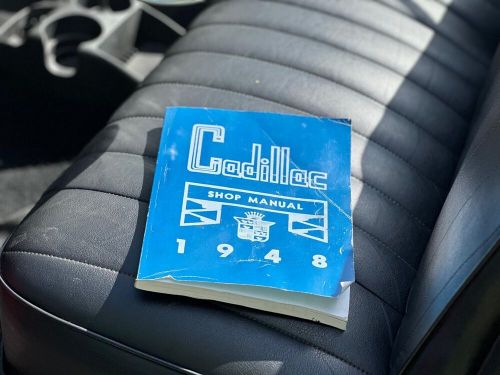

1948 Cadillac Series 62 on 2040-cars

Miami, Florida, United States

Transmission:Automatic

Vehicle Title:Clean

Engine:346 CI V8

VIN (Vehicle Identification Number): 486248838

Mileage: 123456

Make: Cadillac

Model: Series 62

Interior Color: Black

Number of Seats: 6

Number of Cylinders: 8

Drive Type: 2WD

Exterior Color: Red

Car Type: Classic Cars

Number of Doors: 2

Cadillac Series 62 for Sale

1947 cadillac series 62(US $154,900.00)

1947 cadillac series 62(US $154,900.00) 1949 cadillac series 62 custom(US $74,999.00)

1949 cadillac series 62 custom(US $74,999.00) 1955 cadillac series 62(US $69,500.00)

1955 cadillac series 62(US $69,500.00) 1949 cadillac series 62(US $1,000.00)

1949 cadillac series 62(US $1,000.00) 1958 cadillac series 62(US $2,025.00)

1958 cadillac series 62(US $2,025.00) 1959 cadillac series 62(US $95,000.00)

1959 cadillac series 62(US $95,000.00)

Auto Services in Florida

Your Personal Mechanic ★★★★★

Xotic Dream Cars ★★★★★

Wilke`s General Automotive ★★★★★

Whitehead`s Automotive And Radiator Repairs ★★★★★

US Auto Body Shop ★★★★★

United Imports ★★★★★

Auto blog

Cadillac expects major growth in China

Thu, 25 Sep 2014The US sales issues facing Cadillac are not being paralleled in the People's Republic of China, as a new report from Automotive News indicates the US luxury maker should see its sales increase by as much as 40 percent.

The report cites Cadillac's own forecasts, which put its 2014 sales in the PRC at 70,000 units after cresting 45,000 vehicles at the end of August. Provided the sales pace holds true through 2015, the brand would hit its new 100,000-unit sales goal, AN reports.

"We're very optimistic about the luxury market, we believe that the luxury market by 2016 here will become the largest luxury market in the world, surpassing even the size of luxury in Europe," GM China President Matthew Tsien told AN. "With [Cadillac president] Johan [de Nysschen], we have somebody that really is an executive that understands luxury, but he also is very, very keen on understanding what do we need here in China for Cadillac to be successful."

Super Cruise will make 2018 Cadillac CT6 semi-autonomous

Mon, Apr 10 2017General Motors has been working on its semi-autonomous driving system for years. Called Super Cruise, it had initially been slated for a fall 2016 debut. Of course, something as critical to safety as a self-driving system should ideally have the bugs worked out before putting it in the hands of customers, and the launch date had to be pushed back. It appears that Super Cruise is road-ready now, as Cadillac has announced the system will be available in the 2018 CT6 sedan when it goes on sale this fall. Super Cruise offers hands-free driving on the highway, taking control of steering and speed under the supervision of the driver. An attention detection system – a camera and infrared lights that track head position – ensures that the driver is paying attention and is available to take over driving responsibilities. If needed, Super Cruise will initiate a series of nags, including a flashing light bar on the steering wheel, to regain the driver's attention. If the driver is unresponsive, the system can bring the car to a safe stop and use OnStar to call first responders. The system employs a suite of sensors, cameras, and GPS, as well as precision lidar-scanned map database, to place the car where it needs to be on the road and in the center of its lane. It only works if the sensors detect appropriate road conditions, and is limited to the more predictable terrain of divided highways with on- and off-ramps. Yes, it's limited, but safety is paramount, and drivers who spend a lot of time on the highway will appreciate the convenience nonetheless. Related Video:

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.