2014 Cadillac Ats 2.5l on 2040-cars

9265 E 126th St, Fishers, Indiana, United States

Engine:2.5L I4 16V GDI DOHC

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 1G6AA5RA4E0191426

Stock Num: 141737

Make: Cadillac

Model: ATS 2.5L

Year: 2014

Exterior Color: Phantom Gray Metallic

Interior Color: Jet Black

Options: Drive Type: RWD

Number of Doors: 4 Doors

Mileage: 12

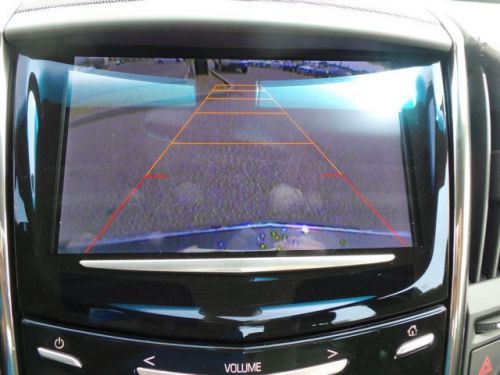

ATS 2.5L, 6-Speed Automatic, Phantom Gray Metallic, Bluetooth Phone & Audio, Cadillac User Experience (CUE) w/ Bose Surround Sound, Heated Front Seats, Power Sunroof, and Rear Vision Camera.

Athletic and expressive, the 2014 Cadillac ATS exquisitely fuses form with function. Besides giving it a bold, distinctive appearance, its taut lines allow the ATS to slice through the air, while brilliant details like the available illuminating door handles add sophistication. The ATS includes stunning painted or polished 17-inch wheels surrounded by performance tires. Available polished or machine-finished 18-inch wheels also make a powerful impression. The available vertical headlamps with LED light signatures are as brilliantly designed as they are just plain brilliant. The ATS reveals its refined side in the precise, handcrafted cut and sewn interior. Available leather seating surfaces come in an array of rich colors complete with French stitching and are finely accented by distinct interior themes. Complementing the athletic nature of the ATS, available bolstered performance seats with thigh extenders are not only remarkably comfortable, but help keep you firmly planted during spirited driving. The welcome warmth of the available heated front seats and steering wheel is the perfect antidote for a cold winter morning. Here at Lockhart, We Strive to Provide the Highest Quality Vehicles and Service. Stop by or Call Today to Experience the LOCKHART DIFFERENCE! Get pre-approved! Just visit "http://www.lockhartcadillac.com/FinancePreQualForm" The Best Car Buying Experience Ever...

Cadillac Catera for Sale

2014 cadillac ats 2.5l(US $36,840.00)

2014 cadillac ats 2.5l(US $36,840.00) 2014 cadillac ats 2.5l(US $36,840.00)

2014 cadillac ats 2.5l(US $36,840.00) 2014 cadillac ats 2.5l(US $36,840.00)

2014 cadillac ats 2.5l(US $36,840.00) 2014 cadillac ats 2.5l(US $37,835.00)

2014 cadillac ats 2.5l(US $37,835.00) 2014 cadillac ats 2.0l turbo(US $40,870.00)

2014 cadillac ats 2.0l turbo(US $40,870.00) 2014 cadillac ats 2.0l turbo(US $40,870.00)

2014 cadillac ats 2.0l turbo(US $40,870.00)

Auto Services in Indiana

Wood`s Battery & Auto Elctrc ★★★★★

Wilsons Auto Repair ★★★★★

Tread Express Tires Inc ★★★★★

The Zone Honda Kawasaki ★★★★★

Ted Brown`s Quality Paint & Body Shop ★★★★★

Swinehart Auto Service ★★★★★

Auto blog

Our interview with Jeremy Clarkson and James May, plus SEMA! | Autoblog Podcast #491

Fri, Nov 4 2016This week, David Gluckman and Mike Austin talk SEMA madness, mis-aligned steering wheels, wireless charging, McLarens (they're sports cars!), and decals. We also have an excerpt from a recent interview with James May and Jeremy Clarkson of The Grand Tour and Top Gear fame. As always, we talk about a variety of cars we've been driving and then respond to some questions from listeners. And as a bonus, there's a trivia question mixed in. The rundown is below. Remember, if you have a car-related question you'd like us to answer or you want questionable buying advice of your very own, send a message or a voice memo to podcast at autoblog dot com. Oh, and please send trivia questions! You'll get the honor of stumping your fellow listeners, and we'll thank you too. Autoblog Podcast #491 The video meant to be presented here is no longer available. Sorry for the inconvenience. Topics and stories we mention Stars Selling Cars The Ford Flex is dying SEMA! Dodge Durango Shaker concept New Mercedes inline-six engines Our interview with Jeremy Clarkson and James May Mercedes-Benz E-Class McLaren 570S Ad of the Week: Volvo ABCs of Death Spend My Money on used cars Rundown Intro - 00:00 The news - 02:15 Clarkson/May interview excerpt - 17:12 What we've been driving - 21:12 Ad of the Week - 39:02 Spend My Money/listener questions - 44:13 Total Duration: 57:05 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Feedback Email – Podcast at Autoblog dot com Review the show in iTunes Celebrities Podcasts SEMA Show Cadillac Dodge Ford McLaren Mercedes-Benz Volvo ford flex the grand tour mclaren 570s SEMA 2016

General Motors posts record earnings, but global sales fall

Thu, Apr 21 2016General Motors started the year with record success. The automaker's $2.7 billion in adjusted earnings before interest and taxes was its highest ever in in the first quarter of 2016, up from $2.1 billion in from the same time period a year earlier. Net income grew to $1.95 billion, which was more than double the $953 million in the same period last year. The company's figures also beat analysts' predictions, according to the Detroit Free Press. Despite the financial growth, global sales actually decreased by 2.5 percent to 2.36 million vehicles. "We're growing where it counts, gaining retail share in the US, outpacing the industry in Europe and capitalizing on robust growth in SUV and luxury segments in China," CEO Mary Barra said in the company's financial announcement. GM did well in North America with an adjusted EBIT of $2.3 billion, up from $2.2 billion last year. Sales in the region also grew 1.2 percent to 800,000 vehicles. According to The Detroit Free Press, the company has been especially successful at selling more expensive models in the US. The company's average vehicle was $34,600 in Q1, about $3,000 more than the industry average. Elsewhere in the world, GM also showed improvement. Europe practically broke even after losing about $200 million last year, and Opel and Vauxhall sales grew 8.4 percent to more than 300,000 vehicles for the quarter. South America only lost $100 million, which was half as much as Q1 2015's $200 million loss. China remained flat at $500 million of income. Cadillac volume jumped 6.1 percent there, and Buick's deliveries increased 22 percent, thanks to the Envision crossover's success. GM Reports First-Quarter Net Income of $2.0 Billion 2016-04-21 EPS diluted of $1.24; First-quarter record EPS diluted-adjusted of $1.26 First-quarter record EBIT-adjusted of $2.7 billion GM Europe posts break-even performance DETROIT – General Motors Co. (NYSE: GM) today announced first-quarter net income to common stockholders of $2.0 billion or $1.24 per diluted share, compared to $0.9 billion or $0.56 per diluted share a year ago. Earnings per share diluted-adjusted for special items was a first-quarter record at $1.26, up 47 percent compared to the first quarter of 2015. The company set first-quarter records for earnings and margin, with earnings before interest and tax (EBIT) adjusted of $2.7 billion and EBIT-adjusted margin of 7.1 percent.

Despite strong profits, GM still fighting flat market share

Fri, Jan 17 2014Looking at the progress General Motors has made since it entered bankruptcy, it's easy to forget that the company still has a long way to go before it's the juggernaut it once was. A recent report from Reuters points out that, while GM is making money, it isn't making any gains in terms of US market share. Quite the opposite, really. Consider this factoid: In 1963, nearly half of the cars sold in the United States were from Chevrolet, Cadillac, Buick, GMC or Pontiac. Now, the company's US market share is stagnant at 17.9 percent. That same number is half of just Chevy's 1963 market share. This is all despite GM going on a binge replacing or updating its models. "Market share increases are not instantaneous," Mark Reuss told Reuters at the 2014 Detroit Auto Show. "We've got a lot of baggage. Don't underestimate what people though of us, or these brands, through these hardships and 30 years." The reasons for the stagnant market share are numerous. Reuters points out that retooling of factories and a focus on limiting incentives are both good things for profit, but not necessarily for market share. There's also the troubling turnover of the brand's marketing department. These issues don't change the fact that Chevrolet has lost 1.4 percent of its market share in two years, and that Cadillac - arguably GM's most improved brand overall - has lost 1.2 percent in the same period. Part of that can be blamed on GM's avoidance of fleet sales in favor of more profitable customer sales. "Our focus has really been on retail and that's where we've got the growth," said Alan Batey, GM's interim global marketing boss. "We want to grow GM and that means growing market share and profits, but it's not at all costs," Reuss said. News Source: ReutersImage Credit: paul bica - Flickr CC 2.0 Earnings/Financials Buick Cadillac GM GMC sales profits