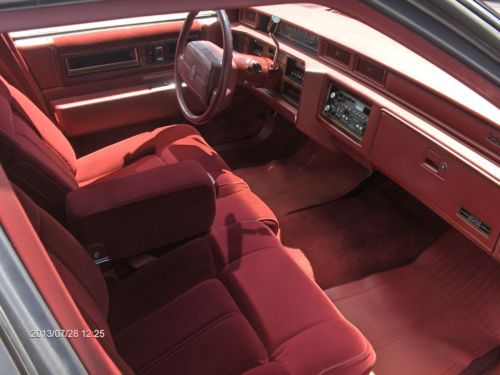

1990 Cadillac Deville Base Sedan 4-door 4.5l on 2040-cars

Macomb, Illinois, United States

Cadillac DeVille for Sale

1990 cadillac deville base coupe 2-door 4.5l

1990 cadillac deville base coupe 2-door 4.5l 2007 cadillac dts performance certified talisman edition navigation clean carfax

2007 cadillac dts performance certified talisman edition navigation clean carfax 1955 cadillac series 62 convertible ground up bolt and nut restoration mint car

1955 cadillac series 62 convertible ground up bolt and nut restoration mint car 2002 cadillac deville vogue package only 23k miles!! 1 owner!! $58k msrp!!

2002 cadillac deville vogue package only 23k miles!! 1 owner!! $58k msrp!! 1966 cadillac coupe de ville 49,000 original miles

1966 cadillac coupe de ville 49,000 original miles 1965 cadillac coupe deville(US $13,999.00)

1965 cadillac coupe deville(US $13,999.00)

Auto Services in Illinois

Zeigler Fiat ★★★★★

Wagner`s Auto Svc ★★★★★

US AUTO PARTS ★★★★★

Triple D Automotive INC ★★★★★

Terry`s Ford of Peotone ★★★★★

Rx Auto Care ★★★★★

Auto blog

2020 Cadillac XT4 Sport Drivers' Notes | Worth a look, or two

Fri, Mar 6 2020The 2020 Cadillac XT4 is Cadillac’s smallest crossover in its burgeoning lineup of SUVs. Most of the attention is on the new Escalade these days, but the XT4 is where someone with a lighter budget might enter the Cadillac brand. Our tester happens to be the Sport model, giving it a distinctive appearance, separate from the Luxury and Premium Luxury trims. This one has a gloss black mesh grille, black trim throughout the exterior and Sport-specific wheels — the others rely much more heavily on chrome. Cadillac stepped it up in the design studio for the XT4, as one of its best qualities is the exterior design. It compares well to other small crossovers and doesn't look like your typical cookie-cutter crossover on the road. ThereÂ’s only one engine available, and itÂ’s a 2.0-liter turbocharged four-cylinder that makes 237 horsepower and 258 pound-feet of torque. When the XT4 came out for the 2019 model year, this engine was brand new. Today, Cadillac is passing it around the lineup to vehicles like the CT5 and CT4. A nine-speed automatic transmission is the only transmission option, as well. Our tester has all-wheel drive, but front-wheel drive is standard on lesser XT4s. There isnÂ’t a whole lot changed for the 2020 model year, but Cadillac did add an “Off Road” mode and made a bunch of safety equipment standard. With our test car being a Sport trim with all-wheel drive equipped, the base price is $42,295, a fair bit greater than the $36,690 standard car. After options, our XT4 totaled $48,310. The most expensive extra is a $1,500 Bose Centerpoint audio system, combined with navigation. An $1,100 Driver Assistance package brought adaptive cruise control, enhanced automatic emergency braking and reverse automatic emergency braking. A Cold Weather package added heated seats all around and a heated steering wheel for $850. Finally, the $470 Driver Awareness package brought automatic high beams and lane-keep assist. Senior Editor, Green John Beltz Snyder: This one grew on me the more I drove it. I was unconvinced for the first part of my drive, but then things started to feel more well-though-out as I used them. For instance, the line of buttons across the center stack looks daunting, until you turn the car on and their labels are illuminated. Then everything is easy to find thanks to the lighting, symmetry and the fact that you only have to look down a single line of buttons rather than hunt around a grid pattern.

Carpool Deville aims to be the world's fastest hot tub

Wed, 16 Jul 2014The world needs crazy inventors with wild dreams. While we might not long for the things that they create, their contraptions certainly make the day a little more enjoyable. Take the Carpool Deville as an example. Nobody (well, almost nobody) is asking for a hot tub fashioned from a 1969 Cadillac that is still drivable. But now that you know that such a beast exists, don't try to tell us you aren't at least intrigued.

The team behind the six-year-long project has a pretty ingenious setup worked out. The Caddy's original 472-cubic-inch (7.7-liter) V8 both provides propulsion and heats the water. The interior is entirely replaced with a watertight, fiberglass tub that includes working jets, and the controls are all done by hand.

As if just building a mobile hot tub isn't enough, the team behind the Carpool Deville plans to take it racing too. Specifically, they intend to go to the Bonneville Salt Flats later this year to make a top speed run while immersed in water at over 100 degrees. They even have a roll cage all set to install to meet the safety requirements there.

2016 Cadillac CTS-V to hit dealers this summer, start at $83,995*

Wed, Apr 29 2015Cadillac has announced pricing for the 640-horsepower CTS-V, and not only will the new super-sedan outgun its heartiest German rivals, it'll undercut them on price, too. Kicking off at $83,995 (not including a $995 destination charge), the CTS-V is nearly $10,000 less than the 560-hp BMW M5, almost $18,000 less than the 577-hp Mercedes-Benz E63 AMG S 4Matic, and is nearly $25,000 less than the 560-hp Audi RS7. So in case you were wondering, yes, the CTS-V will continue to be one of the auto industry's very best high-performance bargains in its third generation. "V-Series represents the pinnacle of Cadillac, a brand that now makes drivers' cars at the highest level," Cadillac's head honcho Johan de Nysschen said in a statement. "The new CTS-V is essentially two cars in one: a luxury sedan with sophisticated road manners and a track-capable sports car with awe-inspiring performance. This type of car is exclusive, the domain of the few who can access this level of incredible capability. V-Series matches or overtakes the finest cars in this elite class, while being more accessible." As for when you can get your hands on bargain-priced beast, dealers are now accepting orders, with deliveries slated to begin late this summer. Scroll on down for the official release from Cadillac. Next-Generation 640-hp Cadillac CTS-V Launches This Summer U.S. DEALERS BEGIN ACCEPTING ORDERS NOW FOR CADILLAC'S UPCOMING PERFORMANCE ICON DETROIT – Cadillac announced today that U.S. dealers will begin accepting orders for the next-generation 2016 CTS-V, the all-new high-performance sedan that launches in late summer. The 640-hp CTS-V is the second of two all-new V-Series models to come to market in 2015, following the smaller ATS-V coupe and sedan, which launches in late spring. Cadillac's new 2016 V-Series models represent a significant expansion of the brand's elite, high-performance line. Not only are the new V-Series cars elevated in terms of performance, they now reach a broader spectrum of drivers by presenting two distinct personalities, size categories and price points. With a top speed of 200 mph and 0-60 performance in 3.7 seconds, the CTS-V is the most powerful car in Cadillac's 112-year history. The 2016 CTS-V is priced from $83,995. Customers can place orders now with dealers and view additional product information at Cadillac.com. The CTS-V elevates into the elite group of the world's highest-performing sedans.