2dr Coupe 4.9l Power Windows Power Door Locks Climate Package Tilt Wheel on 2040-cars

Trenton, New Jersey, United States

Body Type:Other

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Make: Cadillac

Model: Eldorado

Warranty: Vehicle does NOT have an existing warranty

Mileage: 107,148

Sub Model: 2dr Coupe

Options: Leather Seats

Exterior Color: Red

Power Options: Air Conditioning

Interior Color: Red

Number of Cylinders: 8

Cadillac Eldorado for Sale

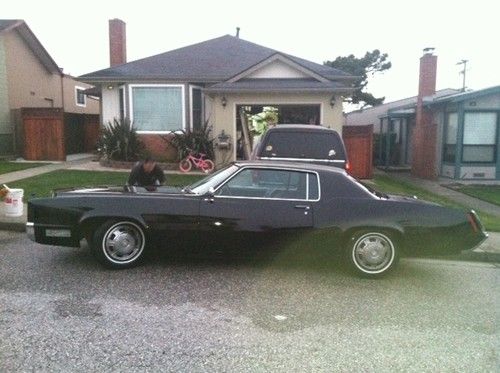

1967 cadillac eldorado all black, all clean

1967 cadillac eldorado all black, all clean 1997 cadillac eldorado coupe 2-door 4.6l(US $3,800.00)

1997 cadillac eldorado coupe 2-door 4.6l(US $3,800.00) 1985 cadillac eldorado biarritz convertible

1985 cadillac eldorado biarritz convertible 1997 cadillac eldorado etc coupe 2-door 4.6l

1997 cadillac eldorado etc coupe 2-door 4.6l Show quality 1966 cadillac eldorado convertible triple black(US $66,500.00)

Show quality 1966 cadillac eldorado convertible triple black(US $66,500.00) 1964 cadillac eldorado convertable barn find

1964 cadillac eldorado convertable barn find

Auto Services in New Jersey

World Class Collision ★★★★★

Warren Wylie & Sons ★★★★★

W & W Auto Body ★★★★★

Union Volkswagen ★★★★★

T`s & Son Auto Repair ★★★★★

South Shore Towing ★★★★★

Auto blog

Cadillac ATS to go racing in 2015 as CTS.V.R replacement

Thu, 21 Aug 2014Cadillac has been racking up victories with the CTS.V.R in Pirelli World Challenge racing for two model generations now, including recent GT class championships in 2012 and 2013. However, even winning racers eventually have to retire, and it looks like the CTS may be taking a bow at the end of the season. In its place, Caddy is reportedly working on a new racecar based on the ATS Coupe, and it might even get to compete internationally.

According to Racer, Pratt & Miller Engineering is leading the development and is already lapping the ATS racecar in Michigan for testing. It reportedly drops the CTS' V8 in favor of a twin-turbocharged V6 powering the rear wheels. Since this is the same team behind the hugely successful Corvette Racing program and the current CTS.V.R, the latest car appears to be in good hands.

The new model would also adhere to GT3 rules, according to Racer, and that might signal a big change for Cadillac's motorsports program. It means that the ATS could be sold to teams in the numerous series around the world that accept these vehicles. That would broaden the luxury coupe's exposure and put it up against GT3 racecars from premium brands, like Bentley, Porsche and McLaren. If it wins, the change could be a marketing bonanza for the brand.

Cadillac Oscars ad shows none of its cars or trucks

Wed, Feb 18 2015Can you sell something without actually showing the product in an ad? While this sounds like a question that Don Draper might have, Cadillac apparently thinks it's possible with at least one of the brand's three upcoming Oscars commercial. Days after whiting-out the company's social media presence in preparation for the new campaign, some of the advertising is finally here. Titled Dare Greatly, the first released spot goes for a stripped down, minimalist aesthetic. The entire piece is made up of voiceover and ambient noise set over slow-motion driving shots of New York City. Viewers catch a few out-of-focus glances at a Cadillac interior, but otherwise the only vehicles in the commercial are the ones parked along the street. The speech that is the centerpiece of the ad is all about the glory in just making an attempt, rather than criticizing others. "There is no effort without error and shortcoming," it says at one point. According to The Detroit Free Press, the text comes from a lecture by Teddy Roosevelt in 1910 at the Sorbonne in Paris. Cadillac's commercial never actually attributes the words to the former president, but the company is playing up the connection on social media. The full 1:30 version of the spot is already streaming online, but Cadillac is cutting the commercial into 30-second and 60-second versions to air during the Oscars, according to The Detroit Free Press. Of the brand's two other ads during the awards show, at least one of them shows the company's vehicles.

MIT puts V2V technology on its 2015 Top Ten list

Thu, Mar 5 2015Of all the technologies swimming around the automotive world, it is vehicle-to-vehicle communication that the Massachusetts Institute of Technology has fished out as one of its Ten Breakthrough Technologies of 2015. It joined emerging tech like brain organoids, supercharged photosynthesis, and Project Loon on the list, and got the nod over autonomous driving because, as the MIT Technology Review wrote, V2V communication "is likely to have a far bigger and more immediate effect on road safety." How so? Because actual cars transmitting data like their location, speed, steering angle, and state of braking to one another at least ten times per second provides a greater degree of awareness than sensor readings and algorithms. The US Department of Transportation and the National Highway Traffic Safety Administration have been working for years on standards and a regulatory schedule for introducing V2V to the marketplace, and Cadillac plans to incorporate V2V into at least one of its vehicles by 2017. Since we've begun the year with a number of stories of cars being hacked into, that got us wondering about the security of V2V communications. In a recent piece by our own Pete Bigelow on what motorists should know about getting their cars hacked into, he wrote that although cyber break-ins are extremely difficult, expensive, and time-consuming to do remotely, V2V is "one more conceivable avenue a hacker could use to impact multiple cars at a given time." So we spoke to Wilmington, Massachusetts-based Security Innovation about it. The automotive consultancy company has been working with the DOT since 2003 on V2V technology and the issues around it - namely security and privacy - and its chief scientist, William Whyte, is the technical editor of the Institute of Electrical and Electronics Engineers (IEEE) 1609.2 standard outlining its security protocols. Those protocols are expected to be finalized by the DOT toward the end of this year and then come into effect in 2016, and the company's Aerolink product is the security solution Cadillac will use. Whyte said, "If you hack into a car, V2V is the hardest place to start," and Pete Samson, the general manager of Security Innovation's automotive team, said "There are ten or 12 alternate attack surfaces" around the car that would make much easier targets.