1966 Cadillac Deville Convertible All Original Runs Like New No Reserve on 2040-cars

Brooklyn, Michigan, United States

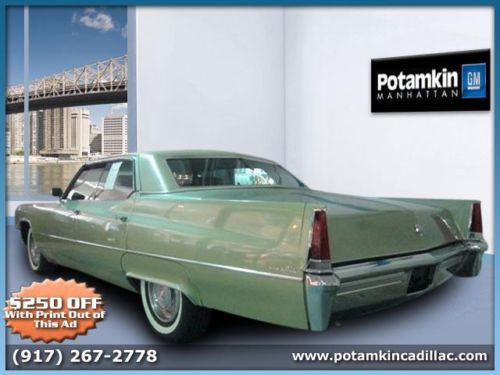

Cadillac DeVille for Sale

1956 cadillac sedan deville ! nice !

1956 cadillac sedan deville ! nice ! 1964 cadillac coupe deville *** beautiful condition ***

1964 cadillac coupe deville *** beautiful condition *** 1969 cadillac deville base hardtop 4-door 7.7l

1969 cadillac deville base hardtop 4-door 7.7l 2004 cadillac deville 1-owner pearl white withtan interior & chrome wheels

2004 cadillac deville 1-owner pearl white withtan interior & chrome wheels 1979 cadillac deville lecabriolet convertible(US $14,500.00)

1979 cadillac deville lecabriolet convertible(US $14,500.00) 4 door sedan, silver exellent condition, low millage(US $12,000.00)

4 door sedan, silver exellent condition, low millage(US $12,000.00)

Auto Services in Michigan

Van Buren Motor Supply Inc ★★★★★

Van 8 Collision ★★★★★

Upholstery Barn ★★★★★

United Auto & Collision ★★★★★

Tuffy Auto Service Centers ★★★★★

Superior Collision ★★★★★

Auto blog

GM design boss Welburn says Lincoln isn't a Cadillac rival [w/poll]

Thu, 05 Dec 2013General Motors Vice President of Global Design, Ed Welburn, had some dismissive words for a certain cross-town luxury brand during an interview with Car and Driver. When asked about his thoughts on Lincoln, Welburn deflected, before saying, "I don't consider Lincoln to be a competitor for Cadillac."

"They're not a global luxury brand. I don't consider them a competitor. Are they a competitor for Buick? Quite possibly. But not for Cadillac," GM's head designer explained. Welburn, who's been at the helm of GM Design North America since 2003 and is the first to hold the position of VP of Global Design, has been instrumental in the styling renaissance at GM, so predictably, Car and Driver's interview with him focused on the design aspect of cars.

During the interview, Welburn explicitly denied plans for a reborn Cadillac XLR, even as a new Chevrolet Corvette is hitting the market and strides are being made with Cadillac's V-Series performance arm saying, "We have a lot of cars that we're working on for the Cadillac brand. The XLR is not one of them right now."

GM announces six new recalls, covering 3.5 million vehicles

Mon, 16 Jun 2014General Motors has just initiated another crushingly large recall, this time affecting some 3.36 million vehicles built between 2000 and 2014 and sold in the US, Canada and Mexico. Once again, the issue surrounds the cars' ignition switches, which can be kicked out of the run position if they're carrying extra weight or if they experience a "jarring" event. In this particular case, though, GM will modify the keys, rather than the ignition itself.

A four-by-six-millimeter hole will be drilled into the key, which will more safely accommodate the weight of the key ring. As is usually the case, the work will be done free of charge. The recalled vehicles include the 2000 to 2005 Cadillac Deville, 2004 to 2005 Buick Regal LS and GS, 2004 to 2011 Cadillac DTS, 2005 to 2009 Buick Lacrosse, 2006 to 2008 Chevrolet Monte Carlo, 2006 to 2011 Buick Lucerne and 2006 to 2014 Chevrolet Impala. Only the Impala is still in production, and even then, it's only sold to fleet companies.

According to an official statement from GM, there have been eight crashes and six injuries due to this latest issue. As if this isn't a dire enough blow for GM, the company has announced five smaller recalls, covering 165,000 vehicles.

GM wants to have 10 plug-in models in China in five years

Sun, Apr 24 2016Last we checked, General Motors was selling all of three plug-in vehicle models in its home country of the US, and is prepared to make the Chevrolet Bolt EV available on these shores later this year. So it's notable that the automaker is hatching plans to have at least 10 plug-in variants for sale in China within the next five years, according to Hybrid Cars. Which plug-ins are coming remains a mystery. GM started selling a hybrid version of the Buick LaCrosse in China this month. The strategy makes sense, as China is now the world's largest car market, and accounts for about a third of GM's annual revenue. The automaker, which operates in China under the SAIC-GM and SAIC-GM-Wuling joint ventures, sells cars there under the Chevrolet, Buick, Cadillac, and Boujun badges, and has been doing so for the better part of two decades. Most recently, GM started selling a hybrid version of the Buick LaCrosse in China this month. What we do know is that GM is building its Cadillac CT6 Plug-in Hybrid in China, with distribution to be split between China and the US. That model, which is scheduled to start sales by the end of the year, is being built overseas because of a combination of Chinese government support for new-energy vehicle technology through incentives and the fact that battery-pack maker LG Chem makes most of its cells in nearby South Korea. The plug-ins are part of a broader plan by General Motors to either introduce or substantially tweak about 60 models by the end of the decade. With such new models, GM looks to boost unit sales by as much as five percent a year for the next few years. As for the other nine plug-in models slated for China by 2021, the company is mum. GM spokesman Dan Flores declined to comment to AutoblogGreen. Related Video: Featured Gallery 2016 Cadillac CT6: First Drive View 32 Photos News Source: Hybrid Cars Green Cadillac Chevrolet GM Electric Hybrid PHEV