1994 Cadillac Deville Base Sedan 4-door 4.9l on 2040-cars

Effingham, Illinois, United States

Engine:4.9L 300Cu. In. V8 GAS OHV Naturally Aspirated

Vehicle Title:Clear

Body Type:Sedan

Fuel Type:GAS

For Sale By:Private Seller

Exterior Color: White

Make: Cadillac

Interior Color: Gray

Model: DeVille

Trim: Base Sedan 4-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

Options: Leather Seats, CD Player

Number of Cylinders: 8

Safety Features: Driver Airbag, Passenger Airbag

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Disability Equipped: No

Mileage: 103,000

Sub Model: Deville Sedan

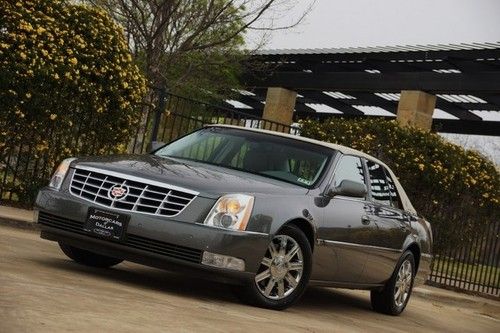

Up for auction today is a 2 owner 1994 Cadilliac Deville Sedan in very good clean condition. This car has always been garage kept and well maintained. The car runs and drives excellent! Tires and brakes are both very good. There are only two flaws with this car and they are the drivers side mirror is discolored and the back seat leather has one discolored spot (see pics). Please email me if you have any questions and Happy Bidding!

Cadillac DeVille for Sale

Gorgeous 1962 cadillac coupe de ville 2 dr hardtop 390 a/c p/b big fins nice !!

Gorgeous 1962 cadillac coupe de ville 2 dr hardtop 390 a/c p/b big fins nice !! 2001 cadillac deville base sedan 4-door 4.6l

2001 cadillac deville base sedan 4-door 4.6l 2006 cadillac dts navigation sunroof front & back heated seats backup sensors

2006 cadillac dts navigation sunroof front & back heated seats backup sensors 2004 cadillac de ville, pearl white,83,000 miles priced to sell at $6495(US $6,495.00)

2004 cadillac de ville, pearl white,83,000 miles priced to sell at $6495(US $6,495.00) 2002 cadillac deville dhs clean repo repo repo !!!!!!!!!!!!!!!!

2002 cadillac deville dhs clean repo repo repo !!!!!!!!!!!!!!!! 2002 cadillac deville 54" limousine

2002 cadillac deville 54" limousine

Auto Services in Illinois

Wolf and Cermak Auto ★★★★★

Wheels Of Chicagoland ★★★★★

Urban Tanks Custom Vehicle Out ★★★★★

Towing Solutions ★★★★★

Top Coverage Ltd ★★★★★

Supreme Automotive & Trans ★★★★★

Auto blog

8 fastest depreciating cars in America

Tue, Feb 27 2018Getting a new car is an amazing experience. The fresh new scent, the barely touched interior, the double digit miles on your odometer, and... the depreciation once it leaves the car dealers lot? Maybe not that last one. To save you from the hurt of a quickly depreciating new car, we collected 8 of the fastest depreciating cars in America. And here's a surprise, one of them is a Toyota. Learn more at Autoblog.com Cadillac Infiniti Jeep Kia Lincoln Toyota Autoblog Minute Videos Original Video jeep compass cadillac xts infiniti q50 camry q50

2013 Cadillac ATS Premium 2.0T 6MT

Wed, 06 Feb 2013The new Cadillac ATS is an impressive sport sedan, often considered one of the most serious threats to the BMW 3 Series. Unlike GM's previous attempts, this four door brings aggressive styling, commendable chassis dynamics and class-leading handling to the highly competitive battle. And, like its daunting German foe, Cadillac offer several powertrain choices.

I recently spent time with the ATS 2.0T Premium on my home California turf. Fitted with a turbocharged 2.0-liter four-cylinder engine mated to a six-speed manual gearbox with a limited-slip rear differential, my tester was lightly optioned, with only a paint upgrade and a cold weather package. That brought the as-tested price to $46,305, configured the way I imagine most enthusiasts would prefer. This meant I fully expected to enjoy a week with a tossable sport sedan that boasted "fun-to-drive" as its middle name, but all was not well...

Driving Notes

Cadillac's new ad campaign to tell you how to get lucky

Thu, 05 Sep 2013Cadillac is set to launch a new ad campaign this fall, as it attempts to maintain the momentum established by new models like the ATS. The campaign comes from an agency called Rogue, and according to AdAge, will lean on American values. It's called, "Work Hard. Be Lucky."

The campaign is fairly self-explanatory, just from the tagline. It's meant to make a Cadillac seem more attainable to the average, aspirational buyer. It does kind of pander to that American idea that everyone's hard work gets rewarded, but as ad campaigns go, that's not a bad thing.

Somehow, it doesn't roll off the tongue quite like "The Standard of the World." As AdAge points out, Cadillac's advertising over the years has lacked a real coherent theme, although we'll admit to enjoying the most recent campaigns, particularly the around-the-world jaunts with the ATS. It's unclear if the "Work Hard. Be Lucky." theme will evolve into an actual tagline for the brand, with Caddy spokesman Dave Caldwell telling the advertising mag, "It could very easily end up being a line of copy along with other lines; we don't really know yet. It's an open question as to how dramatically it will be featured."