1964 Cadillac Slammed, Bagged, Shaved. Cool Looking Sedan De Ville Old Skool on 2040-cars

Casper, Wyoming, United States

Body Type:Sedan

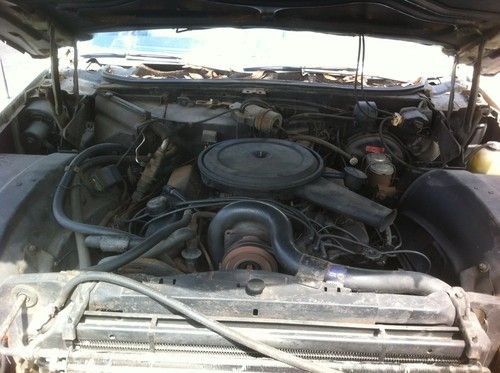

Engine:429

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Cadillac

Model: DeVille

Trim: Sedan

Warranty: Vehicle does NOT have an existing warranty

Drive Type: RWD

Mileage: 56,000

Exterior Color: Black

Number of Doors: 4

Interior Color: Red

1. I have not had any mechanical problems with the car.

Cadillac DeVille for Sale

Warranty 100k miles++htd/cld seats++sat rad++xtra clean++much more++(US $17,000.00)

Warranty 100k miles++htd/cld seats++sat rad++xtra clean++much more++(US $17,000.00) 1976 cadillac sedan deville

1976 cadillac sedan deville 1969 cadillac deville convertible

1969 cadillac deville convertible 2002 cadillac deville base sedan 4-door 4.6l no reserve

2002 cadillac deville base sedan 4-door 4.6l no reserve 1990 cadillac sedan deville

1990 cadillac sedan deville 1977 cadillac coupe de ville. black. 16,711 actual miles. excellent condition

1977 cadillac coupe de ville. black. 16,711 actual miles. excellent condition

Auto Services in Wyoming

Straight Lines ★★★★★

Napa Auto Parts - Bearing Belt & Chain ★★★★★

Midas Auto Service Experts ★★★★★

Hometown Garage ★★★★★

Grabers Diesel Repair ★★★★★

Camel Towing ★★★★★

Auto blog

Weekly Recap: 2016 CTS-V gives Cadillac new momentum for the new year

Sat, Dec 27 2014It's been a rough year for Cadillac. The historic luxury carmaker been in the news for all of the wrong reasons: Declining sales, ditching its advertising agency and the relocation of its headquarters from Detroit to New York. But in late December, Cadillac reminded everyone what it does best: Build some of the rawest and most compelling luxury sedans in the world, as evidenced by the 2016 CTS-V. This monster churns out 640 horsepower from a supercharged 6.2-liter V8. Sound familiar? That's the Corvette Z06 engine, and it makes this CTS the most powerful production Cadillac ever. It also puts the sporting divisions of the Germans on notice. The new CTS-V easily overpowers the Mercedes-Benz E63 AMG S 4Matic and its 5.5-liter biturbo V8 rated at 577 hp, and the BMW M5 (with the competition pack) and its 4.4-liter twin-turbo V8 that pushes out 575 hp. The rear-wheel drive Cadillac can sprint to 60 miles per hour in 3.7 seconds, which is close to the 3.5-second time turned in by the 4Matic-driven E63 S, and a bit quicker than the 4.1 seconds posted by the M5. With Magnetic Ride Control, General Motors' stout eight-speed automatic transmission (also used in the Corvette), Brembo brakes and a carbon-fiber option package that pretty much builds your car out of carbon fiber – it's clear this Cadillac means business. Truth be told, we expected this CTS-V to deliver. It's been a serious sports sedan for a decade, and the recent generation and its 556-hp arrogance have been particularly memorable. But notice what we're doing here? We're talking about product. Not who makes Cadillac's ads, or if the brand's headquarters has a mailing address in NYC. Like the 2016 ATS-V that's due in the spring, the debut of the 2016 CTS-V (on sale in late summer) is a shot in the arm for Cadillac, and its arrival comes during time of transition. The brand is trying to reinvent itself as a modern luxury maker. It wants new customers, a different image and obviously more sales. Those things are going to take time, but with a 640-hp sledgehammer of a sports sedan on tap for next year, Cadillac can still maintain some of its swagger through all of the change. Other News And Views 1984 Audi Sport Quattro heads for the auction block If you're into '80s rally cars, you're really a car person. But if you're into that stuff – and we are – this 1984 Audi Sport Quattro is sure to get your blood flowing.

Cadillac's Butler announces surprise departure

Mon, 05 Aug 2013The Detroit Free Press is reporting that Cadillac's vice president of global strategic development, Don Butler, has resigned. Butler has held the position since April, after a term as vice president of US marketing for General Motor's luxury brand.

As the report explains, the timing here is pretty unfortunate for Cadillac. Butler is the third high-profile member of Cadillac's brass to depart in recent months, following the firing of US sales boss Chase Hawkins and the pending departure of Susan Docherty. Cadillac spokesman David Caldwell told the Detroit paper, "Bob [Ferguson]," global boss for Cadillac, "and other leaders asked him to stay on. Don's here in the office today - and told our team that his decision is purely on a personal level. After three years of putting everything into Cadillac, he is stepping away for some personal time, and to consider new avenues in his life."

Butler says his decision is part of a decision to "recalibrate, reassess my priorities." Whatever the reason, it's an unpleasant surprise for Cadillac, which has been on a surge in 2013, with 30-percent jump in sales on the heels of the hot-selling ATS.

2015 Cadillac ATS-V gunning for the BMW M3

Mon, 03 Jun 2013Spy photographers have spotted something interesting. Cadillac engineers have taken to public streets with the upcoming ATS-V and a playmate: the current BMW M3 Sedan. The prototype seen here wears a more aggressive front fascia, flared fenders and beefy brakes. Quad exhaust tips and what looks to be a small lip spoiler on the trunk deck sum up the most obvious visual changes over the standard ATS outside. Word has it the ATS-V will bow with the same twin-turbo 3.6-liter V6 available in the nose of the XTS. In that application, the engine is good for a stout 410 horsepower, which should be more than enough to hustle the sedan around a track.

Other details are still murky, however. First and foremost: will GM offer the ATS-V with an honest manual transmission, like it does with its big brother, the CTS-V? Something tells us we won't have long to wait to find out - the machine will likely bow next year as a 2015 model. Until then, dig in on our newest bevy of spy photos.