1963 Cadillac Sedan Deville 59,000 Documented Original Miles on 2040-cars

Beaufort, South Carolina, United States

Body Type:Sedan

Vehicle Title:Clear

Engine:390 V-8

Fuel Type:Gasoline

For Sale By:Owner

Make: Cadillac

Model: DeVille

Trim: four door

Options: Leather Seats

Power Options: Air Conditioning, Power Windows, Power Seats

Drive Type: rear wheel drive

Mileage: 59,259

Exterior Color: Bahama Sand White

Disability Equipped: No

Interior Color: Red leather

Number of Doors: 4

Number of Cylinders: 8

Warranty: none

This is a beaufiful 1963 Cadillac Sedan deville it has only 59,259 miles. These miles are documented starting from the original date of purchase in 1963. The owners manual is original and completely filled by the original purchaser and salesman. I have numerous documents reflecting the history of this car most including milage and dates of services rendered. To Include one repaint in 50 years which looks very presentable. (no sighns of accident damage anywhere) Cadi runs and drives very smooth and effortlessly. Brakes are in excellent cond. It has factory power leather bucket seats,power windows in perfect working cond,auto emergency brake release, perfect headliner, perfect door pannels,carpet looks new,dashboard looks new ,trunk looks in new cond. Car has cold A/C and new heater core,radio and power antena work perfect. There are no dents in the body, bumpers or trim. There are no rust issues. This Caddy impreses every where it goes. You will look long and hard before you find a nicer 1963 Cadillac at this price.

Cadillac DeVille for Sale

Auto Services in South Carolina

Wiley Body Shop Inc ★★★★★

Ultimate Autowerks ★★★★★

Turner`s Custom Auto Glass ★★★★★

Turner`s Custom Auto Glass ★★★★★

Team Charlotte Motor Sports ★★★★★

Steve`s Auto Repair Service ★★★★★

Auto blog

Which electric cars can charge at a Tesla Supercharger?

Sun, Jul 9 2023The difference between Tesla charging and non-Tesla charging. Electrify America; Tesla Tesla's advantage has long been its charging technology and Supercharger network. Now, more and more automakers are switching to Tesla's charging tech. But there are a few things non-Tesla drivers need to know about charging at a Tesla station. A lot has hit the news cycle in recent months with regard to electric car drivers and where they can and can't plug in. The key factor in all of that? Whether automakers switched to Tesla's charging standard. More car companies are shifting to Tesla's charging tech in the hopes of boosting their customers' confidence in going electric. Here's what it boils down to: If you currently drive a Tesla, you can keep charging at Tesla charging locations, which use the company's North American Charging Standard (NACS), which has long served it well. The chargers are thinner, more lightweight and easier to wrangle than other brands. If you currently drive a non-Tesla EV, you have to charge at a non-Tesla charging station like that of Electrify America or EVgo — which use the Combined Charging System (CCS) — unless you stumble upon a Tesla charger already equipped with the Magic Dock adapter. For years, CCS tech dominated EVs from everyone but Tesla. Starting next year, if you drive a non-Tesla EV (from the automakers that have announced they'll make the switch), you'll be able to charge at all Supercharger locations with an adapter. And by 2025, EVs from some automakers won't even need an adaptor. Here's how to charge up, depending on which EV you have: Ford 2021 Ford Mustang Mach-E. Tim Levin/Insider Ford was the earliest traditional automaker to team up with Tesla for its charging tech. Current Ford EV owners — those driving a Ford electric vehicle already fitted with a CCS port — will be able to use a Tesla-developed adapter to access Tesla Superchargers starting in the spring. That means that, if you own a Mustang Mach-E or Ford F-150 Lightning, you will need the adapter in order to use a Tesla station come 2024. But Ford will equip its future EVs with the NACS port starting in 2025 — eliminating the need for any adapter. Owners of new Ford EVs will be able to pull into a Supercharger station and juice up, no problem. General Motors Cadillac Lyriq. Cadillac GM will also allow its EV drivers to plug into Tesla stations.

Why Cadillac is willing to lose 43 percent of its dealers

Sun, Sep 25 2016Cadillac is offering about 400 dealers in the United States a lump sum of money to close down. That represents over 40 percent of Cadillac dealers in America. Offers start at $100,000 and top out at $180,000. The average offering is around $120,000. According to Automotive News, Cadillac chief Johan De Nysschen estimates it will cost the automaker around $50 million to close these dealers. Any dealer that chooses to remain open will have to submit to Cadillac's ambitious Project Pinnacle, which will divide dealers into incentive categories based on how many units they sell. "Every single Cadillac dealer will have the potential to earn significantly higher profits than they do today," says De Nysschen. Dealers have until November 21 to decide if they want to take the cash or submit to Project Pinnacle. A logical question: Why is Cadillac willing to spend $50 million to close down 43 percent of its dealers? First, GM's luxury brand has way more dealerships than it needs. Second, the 400 dealers with offers to shutter each sold 50 or fewer vehicles in 2015, representing just 9 percent of its sales volume in America. So, while closing these smaller dealerships may have a small initial impact on sales, it's not going to be a major hit to Cadillac. Related Video: News Source: Automotive News - sub. req.Image Credit: Gary Cameron / Reuters Cadillac Car Dealers Luxury Performance

Ghostbusters director tweets first photos of new Ecto-1

Wed, Jul 8 2015Ghostbusters is heading back to theaters next year with a new look. Rather than bringing back the original's aging comedic actors, four actresses are taking over the starring roles, including Melissa McCarthy, Kristen Wiig, Kate McKinnon, and Leslie Jones. Although, one of the movie's major highlights is missing from that list – the Ecto-1. Originally based on a 1959 Cadillac ambulance, we're now getting the first glimpses of the decked-out, ghost-hunting wagon from the new version thanks to director Paul Feig on Twitter. Purists might like that the Ghostbusters are sticking with a Caddy, but the producers are going for a slightly newer, more macabre approach, as well. Rather than an ambulance conversion, the latest one starts as a hearse. Feig also has his Twitter profile picture of a ghost taking over as the hood ornament, and he even tweeted a shot of the rear. @szewcik_james Okay. pic.twitter.com/sHkx1Soj6p — Paul Feig (@paulfeig) July 8, 2015 Being the Internet, Feig is being deluged both with hyperbolic vitriol for changing things, and praise for the switch. He has politely tweeted about the situation. Not blocking or deleting. I hear you all and appreciate all your input, good or bad. Thanks. https://t.co/pxZsWGeNyL — Paul Feig (@paulfeig) July 8, 2015 Keep in mind this Caddy hearse is about as old today as the original Ecto-1 from Ghostbusters' release in 1984. Having the ladies driving a '50s Caddy might stretch the imagination too far even in a movie about fighting the undead. This approach seems like a perfect compromise between old and new.

Absolutly mint 1966 cadillac deville converetible folks this one is the best wow

Absolutly mint 1966 cadillac deville converetible folks this one is the best wow 2003 cadillac deville base 4-door 4.6l blk/blk loaded low miles

2003 cadillac deville base 4-door 4.6l blk/blk loaded low miles Coupe deville

Coupe deville 1995 cadillac - sedan deville

1995 cadillac - sedan deville 1992 cadillac deville sedan only 80k miles 4-door 4.9l runs perfect

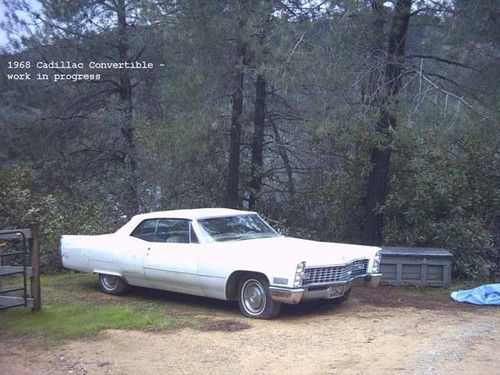

1992 cadillac deville sedan only 80k miles 4-door 4.9l runs perfect 1967 cadillac deville convertible

1967 cadillac deville convertible