2008 Cadillac Dts 1sa on 2040-cars

9921 US HWY 19, Port Richey, Florida, United States

Engine:4.6L V8 32V MPFI DOHC

Transmission:4-Speed Automatic

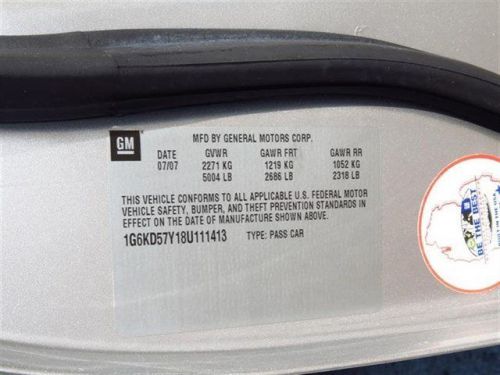

VIN (Vehicle Identification Number): 1G6KD57Y18U111413

Stock Num: 8U111413

Make: Cadillac

Model: DTS 1SA

Year: 2008

Exterior Color: Silver

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 52254

When your newly purchased Cadillac from AutoNation Cadillac Port Richey comes with the CARFAX BuyBack Guarantee, you know you're buying smart. This DTS w/1SA's level of quality is not meant for just anyone. It's meant for the person who strives for a classy, comfortable, and luxurious car. You can tell this 2008 Cadillac DTS has been pampered by the fact that it has less than 52,254 miles and appears with a showroom shine. This Cadillac DTS w/1SA is in great condition both inside and out. No abnormal wear and tear. Engineered with the latest in technology and features, this vehicle is an automobile lover's dream. This DTS w/1SA has a showroom quality finish with no dents or scratches visible. There are other vehicles and then there is the DTS w/1SA. It is one of the most unique vehicles on the market, and you would be hard pressed to find another dealer offering something quite like this Cadillac. This Cadillac includes: ENGINE, NORTHSTAR 4.6L DOHC V8 8 Cylinder Engine Gasoline Fuel *Note - For third party subscriptions or services, please contact the dealer for more information.* More information about the 2008 Cadillac DTS: For traditional luxury large car buyers, the 2008 Cadillac DTS remains one of only a handful of choices. The DTS compares favorably against its rivals, with more power than the Lincoln Town Car and a larger, more impressive interior than the Chrysler 300. It also offers plenty of luxury features and comfort for its $41,970 base price. Strengths of this model include enough room inside to stretch out, Fresh Cadillac styling, and comfortable ride. Call our Internet Sales Department and Save an additional $200 off the Internet Price listed above.

Cadillac DTS for Sale

2008 cadillac dts 1sd(US $15,471.00)

2008 cadillac dts 1sd(US $15,471.00) 2007 cadillac dts(US $7,900.00)

2007 cadillac dts(US $7,900.00) 2008 cadillac dts 1sb(US $15,869.00)

2008 cadillac dts 1sb(US $15,869.00) 2006 cadillac dts(US $12,995.00)

2006 cadillac dts(US $12,995.00) 2006 cadillac dts luxury i(US $8,900.00)

2006 cadillac dts luxury i(US $8,900.00) 2006 cadillac dts(US $9,363.00)

2006 cadillac dts(US $9,363.00)

Auto Services in Florida

Xtreme Auto Upholstery ★★★★★

Volvo Of Tampa ★★★★★

Value Tire Loxahatchee ★★★★★

Upholstery Solutions ★★★★★

Transmission Physician ★★★★★

Town & Country Golf Cars ★★★★★

Auto blog

2023 Cadillac Lyriq driven, Celestiq coming | Autoblog Podcast #736

Fri, Jul 1 2022In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder. JBS is fresh off the first drive of the 2023 Cadillac Lyriq, and our hosts have some thoughts about the upcoming Cadillac Celestiq. Greg has been spending time with the Lincoln Navigator. The next-generation Ford Ranger is coming, and we've got some thoughts about it. We also discuss some of the electric pickups coming our way (and some that will almost certainly not come to fruition). Finally, in this week's "Spend My Money" segment, a reader selling a Tesla Model Y, and is looking to replace it with another EV and a hybrid, with a budget of $70,000. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #736 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Driving the 2023 Cadillac Lyriq Cadillac Celestiq is coming, could cost over $300,000 Driving the 2022 Lincoln Navigator Next-gen Ford Ranger spied Electric pickup trucks in the works Spend My Money: An EV and a hybrid for under $70,000 Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video:

Cadillac picks Publicis as new agency of record, continues cutting ties with Campbell Ewald

Fri, Dec 5 2014Cadillac is setting itself up for major changes in the coming years with its decision to hire Johan de Nysschen as the brand's new boss and moving some of the staff to new digs in the trendy SoHo neighborhood of Manhattan. With those two big shifts in place, there's one more on the way with the company's announcement that Publicis Worldwide is now its global creative agency of record, effective immediately. The firm replaces former, long-time General Motors associate Campbell-Ewald; now a portion of Lowe and Partners. "This appointment is designed to accelerate the global expansion and elevation of Cadillac into a truly global luxury brand," said Cadillac Chief Marketing Officer Uwe Ellinghaus in the company's announcement. "We have spent much of this year refocusing on the core values of our brand." Although, some work may remain at Lowe and Partners for now. According to Cadillac spokesperson David Caldwell via email to Autoblog: "The bulk of work makes this shift. It is possible that maybe a small individual smaller project or two might still be handled by Lowe. Not certain yet." The fruit of this new partnership shouldn't take long to mature, either. "We will have substantially new marketing and brand identity work in early 2015." said Caldwell. According to Ad Age, Cadillac's advertising had been handled by Lowe and Partners, Campbell-Ewald in Detroit (now entirely part of Lowe) and Hill Holiday. Caddy had a relationship with the agency since 2013 but has changed firms several times in 2006. GM had a long collaboration with Campbell-Ewald, though. Chevrolet was its partner for nearly a century until the automaker also jumped to Publicis in 2010. The firm was responsible for campaigns like, "The Heartbeat of America", "Like A Rock" and "An American Revolution." Scroll down to read Cadillac's full announcement of the change. Cadillac Appoints Publicis Worldwide 2014-12-04 DETROIT – Cadillac announced today the appointment of Publicis Worldwide as its global creative agency of record. Publicis Worldwide is the largest creative agency of the Publicis Groupe network and its appointment to Cadillac is effective immediately. A fully dedicated team, comprising key managers from Publicis Worldwide, will lead the account and have access to specialist and premium resources within the larger Publicis Groupe.

North American Car, Truck and SUV of the Year finalists revealed

Thu, Nov 17 2022The finalists for the 2023 North American Car, Truck and Utility Vehicle of the Year Awards were announced Thursday at the L.A. Auto Show. — The Acura Integra, Genesis Electrified G80 and Nissan Z made the cut in the car category. — The Ford F-150 Lightning, Chevy Silverado ZR2 and Lordstown Endurance advanced in trucks. — And the Cadillac Lyriq, Genesis GV60 and Kia EV6 advanced among utilities. The winners will be announced Jan. 11 in Detroit. The finalists underscored the industryÂ’s shift to electric vehicles, as all three utilities and two of the three trucks are EVs. The finalists were culled from a list of 26 semifinalists made up of three trucks, 10 cars and 16 utility vehicles that are new this year. Notables that missed the cut include the Mercedes EQE, Subaru WRX and Toyota GR Corolla in cars; while the Honda CR-V, Kia Sportage and Rivian R1S were among the utes that did not advance. The three trucks are the only ones eligible this year and have advanced through the voting. 50 jurors who work for media outlets across North America vote three times over the course of the year to whittle down the field, which was originally 47 vehicles. Jurors also test the semifinalists at an October group event in Ann Arbor, Mich. The Honda Civic (car), Ford Maverick (truck) and Ford Bronco (utility vehicle) were the 2022 winners. Autoblog Editor-in-Chief Greg Migliore is a NACTOY juror.  Featured Gallery Ford F-150 Lightning View 48 Photos Green LA Auto Show Acura Cadillac Chevrolet Ford Genesis Kia Nissan Truck SUV NACTOY Lordstown Endurance