2002 Cadillac Deville on 2040-cars

Delhi, California, United States

Transmission:Automatic

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

Engine:4.6L Gas V8

VIN (Vehicle Identification Number): 1G6KD54Y12U196779

Mileage: 110000

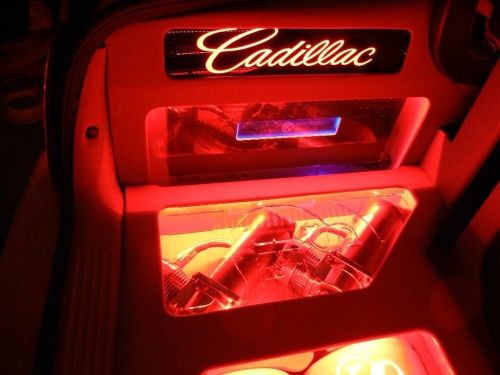

Interior Color: Burgundy

Number of Seats: 5

Number of Cylinders: 8

Make: Cadillac

Drive Type: FWD

Engine Size: 4.6 L

Model: DeVille

Exterior Color: Beige

Number of Doors: 4

Country/Region of Manufacture: United States

Cadillac DeVille for Sale

1967 cadillac deville(US $34,995.00)

1967 cadillac deville(US $34,995.00) 2006 cadillac dts presidential(US $1,375.00)

2006 cadillac dts presidential(US $1,375.00) 1995 cadillac deville sedan(US $5,995.00)

1995 cadillac deville sedan(US $5,995.00) 1978 cadillac deville 425ci auto a/c power steering & brakes(US $12,000.00)

1978 cadillac deville 425ci auto a/c power steering & brakes(US $12,000.00) 1957 cadillac deville(US $58,500.00)

1957 cadillac deville(US $58,500.00) 1984 cadillac deville(US $10,000.00)

1984 cadillac deville(US $10,000.00)

Auto Services in California

Yuba City Toyota Lincoln-Mercury ★★★★★

World Auto Body Inc ★★★★★

Wilson Way Glass ★★★★★

Willie`s Tires & Alignment ★★★★★

Wholesale Import Parts ★★★★★

Wheel Works ★★★★★

Auto blog

2014 Cadillac CTS images leak from somewhere

Sun, 24 Mar 2013The redesigned 2014 Cadillac CTS will be unveiled this Tuesday on the eve of the New York Auto Show, but as often happens, some images of the car have leaked onto the web a few days early. Previously, the only information we had on the 2014 CTS concerned the all-new twin-turbo V6 engine that will be found underhood, rated at 420 horsepower and 430 pound-feet of torque.

While none show the new car in its entirety, the images do show much of the front end, particularly the headlights that feature vertical bars of LEDs that start down low as foglights and continue up to the top of the front fenders. They're similar to the lighting design first shown on the XTS and ATS, except the lower portions are much taller.

There are also views of the rear end and one of the taillights, as well as an interior shot of the front passenger door. The latter image has us most intrigued, as it shows some very high end materials being used in the new CTS interior. The low-gloss wood trim, in particular, looks very premium.

Shatner's Rivet motorcycle to enter limited production with CTS-V engine [w/video]

Sat, Apr 11 2015William Shatner has entertained the world for decades, from playing Captain Kirk on Star Trek to covering songs like Rocket Man and Common People. Now in his 80s, Billy Shatz has embarked on one of his weirdest projects yet: helping to design the wild Rivet One trike with motorcycle fabrication company American Wrench. Now, you can order one too with power as crazy as the three-wheeler's design. We last saw the Rivet One's aluminum body with the styling like a menacing, art-deco easy chair a few months ago, but now Shatner has started talking about the trike's powerplant, which is based around the heart of a Cadillac CTS-V. "It's a beast with advanced guts. It's powered by an all-aluminum, computer-controlled, supercharged and intercooled V8 engine – producing over 500 HP," Shatner said to Gizmag. Keep an eye out because Shatner intends to captain the Rivet One from Chicago to Los Angeles later this year. Also, if you want a ride like Captain James T. Kirk, the company is taking requests for the trike, made on a build-to-order basis after completing Shatner's job, according to Gizmag. Prices aren't announced yet but expect the number to be as out of this world as a voyage of the Enterprise. The video below provides a further look at the Rivet One's unconventional design. Superheroes Wanted - A Look At The Machine from Rivet on Vimeo. News Source: Gizmag, Rivet via VimeoImage Credit: Rivet Motors Celebrities Design/Style Cadillac Motorcycle Performance trike William Shatner american wrench

Want to beat LA traffic? Chargers QB Philip Rivers has found a way

Wed, Sep 6 2017Slogging through traffic in Southern California is about as pleasurable as being slowly eaten by bears or being the awkward third wheel on a bad first date. It feels like it's never going to end. After the team relocated to Los Angeles from San Diego, Chargers quarterback Philip Rivers decided that three hours wasted each day in a car was too much. As The San Diego Union-Tribune reports, Rivers' rolling office makes his days more productive than ever. After deciding that he wasn't going to relocate his family to Orange County, Rivers was stuck with the prospect of either spending considerably less time with his children or skipping out on much-needed film work at the team's training facility (not really an option given his profession). Instead, he began investigating a number of options to make his lengthened commute slightly more viable and productive. First, he considered carpooling with a teammate. That was still too much of a pain. He looked at flying a helicopter, but unless it could land close to both his home and the practice field, it too was useless. A quick online search eventually led to the rolling footage review room you see here. Becker Automotive Design in Oxnard, Calif., builds these rolling offices for a wide range of customers. It sells modified Mercedes-Benz Sprinters, Ford Transits, and, in Rivers' case, a Cadillac Escalade with a raised roof. His needs were simple: a television and an HDMI input so he can hook up his computer. No fancy armor or recumbent exercise bicycle. His goal was to review game footage on his commute rather than slowly waste away behind the wheel of a car. Photos show a sea of leather and wood and a mini fridge, so it's not totally without niceties. Column | Philip Rivers' new ride allows him to stay home https://t.co/btwCEgIsFq pic.twitter.com/DHud3ho5UF — The Union-Tribune (@sdut) September 5, 2017 The Union-Tribune lists the price of the Escalade at about $200,000. That's not including the driver's salary. In 2015, Rivers signed a four-year deal with the Chargers worth $84 million, so he's not hurting for cash. If it increases productivity and saves the headache of being behind the wheel in traffic, we can imagine more people with means (and not just quarterbacks) will be opting for such daily transport. Related Video: