2014 Cadillac Xts Luxury on 2040-cars

9921 US HWY 19, Port Richey, Florida, United States

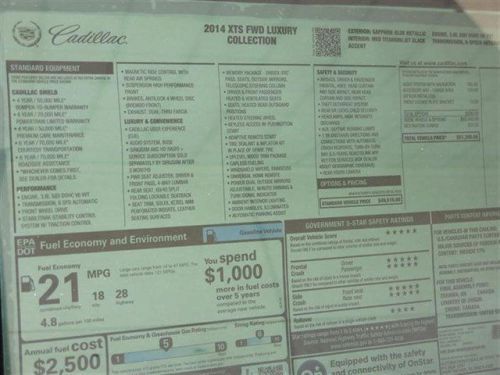

Engine:3.6L V6 24V GDI DOHC

Transmission:6-Speed Automatic

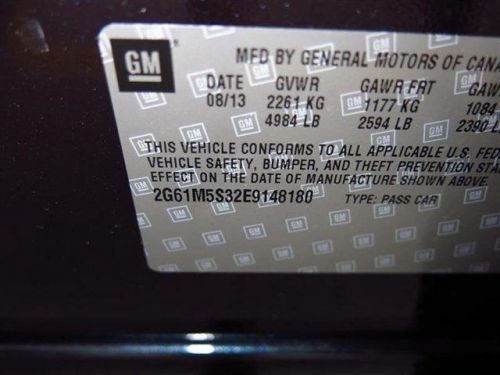

VIN (Vehicle Identification Number): 2G61M5S32E9148180

Stock Num: E9148180

Make: Cadillac

Model: XTS Luxury

Year: 2014

Exterior Color: Sapphire Blue Metallic

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 95

Call our Internet Sales Department and Save an additional $200 off the Internet Price listed above.

Cadillac SRX for Sale

2014 cadillac xts luxury(US $47,690.00)

2014 cadillac xts luxury(US $47,690.00) 2014 cadillac xts luxury(US $48,240.00)

2014 cadillac xts luxury(US $48,240.00) 2014 cadillac xts luxury(US $48,345.00)

2014 cadillac xts luxury(US $48,345.00) 2014 cadillac xts premium(US $53,670.00)

2014 cadillac xts premium(US $53,670.00) 2012 cadillac srx performance collection(US $33,872.00)

2012 cadillac srx performance collection(US $33,872.00) 2014 cadillac xts base(US $41,645.00)

2014 cadillac xts base(US $41,645.00)

Auto Services in Florida

Y & F Auto Repair Specialists ★★★★★

X-quisite Auto Refinishing ★★★★★

Wilt Engine Services ★★★★★

White Ford Company Inc ★★★★★

Wheels R US ★★★★★

Volkswagen Service By Full Throttle ★★★★★

Auto blog

You want screens? The 2021 Cadillac Escalade infotainment system gives you screens

Wed, Mar 3 2021The 2021 Cadillac Escalade’s infotainment system shocked and awed when it debuted, but now weÂ’ve finally had a chance to live with both it and the giant SUV that surrounds it for a week. Sliding behind the triple OLED screens is like stepping into the tech-forward future Cadillac promised us. The 6.2-liter push-rod V8 under the hood says otherwise, but the interior technology has already arrived. There are three screens in total: a 16.9-inch touchscreen for the infotainment system, a 14.2-inch instrument cluster and a 7.2-inch touchscreen to the left of the cluster. All three are OLED displays, and just as you might expect, they are gorgeous to take in. None of the high-tech German luxury vehicles have screens this pretty. The Escalade's donÂ’t just look great, though. All three screens are quick to react and pop through functions/menus without a hitch. The only slop or delay in the whole system is when you go to turn the cluster's augmented reality (AR) camera on — you wait one potato, two potato, and then the feed pops up. ItÂ’s a new take on GMÂ’s infotainment system as a whole. YouÂ’ll still be swiping side-to-side through an iPad-esque display of apps, but the UI is totally rethought and appears fresh. Icons are big and easy to press. Nothing is hidden off-screen at any point. It just makes good sense. 2021 Cadillac Escalade infotainment View 17 Photos Cadillac has found a way to better utilize its redundant scroll wheel, too. Though it's the same wheel as is on other models, this time the whole display changes to match the wheelÂ’s action when you use it. For example, the home screen turns into a revolving circle of apps that you twist through as soon as you twist the dial. It may take some getting used to, but the option between two different interfaces that both function well is a positive. Redundant combos of touchscreen and control wheel are common, but no one offers something like this. Keeping a few physical buttons and an actual volume knob around to control the infotainment system is another thoughtful touch — same goes for the climate controls, which entirely consist of physical buttons. Despite the central instrument panel screenÂ’s prodigious size, you wonÂ’t actually find a whole lot buried in there. All of the trip settings and general car settings have been moved into the infotainment system itself.

GM recalls 55,000 trucks, SUVs for separating axles, fuel pump failures

Mon, Feb 13 2023General Motors issued four separate recalls covering eight of its truck and SUV models for issues related to fuel pump and half-shaft failure. In total, the four campaigns include more than 55,000 vehicles spread out over three brands and six model years, but they've sorted themselves neatly into two categories. Let's dive in. Axle separation Four models are being recalled for potential axle separation: The 2023 Cadillac XT5, 2023 GMC Acadia, 2023 Chevy Blazer and 2023 Chevy Traverse. The number of units affected is incredibly small (10 units each times two recalls, for a total potential population of just 20 cars). In each case, a small number left the factory with half-shaft assemblies that may have been missing the retention rings that keep them in place, possibly allowing the axles to separate or eject from the transmission. In the case of the XT5 and Acadia, it's the right-side axle assembly; Chevy dealers, however, will have to check the left side. Fuel pump failure Again, we have multiple vehicles being recalled for similar issues, but in this case they're a bit more distinct. The first of these recalls covers the 2021-2022 Chevy Equinox and 2022 GMC Terrain. GM says a supplier-initiated change may have led to fuel pumps shipping with inadequate clearances to allow for the prescribed flow of fuel, meaning the pump could starve the engine. Customers experiencing the issue may see a check engine light and experience engine hesitation. In some cases, the cars may not start at all. Chevy and GMC will replace the units in question with correctly specified pumps. The second recall covers a fairly specific cross-section of GM's HD truck lines. 2017-2019 Silverado and Sierra HD trucks sold with the diesel engine and a dual-tank configuration may have shipped with a rear fuel pump that is susceptible to fouling by debris, preventing fuel from properly transferring to the front tank, or, in extreme cases, resulting in a collapse of the rear tank. This issue can lead to inaccurate/erratic fuel tank readings, engine hesitation, a check-engine light or failure to start. In both cases, GM will inspect and replace faulty units free of charge for customers. Expect notifications to be delivered by March. Related video: Recalls Cadillac Chevrolet GMC Ownership Safety Truck SUV

Cadillac CTS-V and Suzuki e-Survivor | Autoblog Podcast #527

Mon, Oct 2 2017This week, Editor-in-Chief Greg Migliore is joined by General Manager Adam Morath. They discuss driving the Cadillac CTS-V and talk about the Suzuki e-Survivor concept. Other news includes possible Jaguar Land Rover acquisitions, the Jeep Grand Cherokee Trackhawk and the Autoblog Car Finder. Autoblog Podcast #527 Your browser does not support the audio element. Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Topics and stories we mention Rundown Jaguar Land Rover acquisitions? Suzuki e-Survivor concept Tesla Model 3 Autoblog Car Finder tool Jeep Grand Cherokee Trackhawk Cadillac CTS-V What we've been driving: Jaguar F-Pace Ken Block's "Climbkhana" Spend my money Feedback Email – Podcast at Autoblog dot com Review the show on iTunes Green Podcasts Cadillac Jaguar Jeep Suzuki Electric Performance Videos Sedan jaguar land rover