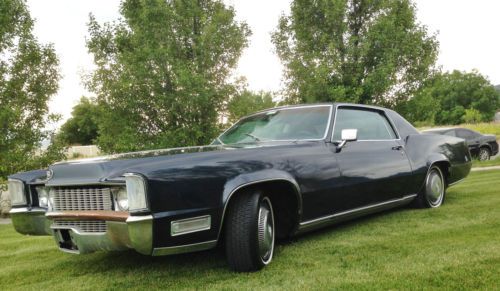

1969 Cadillac Eldorado Loaded With Options Beautiful Caddy No Reserve Perfect on 2040-cars

Salt Lake City, Utah, United States

Cadillac Eldorado for Sale

1994 cadillac eldorado coupe

1994 cadillac eldorado coupe No reserve - nice caddy eldorado convertible, 65k orig, not 1975 1976 1984 1982

No reserve - nice caddy eldorado convertible, 65k orig, not 1975 1976 1984 1982 1958 cadillac eldorado brougham #424 1 of 4 maharani maroon. air bags,vanityss

1958 cadillac eldorado brougham #424 1 of 4 maharani maroon. air bags,vanityss Cherry 1972 cadillac eldorado 8.2l 2-door convertible(US $16,950.00)

Cherry 1972 cadillac eldorado 8.2l 2-door convertible(US $16,950.00) 1993 cadillac eldorado base coupe 2-door 4.9l

1993 cadillac eldorado base coupe 2-door 4.9l 1986 cadillac eldorado america's cup ii 6,446 miles as new

1986 cadillac eldorado america's cup ii 6,446 miles as new

Auto Services in Utah

Whitlock`s Collision Repair Center ★★★★★

Tunex of South Ogden ★★★★★

The Car Guys ★★★★★

Terrace Muffler & Auto Repair ★★★★★

Stevens Electric Motor Shop ★★★★★

Rocky Mountain Collision of West Valley City ★★★★★

Auto blog

Cadillac SRX likely to see next-gen built in China

Tue, 08 Jul 2014Here's some shocking news to no one: People love crossovers, including those living in China. Since introducing the Cadillac SRX there in 2009, the model's sales have gone through the roof. Now, the brand is considering moving some production of the next-generation model in China to eliminate import tariffs and make it an even bigger player in the market.

According to a recent report in The Wall Street Journal, the crossover is leading Cadillac's Chinese growth, despite its US-equivalent price of over $67,000 after the country's high import tariffs. The CUV's sales are up 23 percent there so far this year, and it's responsible for over 40 percent of the brand's sales. John Stadwick, General Motors' VP of sales, service and marketing in China, told the WSJ that GM could "very possibly" build the next-gen model there.

The SRX is Cadillac's golden goose in China, and it just keeps pushing the brand's sales forward. "It's the vehicle that took us out of being a small niche in the market," said David Caldwell, Cadillac Communications Manager, to Autoblog. Before the CUV, Caddy was selling a little over 20,000 cars a year there, but partially thanks to the crossover's success, the brand sold 50,000 vehicles last year and could reach 60,000 this year. "The SRX is the most popular Cadillac in that market," he said.

Semi-autonomous Cadillac CT6 has Batman's seal of approval

Fri, Nov 11 2016Earlier this year, Cadillac pushed the launch of its Super Cruise semi-autonomous technology back to 2017, but it looks like the automaker is still hard at work testing the system on its vehicles. Our photographers snapped a CT6 sedan with what appears to be the Super Cruise technology in broad daylight. The CT6 in the pictures, ignoring the massive equipment on the car's roof, appears to be stock. The barely camouflaged vehicle has more sensors on the front fascia and a black rear bumper, but other than those points, looks normal. Getting back to the massive piece of equipment on the CT6's roof. There's no way to definitively state what it is, but there appears to be four cameras on the corners of the rack. A sensor or camera is also fitted to the right side mirror, which is slightly camouflaged. With all of the wires from the roof going into the vehicle, there's a chance that the massive blacked-out piece of equipment on the roof could be used to gather data. While the equipment looks extremely scientific, someone at Cadillac must have a sense of humor, or be a huge fan of DC Comics, as a Batman's logo is prominently displayed on the roof-mounted gear. Cadillac announced its Super Cruise semi-autonomous technology two years ago. The system will be able to speed the car up, keep the vehicle in its lane, and slow it down. The goal, in 2014, was to introduce the technology in two years (2016), but the automaker delayed the tech until 2017. Related Video: Featured Gallery Cadillac CT6 Super Cruise Spy Shots View 13 Photos Image Credit: Spied Bible / Brian Williams Design/Style Spy Photos Cadillac Technology Autonomous Vehicles Luxury Sedan cadillac ct6 Super Cruise

Cadillac executive appointments have global flair

Wed, 17 Apr 2013Cadillac has rearranged its executive suite in order to take full advantage of its sales momentum. Don Butler is moving from his role as US VP of marketing to a newly created position with the title VP of global Cadillac strategic development. It will be his job to "drive the next phase of Cadillac growth internationally," planning strategy and developing new markets.

He will be replaced by Steve Majoros, an exec poached from Chevrolet's ad agency of record, Campbell Ewald. Majoros, who has the Chevrolet campaigns "Like a Rock" and "American Revolution" on his resume, will oversee Cadillac's US and international marketing.

Another component in the brand's renewed global focus includes conducting an ad agency review. Announced last month, Fallon Worldwide remains Cadillac's agency of record, but others, said to include Campbell Ewald, will be bidding to make the creative that helps Cadillac expand sales percentages by triple digits here and in China. Scroll down below for the official press release.