miles & great condition! no reserve!

Cadillac eldorado biarritz low miles & great condition! no reserve! 1978 cadillac eldorado - white - great condition - low miles

1978 cadillac eldorado - white - great condition - low miles In excellent condition, orginal 62,000 miles

In excellent condition, orginal 62,000 miles

Auto Services in Texas

Zepco ★★★★★

Xtreme Motor Cars ★★★★★

Worthingtons Divine Auto ★★★★★

Worthington Divine Auto ★★★★★

Wills Point Automotive ★★★★★

Weaver Bros. Motor Co ★★★★★

Auto blog

2016 Cadillac ATS-V brandishes 450 horses and 6-speed manual

Tue, 11 Nov 2014Details about the hotly anticipated 2016 Cadillac ATS-V are tumbling out, and they look to be everything we could ask for in a high-performance Caddy coupe.

According to Road & Track, the ATS-V will use a version of the twin-turbocharged 3.6-liter V6 from the CTS Vsport, but the wick will be turned up to 450 horsepower and 445 pound-feet of torque. In glorious news for driving enthusiasts everywhere, that potent mill will be available with either a six-speed manual or eight-speed automatic.

According to R&T, the engine has a heap of high-performance tech to let it make the extra ponies, including titanium connecting rods, two water-to-air intercoolers, titanium turbines for the turbos and an additional radiator dedicated to cooling the gearbox and electronically locking differential. Keeping it all planted are a set of Michelin Pilot Super Sport tires, and a suspension with 50 percent more roll stiffness.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

GM extending warranties on Cadillac CTS-V and Chevy Camaro ZL1 for supercharger issue

Wed, 04 Jun 2014Okay General Motors, we've sat by and watched you recall the compact cars, crossovers and pickup trucks, and aside from reporting on it, we've been fairly quiet. This, though, this will not do. We can almost tolerate the recalls on the bread-and-butter cars, but leave the performance vehicles alone.

According to a report from The Car Connection, GM has discovered a problem with the superchargers of the 6.2-liter V8s found in the Chevrolet Camaro ZL1 and the Cadillac CTS-V. Apparently, the issue rests around the internal bearing shaft grease, which can become contaminated (we aren't sure with what). If left unchecked, it'll first lead to a rattle at idle, which goes away under slight throttle. The real warning stage is when a high-pitched squeal develops, signaling that the bearing shaft has failed. Naturally, severe engine damage is the next step (although it's possible that the engine will also just refuse to turnover, although neither case is desirable).

According to TCC, GM will replace the superchargers on vehicles that have exhibited symptoms of bearing shaft failure free of charge. It will also, allegedly, be extending the warranty on all supercharged ZL1s and CTS-Vs to 10 years or 120,000 miles (whichever comes first), from the date of purchase. Officially, only 2009 to 2013 CTS-Vs and 2012 to 2013 ZL1s are suffering from this issue.